The State of Kamino (Q4 Edition)

Quarterly overview of Solana's biggest decentralized finance powerhouse.

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Introduction

This report provides an overview of Kamino’s recent growth, focusing on Kamino Lend, vault activity, fee generation, and new product initiatives such as xStocks.

Protocol Growth

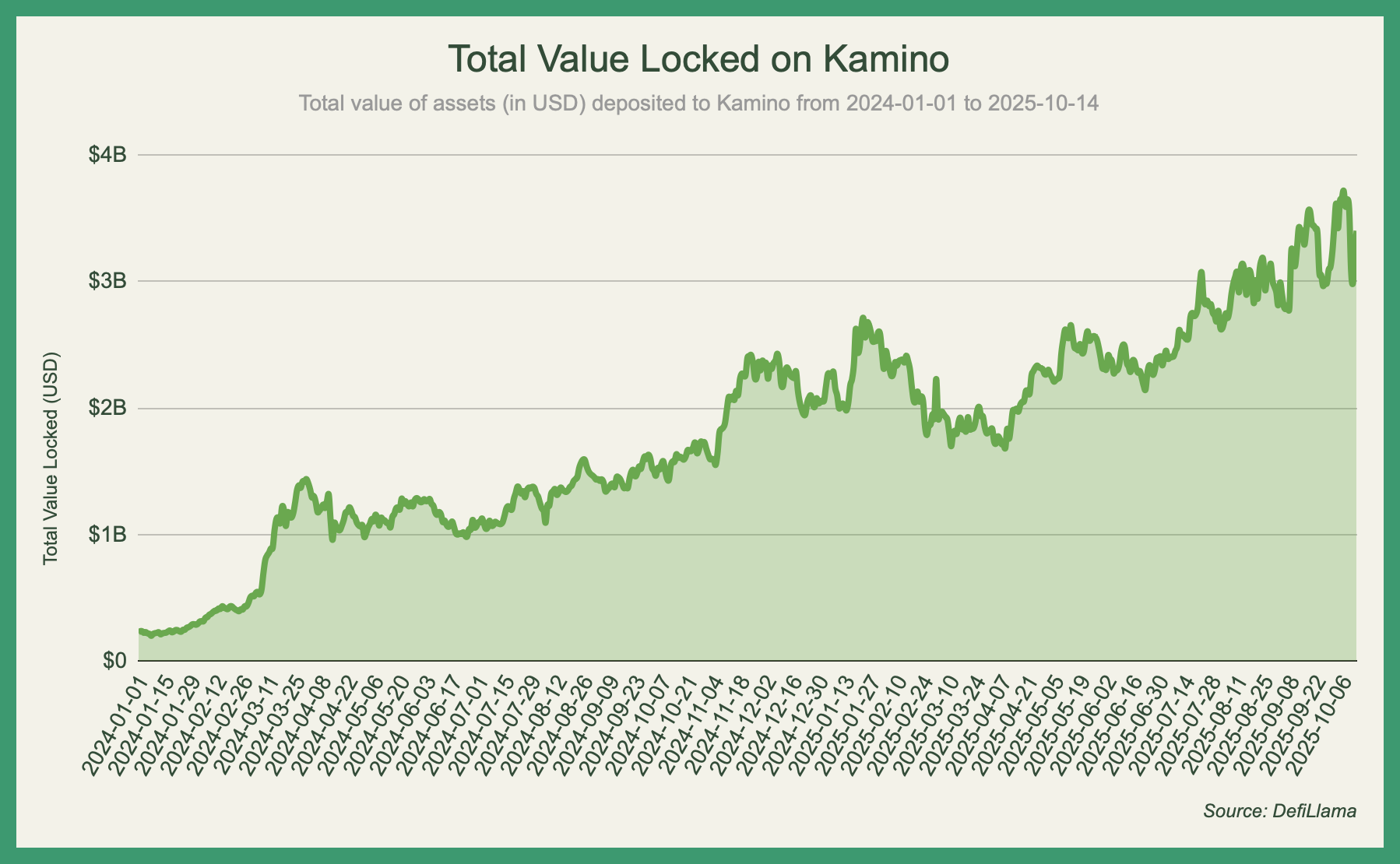

Over the past couple of months, Kamino has shipped several new markets and assets which have led to significant total value locked (TVL) growth. As seen below, the combined value of supplied assets continues to be in a strong uptrend despite choppy market conditions, currently exceeding over $3.2 billion.

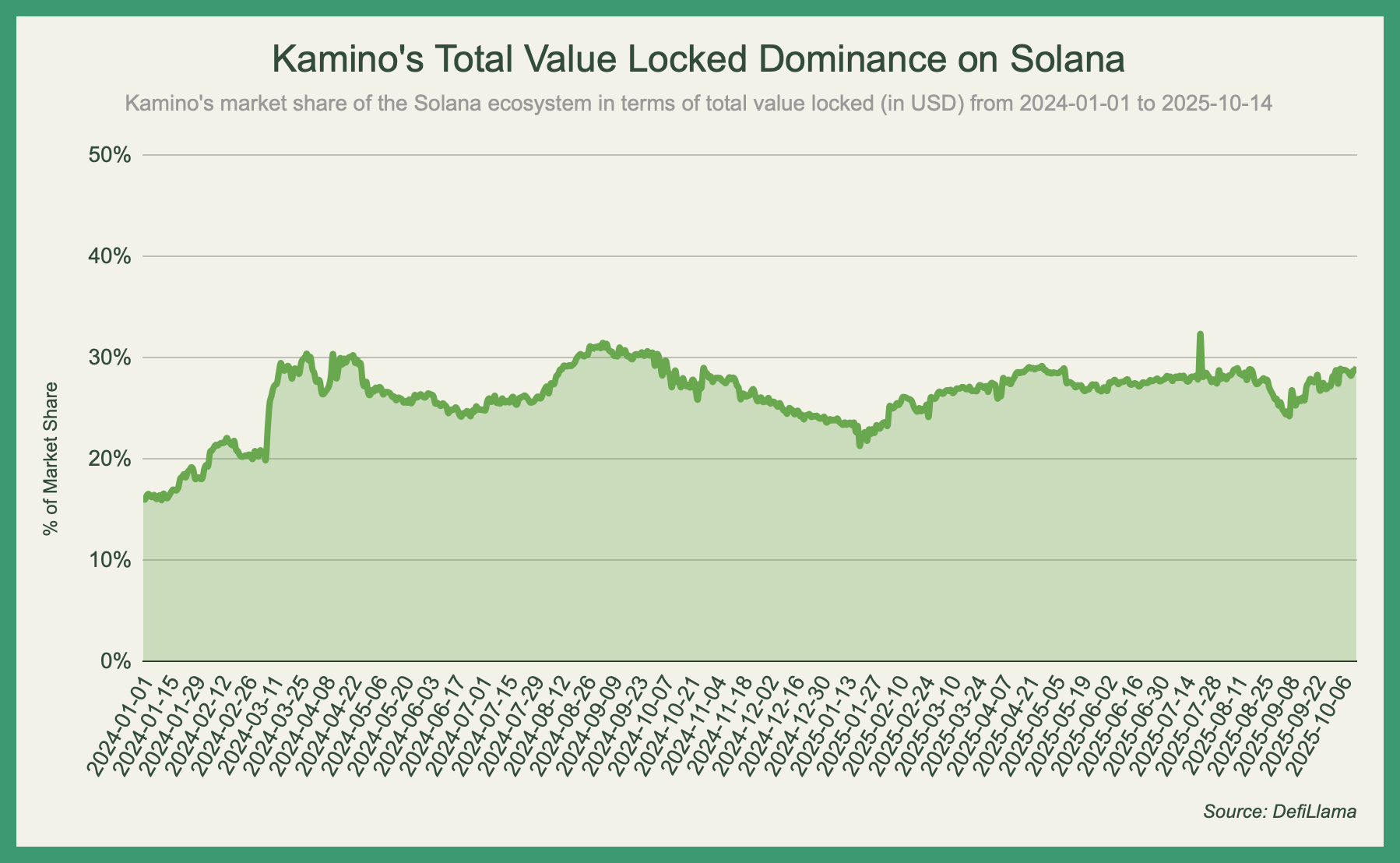

Kamino is the largest lending and borrowing protocol on Solana, and ranks second overall on the chain in terms of value locked. For more than a year and a half, Kamino has consistently accounted for 20-30% of the chain's TVL and is also one of the biggest (6th) lending protocols in all of DeFi.

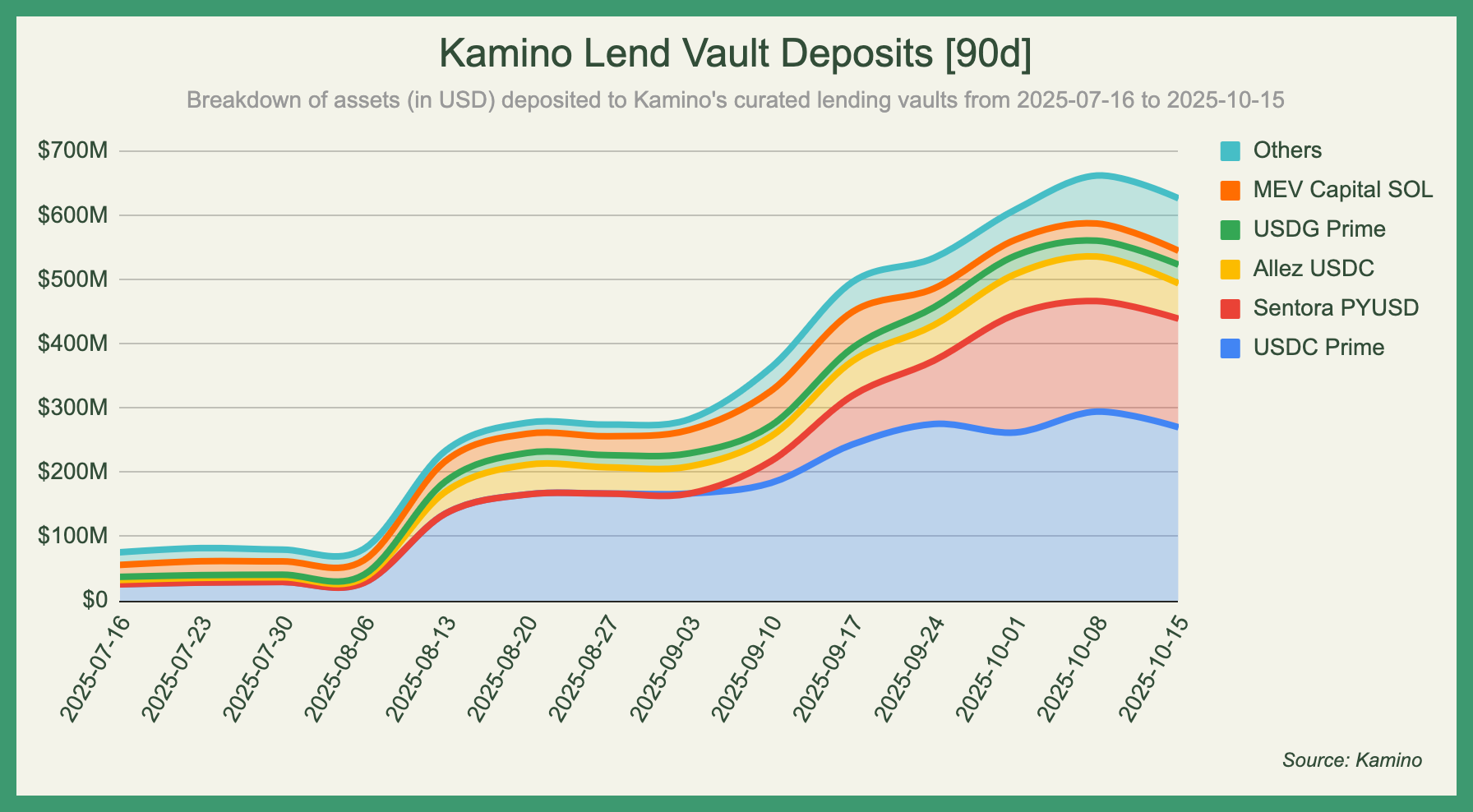

A large contributor to its recent growth has been the project's automated lending layer, launched as part of the V2 upgrade earlier this year. Kamino Lend offers some of the highest liquid stablecoin yields curated by reputable vault managers. These vaults provide liquidity across various native markets and have gathered over $600 million in deposits with more than $4.5 million paid out in yield to lenders thus far.

Automated Lending Vaults

A few months ago, comprising a mere fraction of the total value locked on Kamino, the curated automated yield strategies now hold roughly a quarter of the funds deployed on the protocol following a coordinated push to onboard users to actively managed lending vaults through incentives. Double-digit returns for stablecoins proved to be a great advert, regardless of a portion of the potential gains being subject to a vesting period.

After incentives were introduced on August 7th, deposits skyrocketed and flocked towards vaults with the highest boosted yields, which at the time were USDC-based strategies operated by Steakhouse and Allez. A third wave of deposits can be seen around the time Solana was gunning for new highs in early to mid September, when additional vaults were introduced to the cohort and KMNO allocations were readjusted to bootstrap new offerings. Sentora, a institutional-grade DeFi solutions provider, made a strong debut with their PYUSD (PayPal USD) deployment, amassing over $40 million in user contributions over the course of five days and subsequently becoming the second largest weekly incentives receiver. Other prominent options broadening the landscape outside the popular picks include the CASH vault curated by Phantom and the Steakhouse USDC High Yield strategy, which at the moment concentrates funds solely into the Maple Market as opposed to the Main Market.

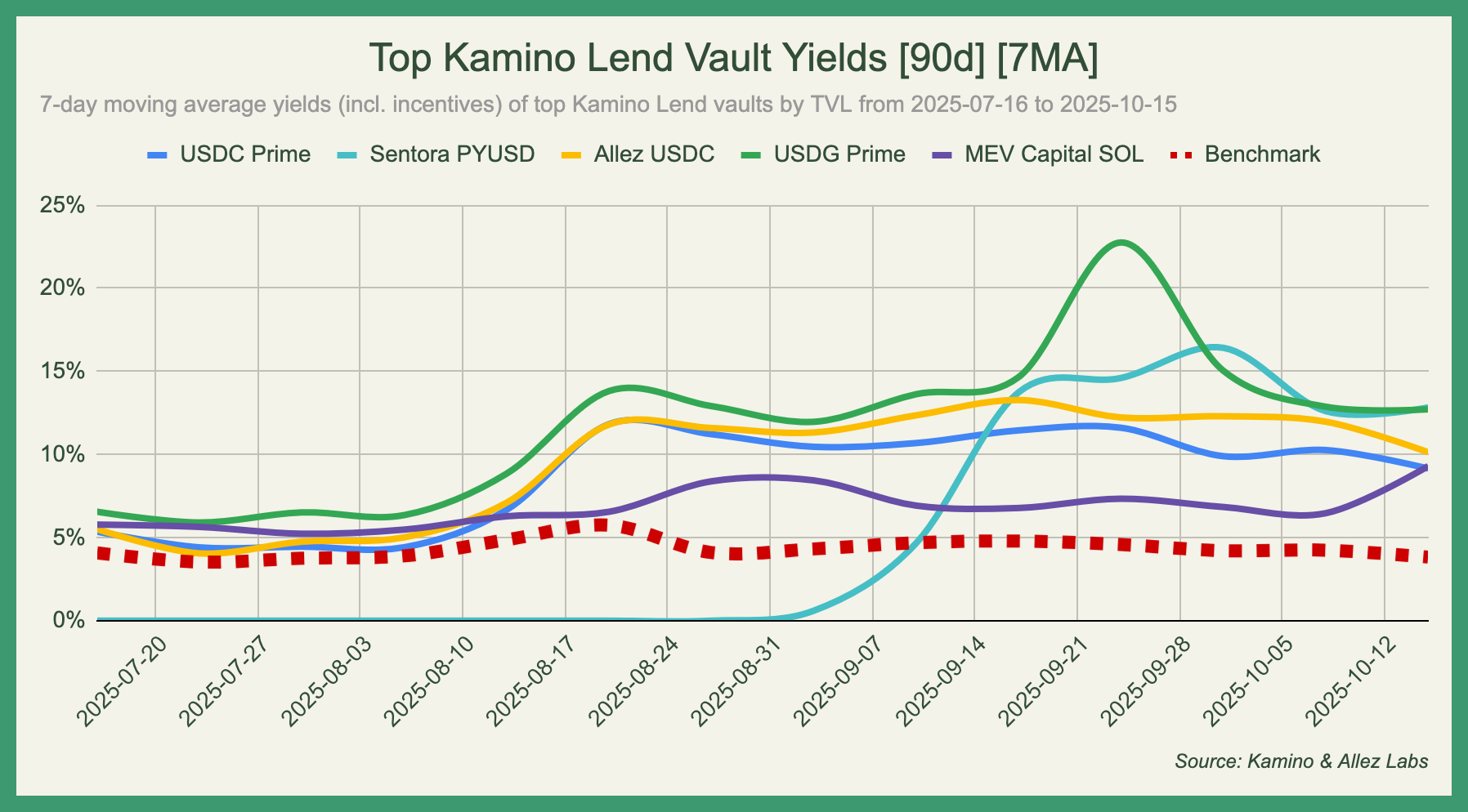

Without the use of leverage, supplying non-yield-bearing stablecoins on established money markets tends to provide relatively similar returns across the board, with notable variance typically arising from active position management. This has been the case with majority of the vaults on Kamino, as they have outperformed the industry average with just the interest alone at no expense to the users (excl. MEV Capital SOL). Throwing external rewards into the mix further amplified the attractiveness of these products.

In most cases the KMNO rewards either matched or surpassed the effective yield, shadowing any basis points added by individual market reward and raising the bar for stablecoin returns to well over 10%. PYUSD and USDG maintained a small premium due to their perceived higher risk profile compared to established stablecoins like USDC, with USDG Prime briefly spiking to over 22% in late September before normalizing. While all vaults have since converged closer to the 10-12% range, they continue to offer substantially higher returns than the benchmark (average aggregate stablecoin rate), which has remained relatively flat around 4-5% throughout the period.

xStocks

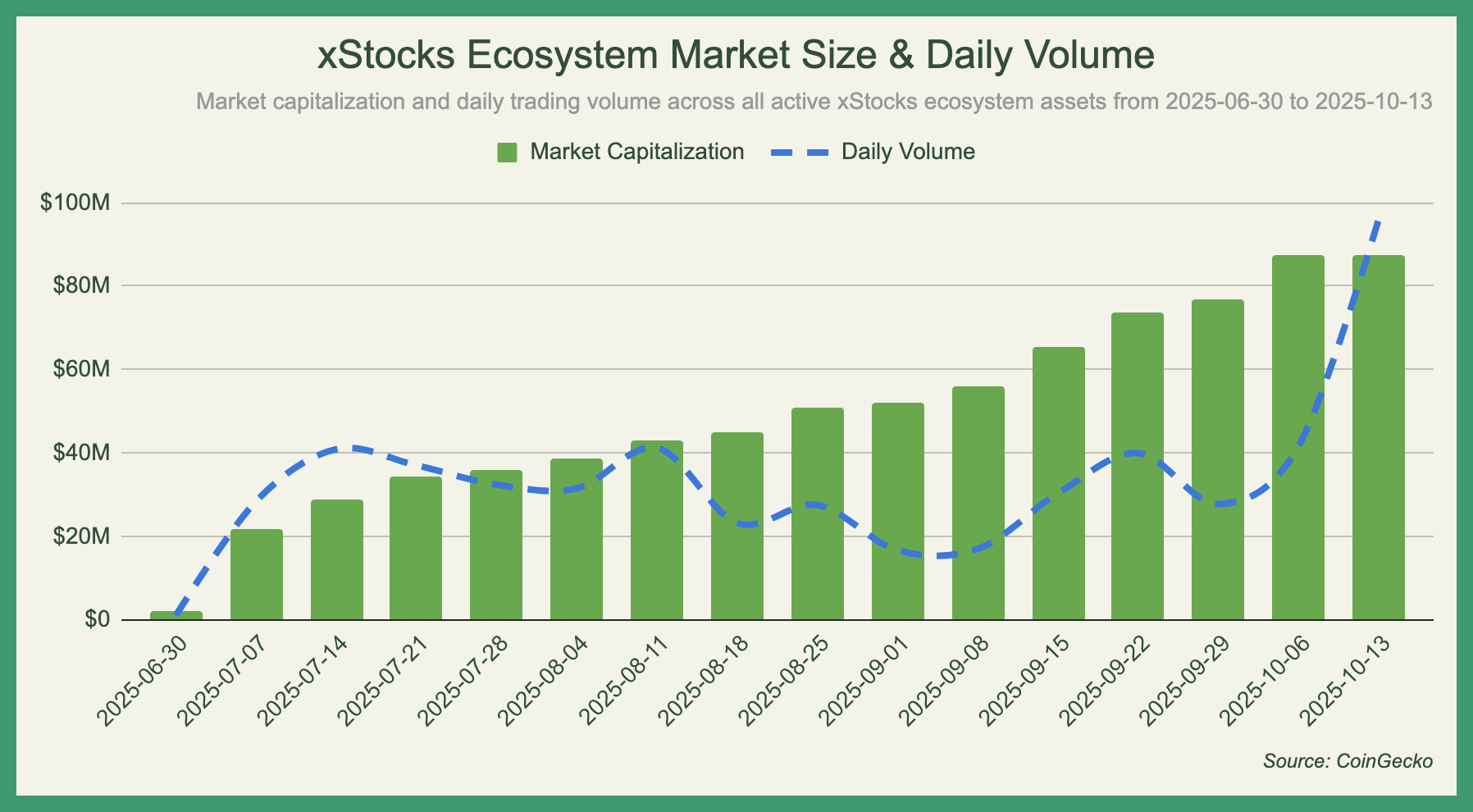

While not nearly as popular as real-world-assets (RWAs), tokenized equities have gradually gained momentum despite regulatory and custodial hurdles, with xStocks at the forefront. As liquidity deepens from increasing capital shifting towards the shares of prominent publicly traded US companies, on-chain spot exposure to stocks is becoming more feasible and cost-efficient than before. Since the time we first time we covered the ecosystem on the 27th of July, the total market capitalization has nearly tripled to over $90 million as per CoinGecko.

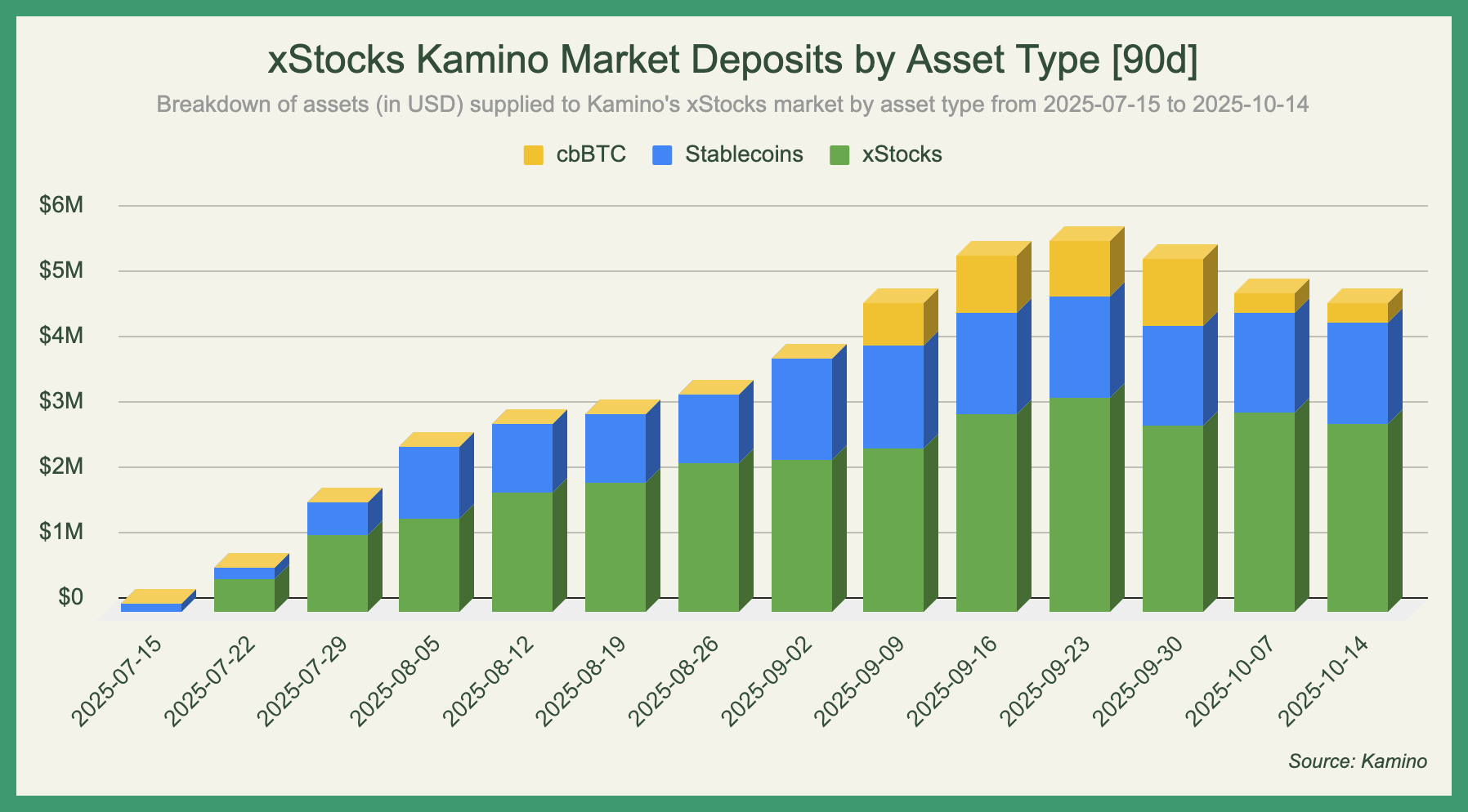

Most of the value addition can be attributed to TSLAx, NVDAx, MSTRx and CRCLx, which inherently attract more speculation than alternatives. Though interactions with these assets predominantly occur on centralized exchanges due to user experience and partnerships with major platforms like Kraken, lending activity on Kamino is lagging behind but is seeing increased adoption.

Within the last 90 days, cumulative deposits for the xStocks Market have grown by ~271.9% with utilization ratios (UR) continuing to showcase a strong preference towards borrowing USDC (74.93% UR) or USDG (86.18% UR) rather than the backed shares (0.02% UR). Indicating that there is little interest in shorting these assets as stocks have been rallying like there's no tomorrow. Now, with leverage of up to 1.5x or 2x available for xStocks through Multiply, users can easily amplify their exposure to traditional markets.

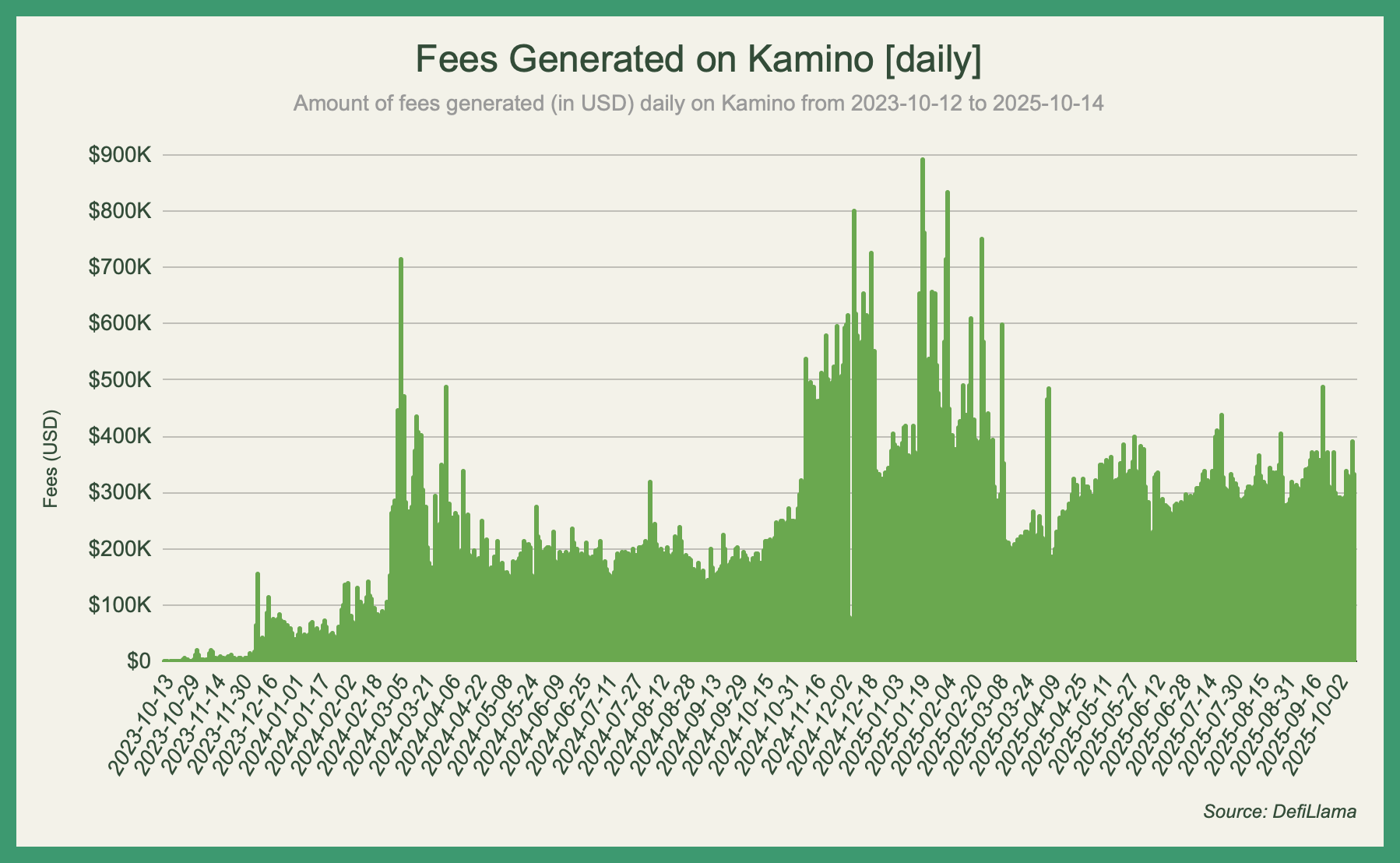

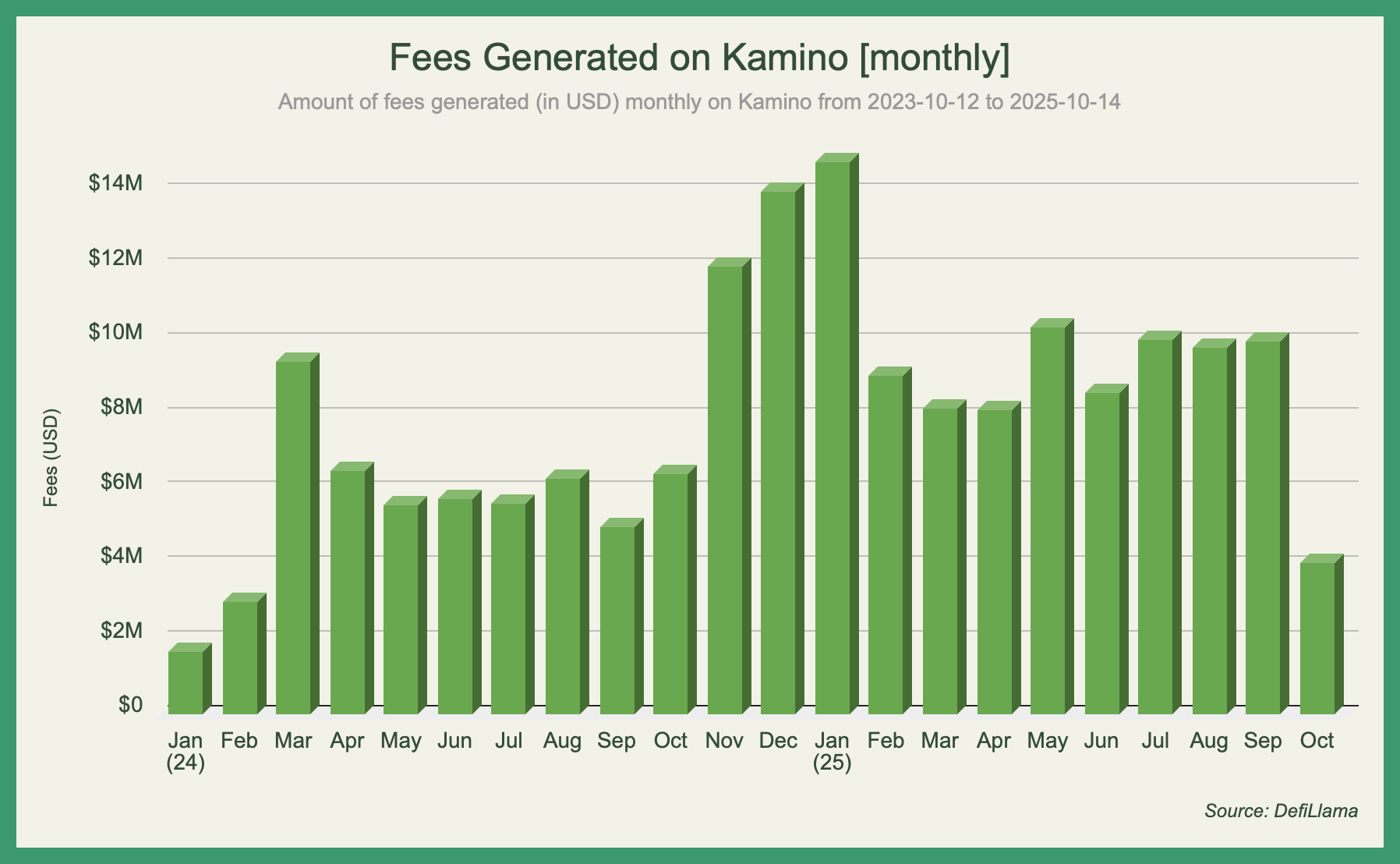

Protocol Fees

Kamino generates approximately $300,000 in daily fees and currently totals ~$120 million in annualized 30-day fees. Fees are earned from user interactions with Kamino’s products including deposits into vaults, withdrawals, borrowing (interest payments), flash-loan leverage via Kamino Multiply and more. Proceeds are primarily distributed to lenders, with the remainder recorded as revenue. Revenue currently flows to the Kamino treasury, helping cover operating expenses and support the platform's growth.

Conclusion

Kamino continues to expand its product suite and strengthen its market presence through strong growth and new products. While broader market conditions remain a factor, DeFi adoption continues to trend upward and Kamino is set to benefit from this growth as one of the cornerstones of this industry.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.