What The HELOC?

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

In a recent strategic shift, Solana's largest lending and borrowing protocol has taken a sizeable bet on the real-world assets (RWAs) market by allocating additional resources for developing the foundation for effectively onboarding institutional entities at scale.

Key Points

- $19+ billion in real-world collateral — Figure introduces a yield-bearing asset backed by its on-chain HELOC portfolio, targeting prime borrowers with an average FICO score of 745 and a conservative 62% LTV ratio.

- From zero to $108.72 million in deposits in two weeks — A new market has quickly become the fifth biggest on Kamino, with demand driven entirely by native yield rather than external incentives.

- Leveraged yields up to 21% — Multiply loops allow depositors to amplify exposure, with net returns varying significantly based on debt asset selection and timing.

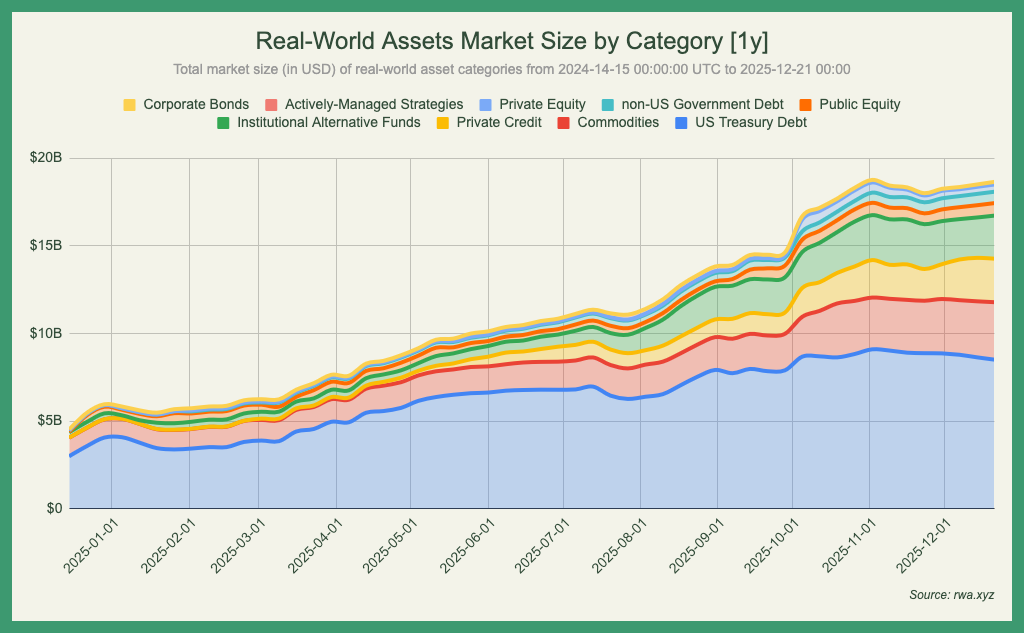

- A blueprint for sustainable and predictable yield — As tokenized RWAs grow 350% year-over-year, the recent Kamino integration offers an early look at how institutional-grade credit might reshape on-chain lending.

Introduction

It's no secret that there are limitations to purely crypto-native returns, reflexive leverage and yields uncoupled from real economic activity, to name a few. Some say that innovation in the space has slowed down, which is unsurprising as modeling novel solutions is difficult and most builders nowadays focus their efforts on improving or optimizing existing concepts. In the interim, big capital has set their sights on modernizing parts of traditional finance through tokenization, a sector that has grown ~350% year-over-year.

Taking into account the unfathomable size and diversity of these markets, the potential for extended growth is almost certain. One of the clearest opportunities within this transition lies in private credit, and more specifically, the United States home equity market. American homeowners are sitting on historically high levels of equity, following the rapid appreciation of real estate in the last decade.

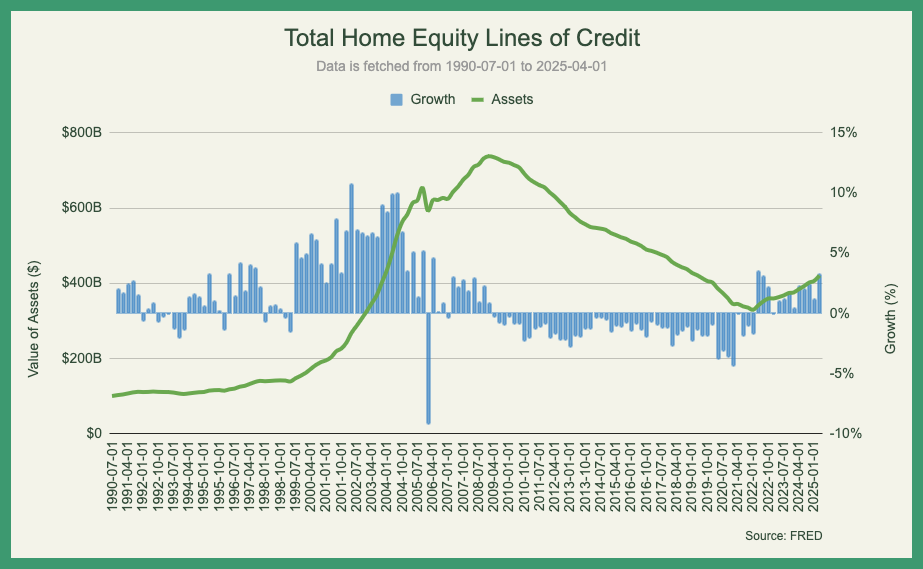

With an unstable job market and rising living costs, an increasing number of homeowners are tapping into the value of their home to consolidate debt, cover necessities and unforeseen expenses. Rather than taking out a home equity loan for a larger lump sum or refinancing their mortgage at unfavorable rates, many prefer to borrow a fixed amount on an as-needed-basis using home equity line of credit (HELOC). Its main benefit being that the borrower only pays interest on the amount borrowed at the time, albeit at above average rates, which is more favorable for periodic expenses (e.g. child's college tuition, car note, home renovation) that don't require the entire payment upfront.

While this concept is not new and has in fact existed since the 1990s, banks once originated the vast majority of these loans but have gradually lost market share to private lenders. Primarily due to regulatory and financial fallout following the 2008 crisis, which made the practice less attractive and prompted banks to scale back operations.

A key player in the revival of this trend is Figure, a publicly traded (FIGR) American fintech company founded in 2018 by Mike Cagney and June Ou. Figure has built its stack on-chain and plans to expand further into decentralized finance.

Prime (Not The Beverage)

Developed in partnership with Provenance Blockchain and Hastra Protocol, PRIME provides lending yield exposure backed by over-collateralized pools totaling more than $19 billion in Figure’s on-chain HELOCs, presenting a compelling alternative to traditional investment strategies.

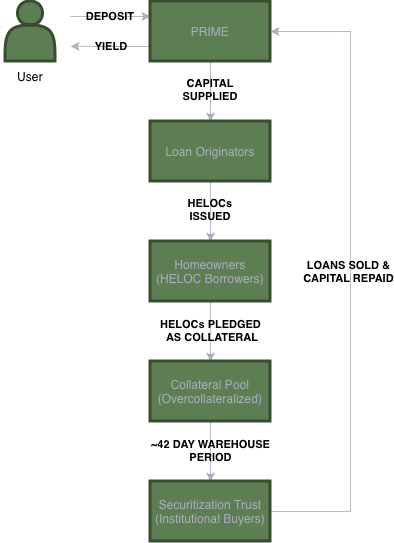

At its core, PRIME is not a speculative yield product but a short-term liquidity layer for HELOC origination. It separates who interacts with homeowners from who provides the capital. Large consumer-facing companies like Lowe's Home Improvement can reach millions of customers seeking financing, but they don't maintain the balance sheets required to fund hundreds of millions in loans while waiting for them to be sold to institutional investors. Figure enables them to receive temporary financing so loans can be originated today and offloaded later.

Historically, this role was filled by large investment banks acting as so-called "warehouse lenders". They would advance capital to loan originators, hold the newly issued HELOCs on their balance sheets for several weeks, and then package and sell them to pensions, insurers and other investors through securitization. PRIME replaces this warehouse function on-chain.

Capital supplied to PRIME is lent to U.S.-based originators issuing HELOCs through Figure's standardized system. Originators borrow against newly issued loans, pledging them as collateral at ~90% of value. Approximately every 40-45 days, the loans are bundled and sold into securitization trusts, the warehouse loan is repaid, and the cycle begins again. Lenders are thus exposed to early-stage loan performance rather than the multi-year life of the HELOC. Yield is derived directly from borrower interest.

Importantly, PRIME does not lend to individual homeowners or to Figure directly, but to regulated originators, secured by homogenized HELOCs originated under a single credit box, with liquidation mechanisms and legal recourse in place should collateral values deteriorate.

Prime Time

The underlying lending portfolio primarily targets prime borrowers, with an average FICO score of 745 (~60th percentile) and a loan-to-value (LTV) ratio of approximately 62.32%, leaving a healthy buffer against sudden declines in home values. Interest rates range from 8.8% to 9.2% and are higher than traditional bank offerings, compensating lenders for expedited origination, enhanced flexibility, and reduced execution risk.

PRIME can be either be (i) bought directly with USDC on Kamino, or (ii) minted in exchange for wYSDL, a yield-bearing stablecoin, on Hastra.

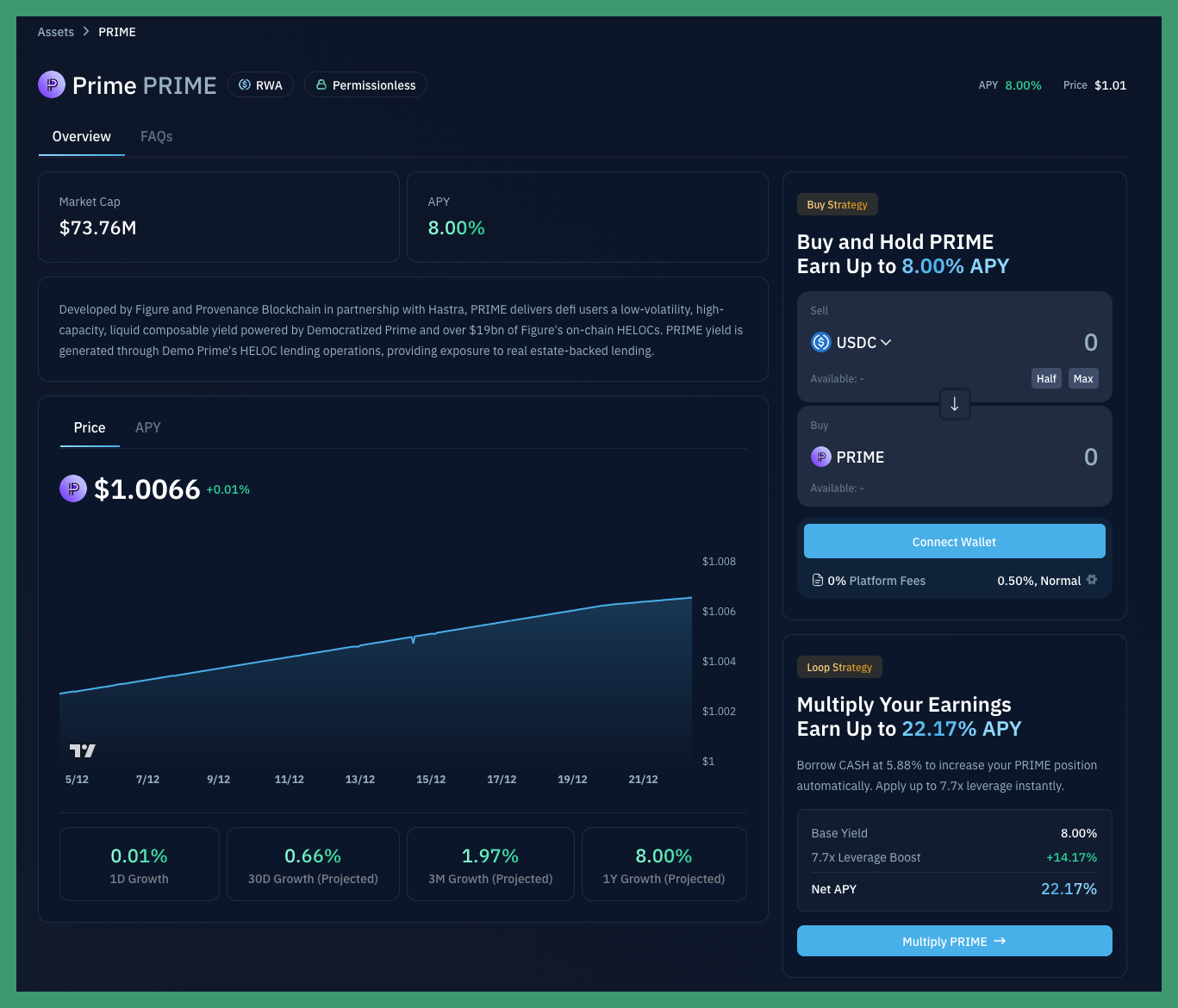

As of writing this article, it delivers a base APY of 8%, and the token’s market capitalization sits at $73.76 million, up more than five-fold since launching two weeks ago. Momentum can largely be attributed to the integration of a dedicated, isolated market on Kamino, expanding use cases beyond simply holding or providing liquidity on decentralized exchanges. This showcase's the platform's ability to bootstrap (coordination across vault managers to supply liquidity) and scale RWAs effectively when managed correctly end-to-end.

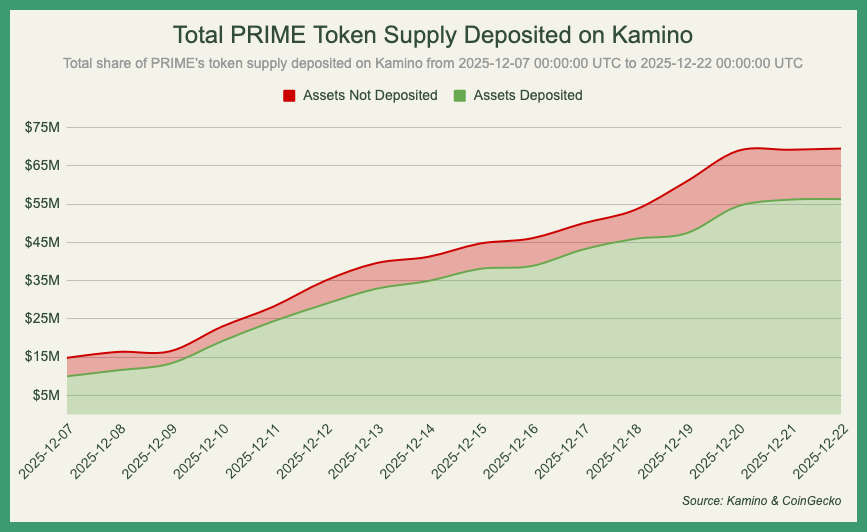

A significant portion of the circulating supply remains consistently locked on Kamino, as depositors take advantage of leveraged strategies by borrowing USDC and CASH to amplify their exposure, so much so that both stablecoins have nearly reached their utilization caps. Notably, this demand is driven entirely by native yield rather than external incentives.

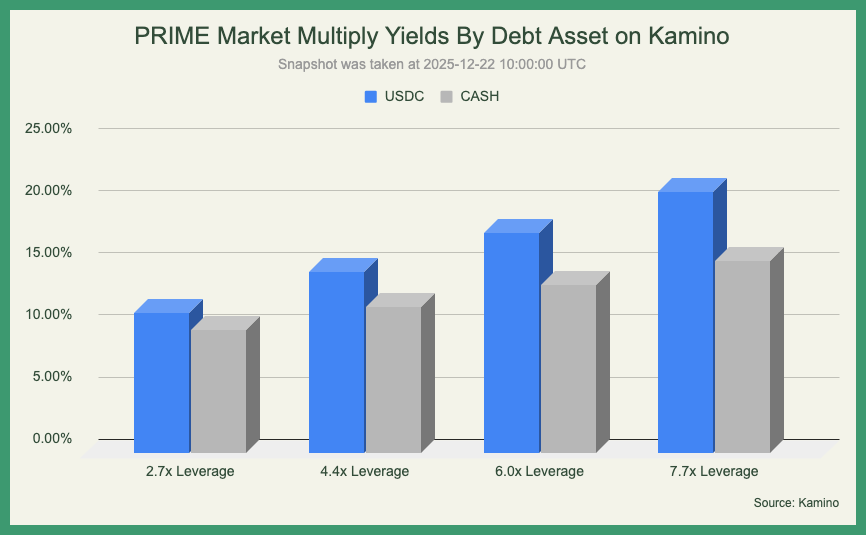

Analytics indicate that the Multiply product is the dominant method for leveraging exposure, with its two available loops accounting for approximately 94.24% of the market’s available liquidity at an average leverage ratio of 5.66x.

Currently, the less liquid USDC debt token loop offers the strongest returns, from 11.30% to 21.01%, while CASH yields range from 9.89% to 15.45%. Net returns are highly sensitive to borrowing costs, which explains the lower yields observed for the latter option even at higher leverage multiples. These returns are expected to eventually stabilize, as supply rates remain competitive and among the most attractive on the platform.

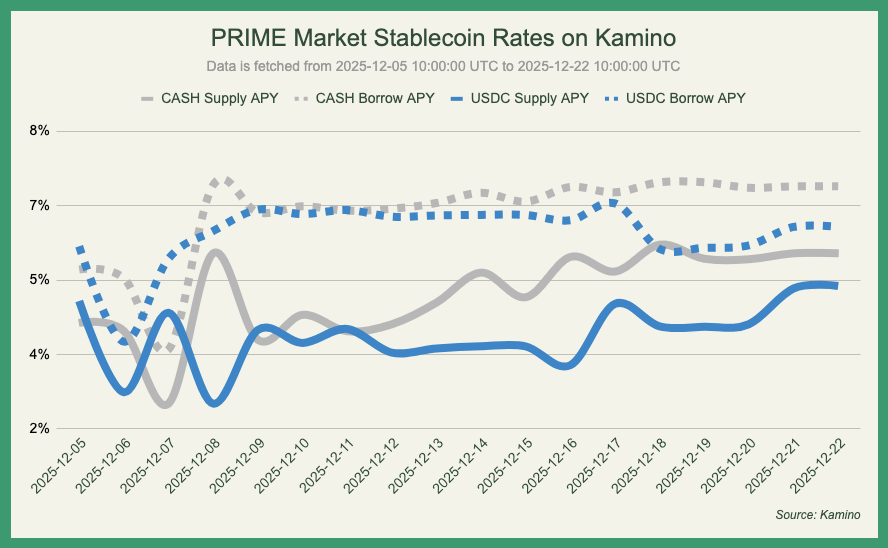

Early rate volatility has eased, with supply APYs now stabilizing between 4.8% and 5.6% and borrow rates hovering around 5.5–7%. USDC's narrowing borrow spread becomes increasingly significant at scale, while the market continues to reflect relative demand imbalances, highlighting timing-sensitive opportunities on both sides of the trade.

Conclusion

PRIME's rapid adoption demonstrates a growing appetite for RWA-backed yield in DeFi. By bridging institutional-grade credit with on-chain infrastructure, Kamino has positioned itself at the forefront of this convergence, offering users an unique window into real economic returns without sacrificing the composability that defines the protocol. The success of the recent integration could serve as a blueprint for future collaborations.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.