Swap Smarter, Not Harder

Elevating user experience through a frictionless and efficient aggregation layer with no ulterior motives

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Introduction

Traders increasingly rely on smart routing systems to navigate a fragmented landscape of liquidity, pricing and execution quality. With more than 30 active decentralized exchanges on Solana, the difference between an optimal swap and suboptimal one often comes down to the sophistication of the algorithms developed by aggregation protocols, which now route more than two-thirds of the chain's total spot trading volume. Leveraging the fierce competition between these actors trying to duke it our for market share, Kamino introduced an aggregator of aggregators (meta-aggregator) in the first half of the year to offer the best-in-class swapping solution. This article covers the product's recent traction and on-chain usage patterns, including the sourcing of routes and how quoted simulations compare to actual execution.

Metrics

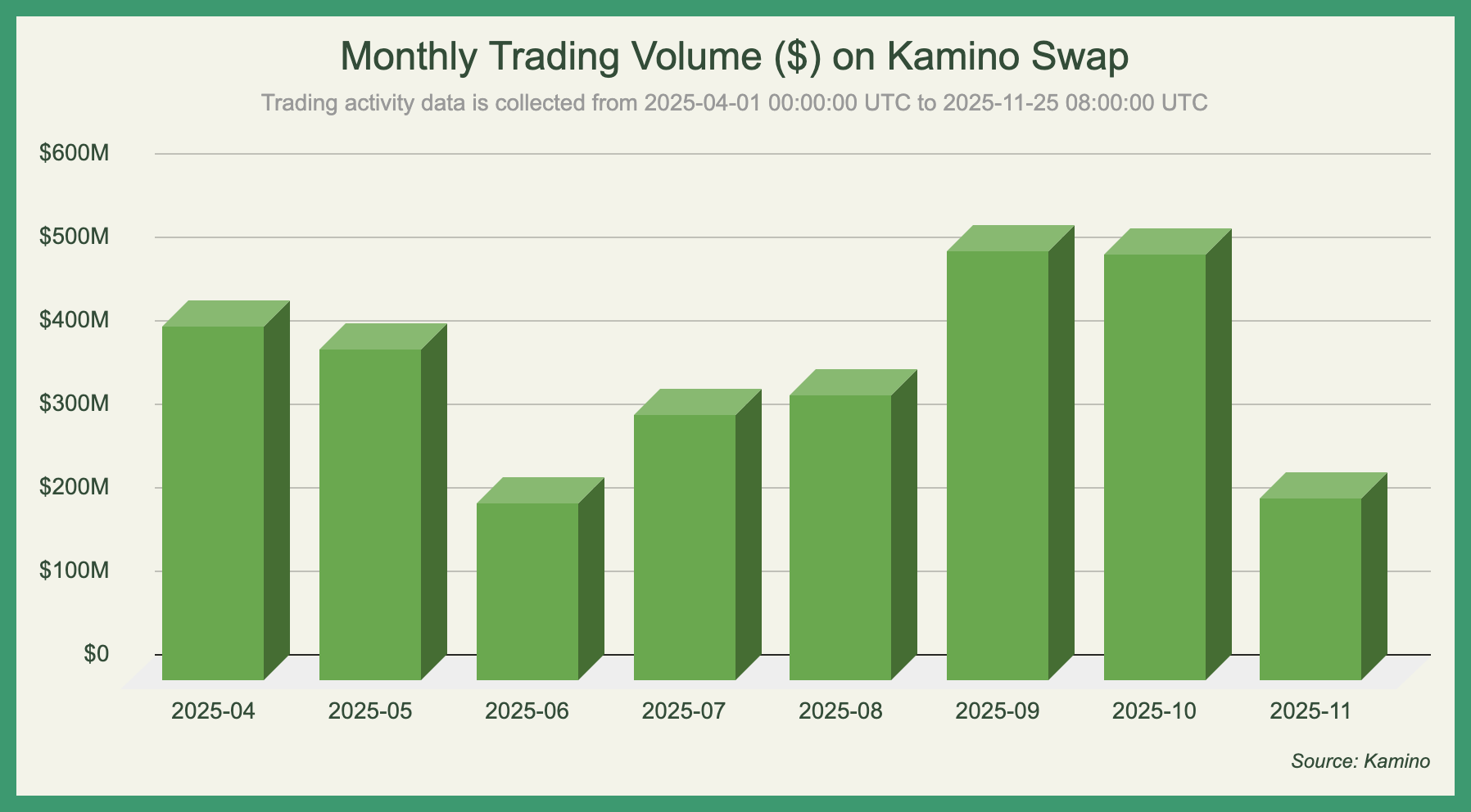

Following the launch of Kamino's meta-aggregator in early April, the product has processed roughly ~$2.94 billion in volume across 594 669 transactions for 38 669 unique users, while charging no additional frontend or hidden fees.

Since then, it has routed an average of $367.27 million in trades per month, with volume strongly correlated to SOL's price action. Earlier months saw considerable usage, followed by a sharp drop in June as the chain's native token failed to form a new lower high and activity stagnated. After a slow summer, volume quickly surged leading into October as optimism for an all-time-high brought people back on-chain. This optimism was soon met with a market-wide correction that spooked many participants, resulting in pessimism and a decline in usage similar to June.

The advantage of aggregating trades through multiple aggregators rather than individual liquidity sources is the reduction of redundancy, since new venues don't need to be integrated independently in an environment where the number of platforms with unique offerings and technical complexities increases rapidly. This approach is optimal, given that Kamino has no operational incentive beyond providing its users with the best and most accurate swaps on the chain.

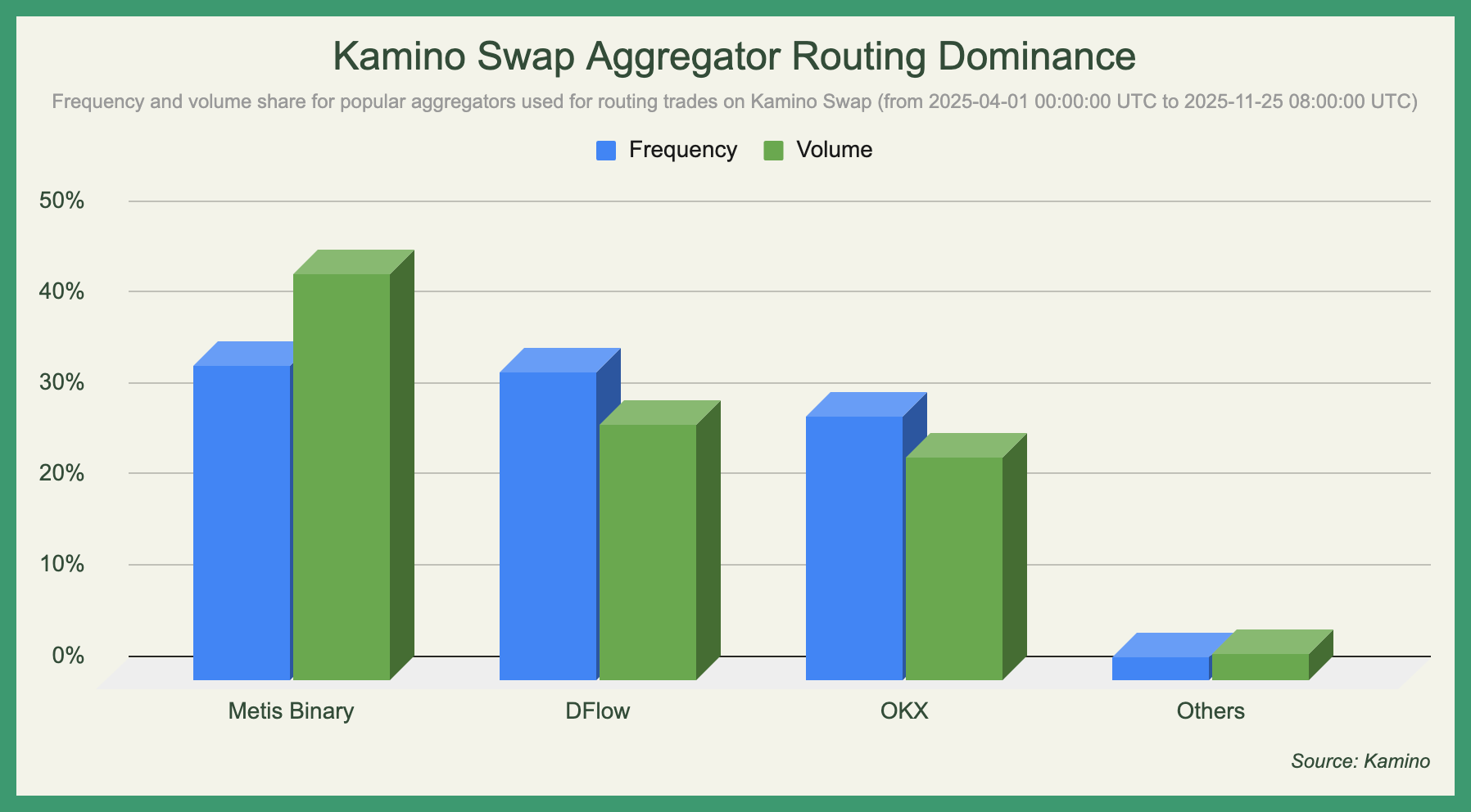

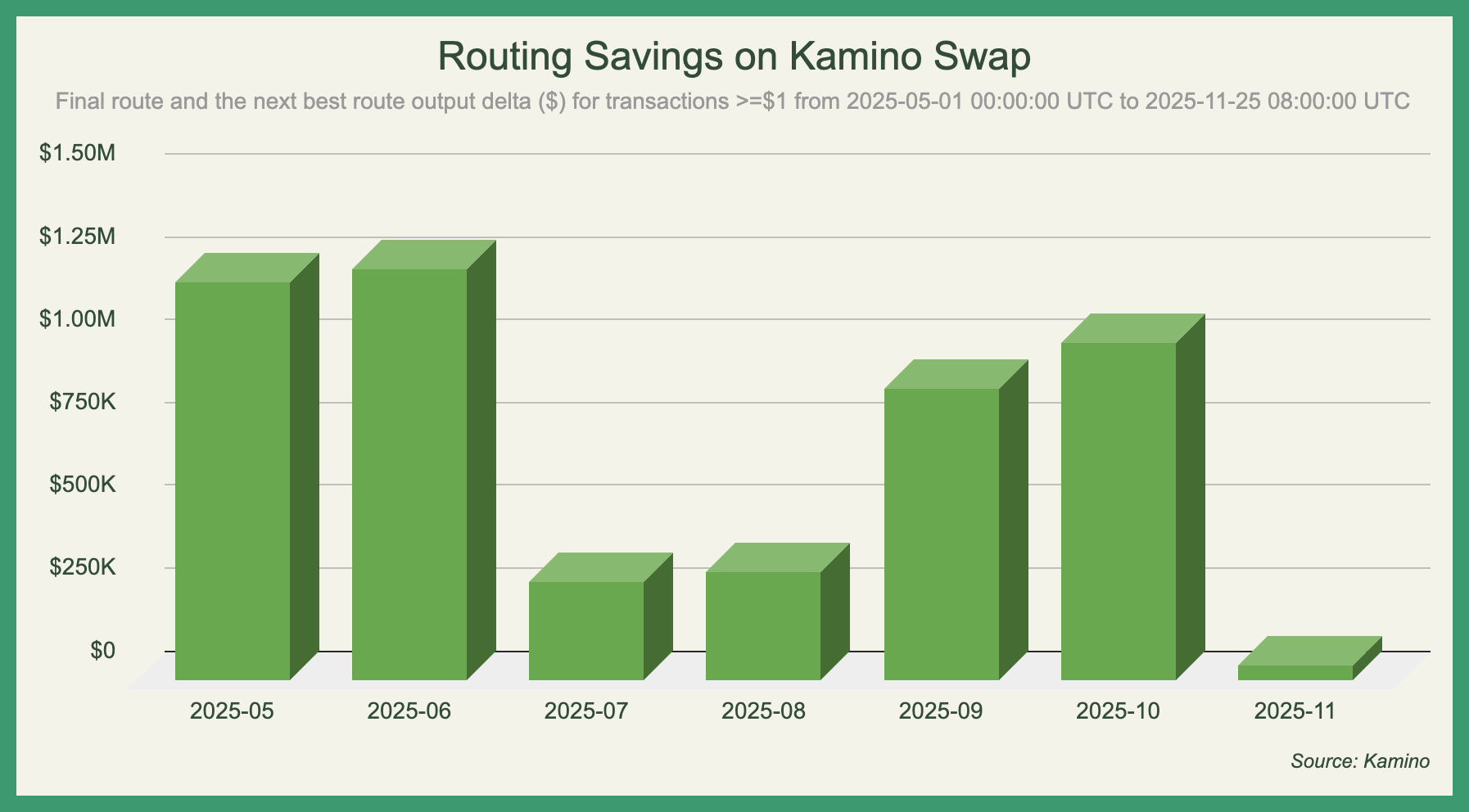

Most of the volume (97.38%) primarily flows through Metis Binary, DFlow and OKX with Metis Binary being the most common venue for large trades based on its volume-to-transaction ratio. Although it accounts for the majority of spot trading on Solana and remains the go-to choice for many users, the other two relevant outlets show, that more often than not, alternatives can offer better quotes. This becomes clear when comparing the value differences between the final routes and those coming in second.

In this case, having a diverse set of options has had a measurable financial effect on traders, cumulatively saving them ~$5.01 million. It underscores the value of meta-aggregators, which can leverage smaller or less popular aggregators that, despite lower standalone volume, still supply the most efficient routes and outcomes.

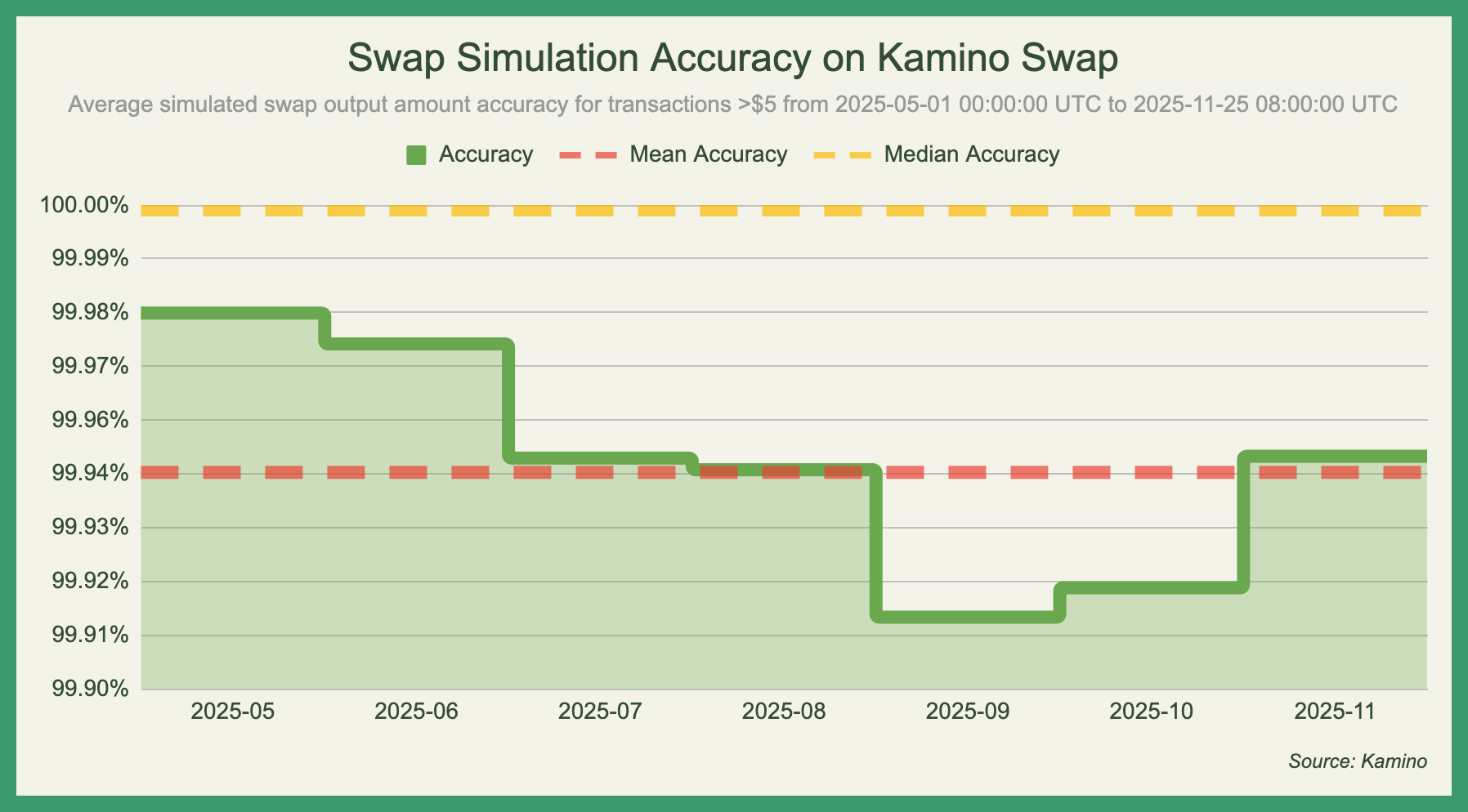

To ensure favorable trade executions, Kamino simultaneously simulates the outcomes of various paths and ultimately selects the option that yields the best result, while also showcasing the process in the interface. Anecdotal claims suggest a significant improvement over traditional optimistic quoter readings. Whether this is accurate, can be determined by quantifying both the accuracy and the consistency of those results.

Generally, the output amounts closely reflect what was displayed in the swap modal, though some variance stands out with less liquid and more volatile pairs. In our dataset of 370 870 transactions with available simulation data, the mean accuracy of the expected output amounts compared to the actual values was 99.944%, proving that there is merit to the claims mentioned earlier. Focusing on small improvements like this can have a large impact on the overall user experience, as even minor frustrations (e.g. receiving less tokens from a swap than expected) quickly accumulate and may discourage future use.

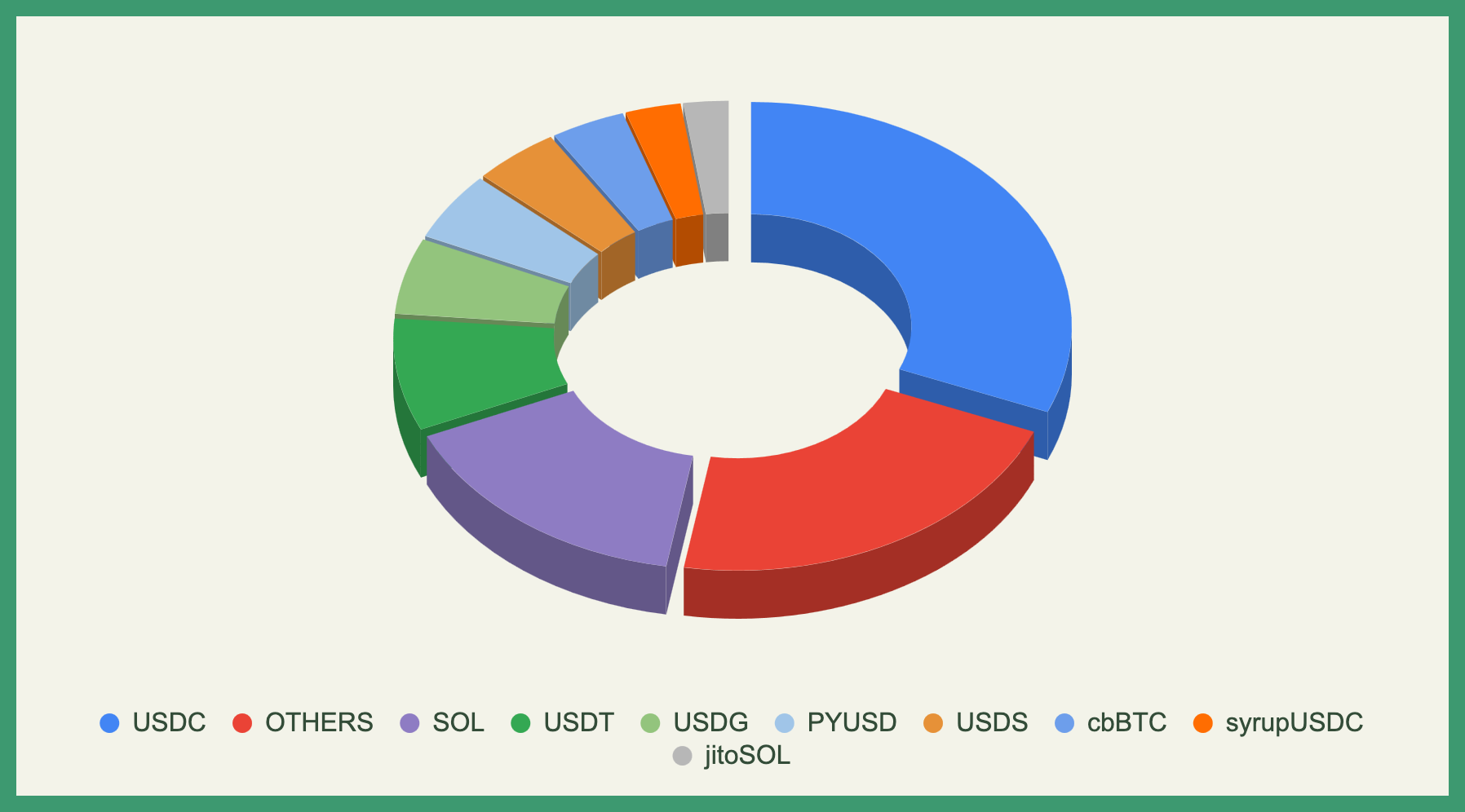

In terms of popularity, frequently traded tokens, besides a mix of memecoins and protocol tokens (represented as others), were assets featured in Kamino's lending and borrowing markets. Suggesting that a portion of the activity may have been driven by users already interacting with other products on the platform and taking advantage of the convenience of efficiently settling everything on the same website.

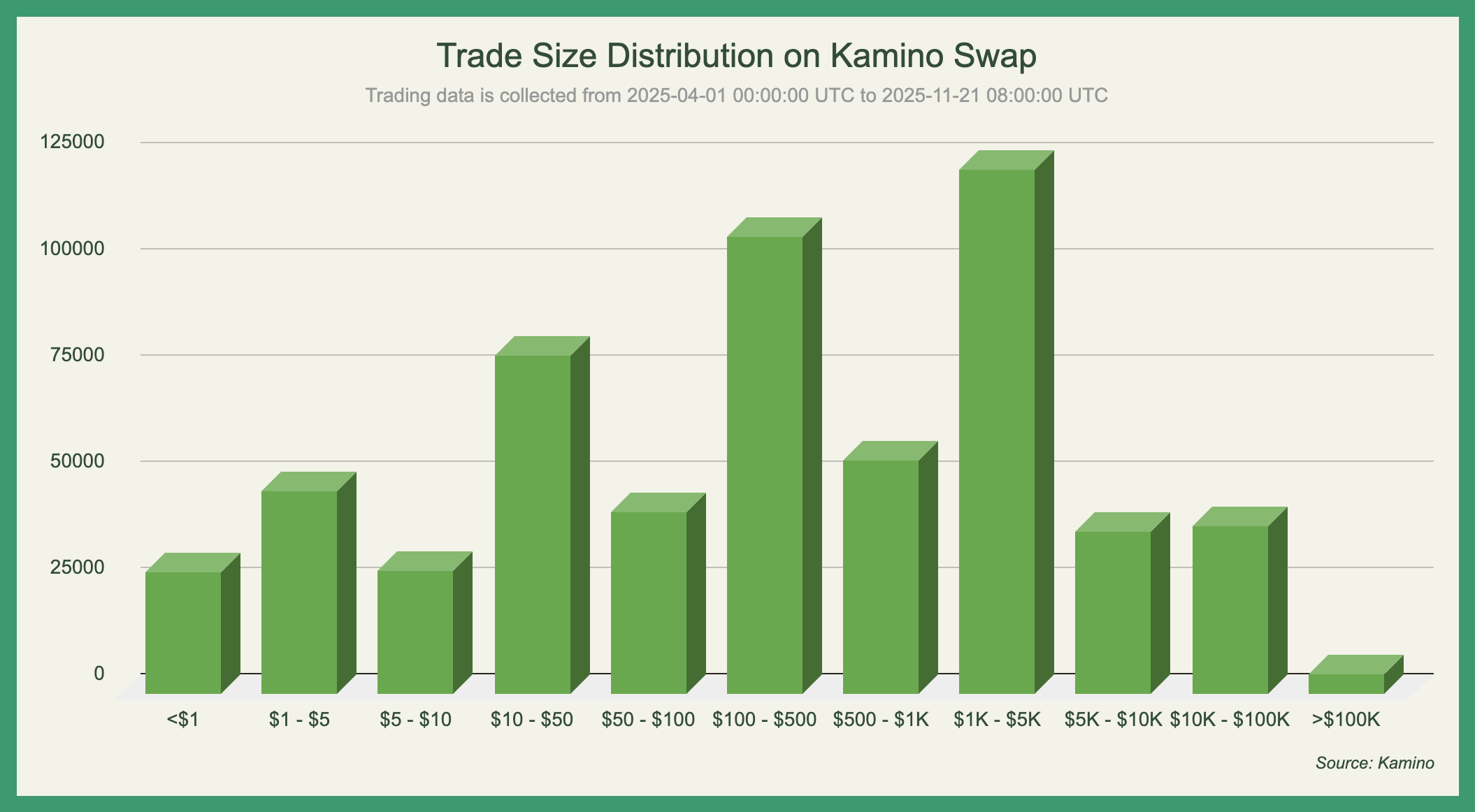

The trade size distribution shows a clear concentration of activity in the mid-range brackets, with most trades falling between the $1 000 to $5 000 range. Although smaller transactions under $50 are common, the data indicates that the meta-aggregator primarily services average retail users who regularly engage with DeFi applications. Larger trades occur as well, albeit far less frequently than those in the low- and mid-range categories. Considering the most commonly used tokens highlighted in the previous chart alongside the trade size distribution, this pattern aligns closely with the profile of existing Kamino users driving a lot of the usage.

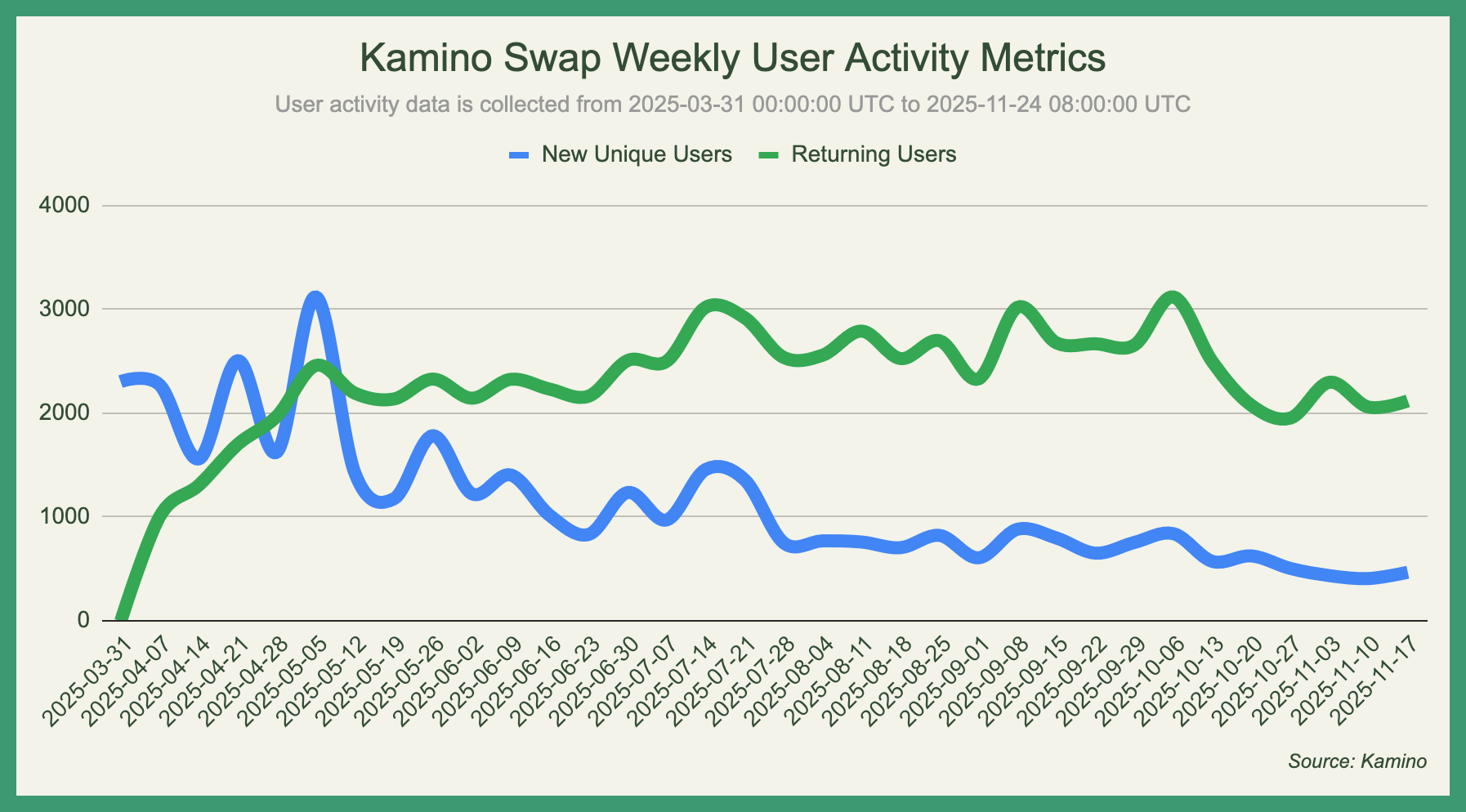

During its debut, Kamino Swap attracted more than a thousand unique addresses per week and managed to retain a decent amount of concurrent users thereafter. Accounting for more casual users with longer transaction intervals, the month-t0-month retention rates have ranged from 30-46%. Slightly more than a third of total unique users have stayed around for a month, with the median user performing 2 transactions and generating $514.14 in trading volume whereas the averages are 15.38 and $76 021.

Conclusion

Kamino Swap has established itself as a credible meta-aggregator on Solana, with usage patterns that look consistent with a product primarily serving DeFi users. Flow is concentrated through a small set of venues, execution generally matches quoted simulations, and activity rises and falls with the broader Solana trading environment. Overall, the on-chain data suggests Kamino’s swap layer is working as intended and has become a relevant part of the Solana swapping landscape.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.