Stocks Arriving On Chain

Will decentralized markets be able to provide reliable spot stock exposure with deep liquidity before GTA VI?

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

Introduction

Building financial on chain applications featuring non-native assets, such as US equities and indices has been typically constrained by the presence of accurate and consistent data feeds. The diversification of oracles from prominent providers like Chainlink and Pyth and the prevalence of in-house solutions have enabled protocols such as Gains Network and Ostium to facilitate frictionless trading of traditional markets otherwise inaccessible on the blockchain. However perpetual futures contracts, despite their undeniable usefulness, are not the desired option to attain exposure for most users in the space. It’s evident that there is a vacancy for spot assets in this category ever since the catastrophic collapse of Mirror Protocol in 2021, which enabled the minting of over-collateralized debt positions (CDPs) for synthetic stock exposure.

While such models are definitely a step in the right direction and some can say, is better than nothing, they still leave much to be desired. Mainly in the realm of capital efficiency, since the thought of providing $200 dollars of collateral for a $100 dollar nominal position with the looming risk of redemptions stemming from algorithmic peg deviations isn’t exactly something to get excited about. If this truly were the standard, we would see many Liquity forks sporting push-based NVIDIA oracles and custom aggregators that would take someone acquainted with Solidity and indexers a month or less to build out. In reality the most sensible course of action from here would be to jump on the tokenization bandwagon and issue backed structured products.

From Ticker to Token

Before anyone starts putting together a pitch deck and starts reaching out to local regulatory agencies, we’d like to point out that the new paradigm is already been spearheaded by Backed Finance (also known as BackedFi), a licensed and regulated tokenized securities issuer primarily focusing on bonds, ETFs and equities. Founded in 2021, the entity has been active on numerous EVM chains for well over a year with their “b” suffix assets, showcasing varying levels of success and adoption.

Their latest flagship product line dubbed as xStocks, has introduced a grand total of 61 tokens, comprising of major publicly traded US companies (e.g. Robinhood, Apple, Microsoft etc) in addition to ETFs like the S&P500 and NASDAQ, on Solana. Each xStock is backed 1:1 by the underlying asset, meaning one token represents on share of the corresponding equity. This backing is supported by Chainlink's real-time data feeds via the Cross-Chain Interoperability Protocol (CCIP) and Proof of Reserve, ensuring transparency and collateralization. Designed strictly for price exposure, the synthetic shares do not grant voting rights in shareholder meetings however but dividends are passed onto the xStock user via a rebasing mechanism.

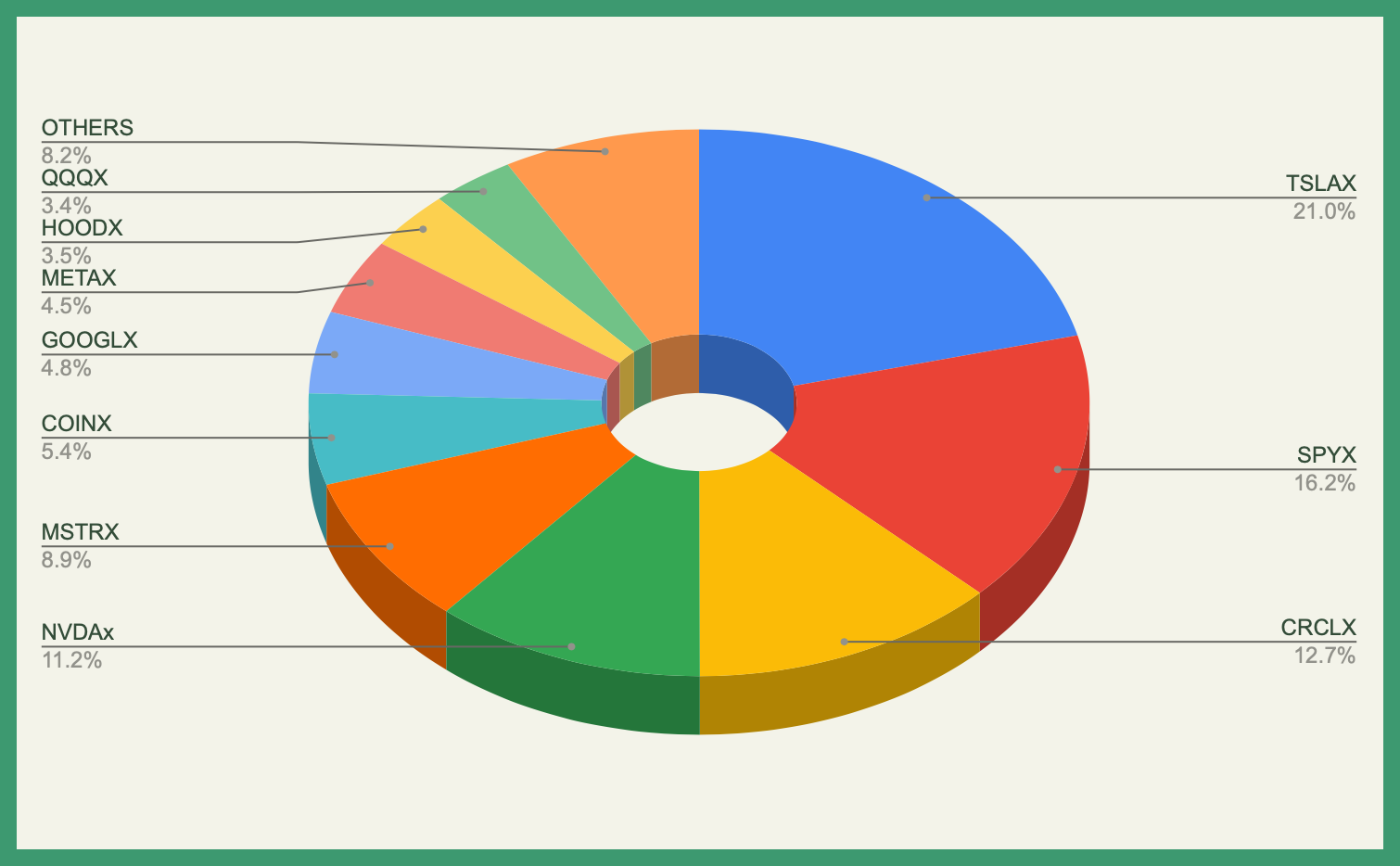

Since its inception on June 30th, the total market capitalization of xStocks has reached roughly ~$32.33 million across 23 tokens (according to multiple sources), swiftly surpassing similar preceding offerings by the company in value.

Unsurprisingly an overwhelming majority of the value is concentrated in tech stocks, likely due to their consistently strong returns, revenue growth and potential. The data suggests that despite a wide array of available options, at the moment, there isn't a noticeable interest in retailers, commercial service providers and manufacturers of physical consumer goods that are generally preferred by value investors.

It's not abundantly clear whether the minting and redeeming of xStocks is currently available to the public, but they are tradable on both decentralized and centralized exchanges with good liquidity. Reported by CoinGecko, the 24-hour trading volume for the entire ecosystem has been approximately ~$53.48 million, hinting at accelerating traction.

xStocks on Kamino Finance

Briefly mentioned earlier, lending and borrowing platform integrations have already begun, with the most noteworthy strategic partnership being Kamino Lend, which has launched a custom, dedicated market for xStocks. Whitelisted assets mostly include popular tech stocks and ETFs alongside stablecoins. The xStocks that have been integrated on Kamino Lend to date:

- SPYx

- TSLAx

- NVDAx

- MSTRx

- AAPLx

- QQQx

- GOOGLx

- HOODx

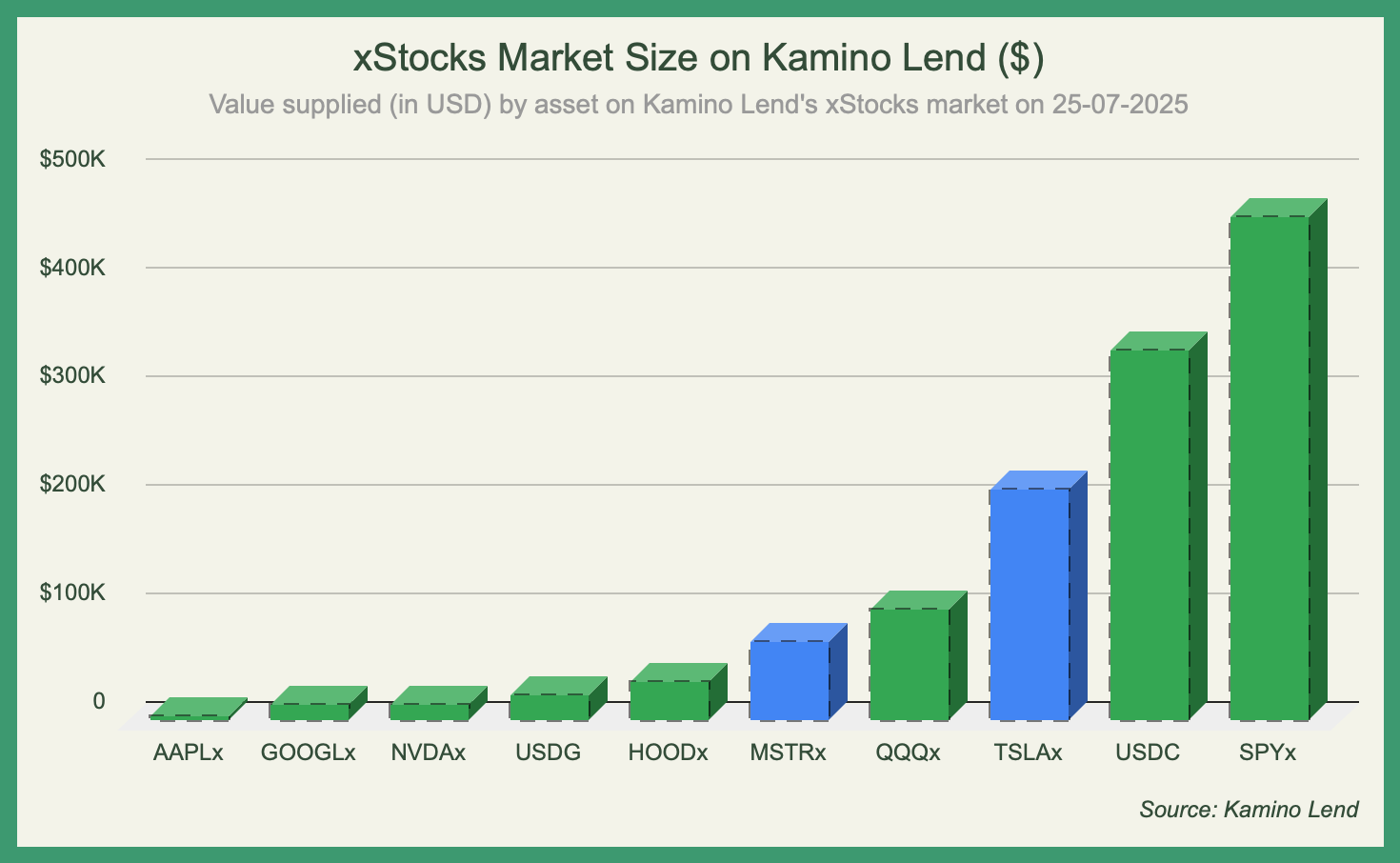

With this integration, Kamino is the first lending market in crypto to enables borrowing against tokenized stocks and indices. The max LTV (loan-to-value) for these assets vary between 35-50% with the SPYx and QQQ indices offering the highest LTV. Currently, USDC or USDG can be borrowed against these assets. As the xStocks market is still quite new, the liquidity is still growing with ~$304k in total borrows currently. The borrow APY has therefore also been somewhat volatile but averages out to 5.74% over the past 30 days and sitting at around 7.87% currently. Considering the current bullish market environment with elevated funding rates and lots of yield opportunities in DeFi, being able to borrow against stock and stock index exposure allows for increased capital efficiency and unlocks additional portfolio yield.

In order to correctly price these assets and reduce the risk of liquidation for holders of xStocks, Kamino has developed a custom oracle solution in collaboration with Chainlink which uses the price of these assets on multiple US equities exchanges. Several of the xStock tokens are still somewhat illiquid due to their recent launch and the solution above prevents spontaneous price wicks to cause liquidations on the Kamino market. Kamino also implements a price band mechanism for low volatility periods (e.g during the weekends and other periods where the stock market is closed). During these periods, Kamino only accepts oracle prices streamed by Chainlink if they fall within a set % range of the asset price at last market close.

Traction

The most commonly supplied assets are also the ones most sought after in the illustration below, with SPYx, TSLAx and NVDAx making up most of the market (excluding USDC and USDG). The utilization ratios for the two stablecoins range from are between 70-90%, with historical metrics showing multiple instances of near total utilization for brief periods.

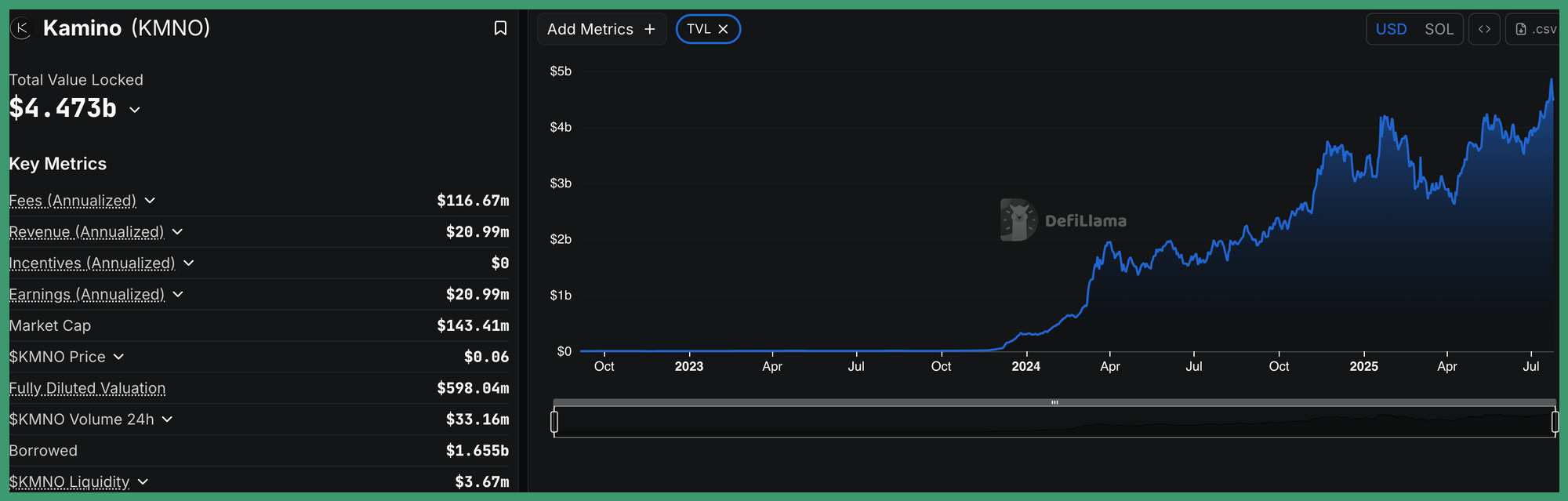

The xStocks Kamino market has already been growing steadily since launch last week. As the adoption of tokenized stocks continue to grow in the future, Kamino is positioned to be a prime beneficiary of this trend.

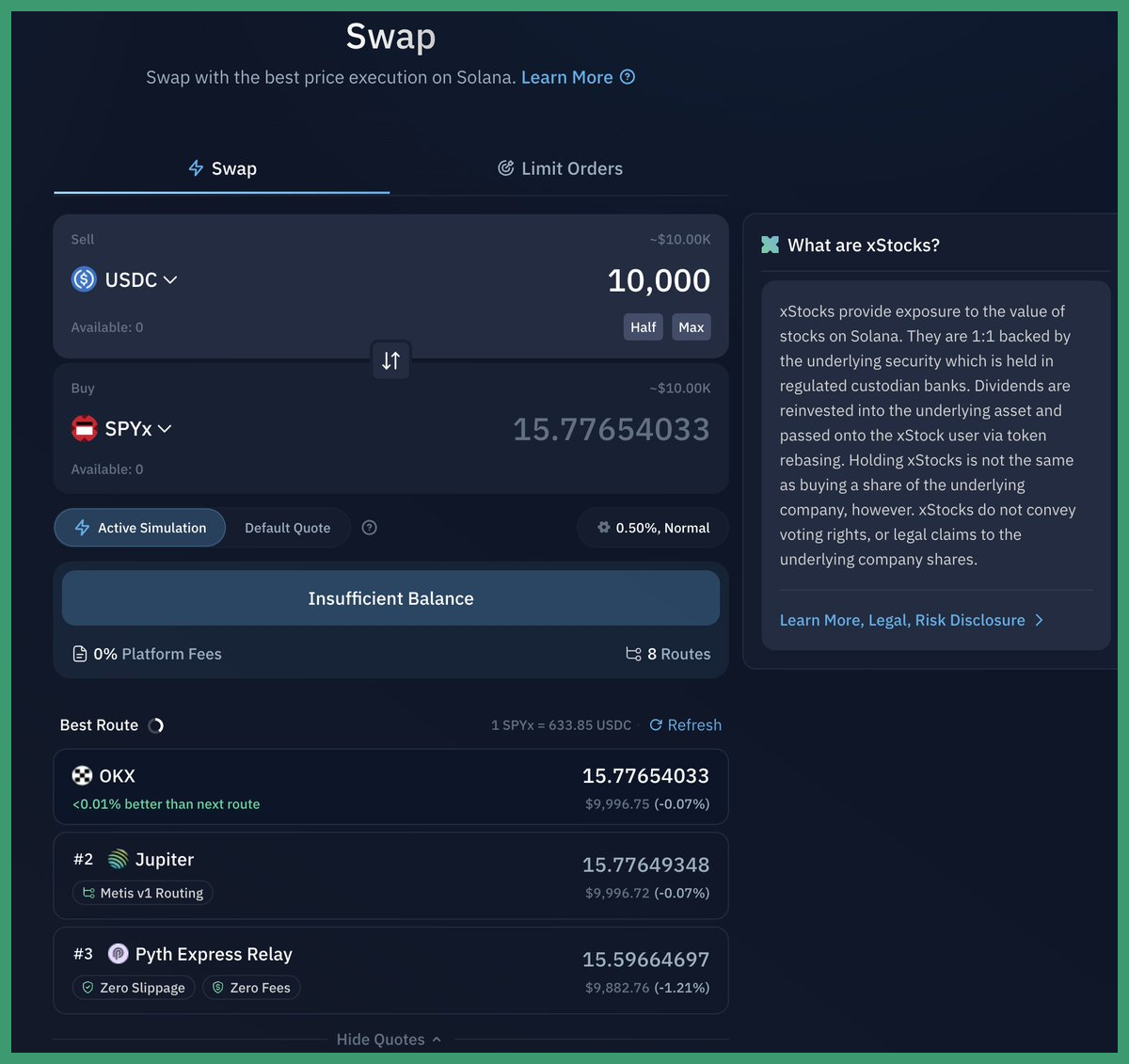

The best way to acquire these xStocks is via Kamino Swap which aggregates all the most liquid routes on Solana without charging any additional fees:

You can read more about how Kamino Swap works below:

Aside from the integration of tokenized stocks, several new features and farms have gone live on Kamino recently. This includes the most recent EUR campaign which offers 85,000 EURC in incentives over the next three months:

Users can earn 4.44% supplying EURC or pay just 3.52% to borrow it on the Main Market. With the USD underperforming the EUR so heavily this year, investors might be looking for diversified fiat exposure and Kamino offers one of the cheapest ways to borrow against the EUR. As most DeFi protocols still only allow USD backed stablecoin deposits, one the best way to earn yield on EUR is to borrow USD against it and use the borrowed e.g USDC across DeFi.

All in all, Kamino continues be at the forefront of DeFi innovation being the premier lending protocol with tokenized stocks. With this and many other recent integrations and collaborations, Kamino has surged to a new all time high in TVL of $4.5b with still a lot of things to come.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.