Perp Dex Vaults - A Look Under the Hood

Introduction

Perp dex vaults have historically offered strong risk-adjusted returns. Their traction grew with GLP (the vault on GMX) and was further cemented as a popular yield strategy with Hyperliquid's HLP. Today, there is a sea of vaults across different on chain exchanges - all with different designs and risk profiles. This report will uncover the return, volatility, TVL and risk-adjusted return (Sharpe ratio) for the vaults on Hyperliquid, Lighter, Ostium and Extended.

Make sure to subscribe to On Chain Times if you haven't already.

Sponsor - Reown

Reown makes it easy for devs to build slick, secure onchain wallets and apps with its AppKit and WalletKit SDKs, bridging complexity and usability in crypto. Reown recently launched a report named 'State of Onchain UX' which is a comprehensive study by Reown with insights from Nansen. In this report, over 1,035 active crypto users across the US and UK were surveyed in February 2025, and onchain analytics from both Reown and Nansen were combined to deliver a 360° view of today’s onchain landscape.

The findings reveal a maturing ecosystem with accelerating wallet adoption. Users still juggle multiple wallets however due to fragmentation and security fears. Ethereum remains the main settlement layer while Solana and Base excel in high-frequency trading and innovation. Although 54% of users have transacted on chain for payments, trading remains the dominant activity. Confidence in security is up to 69%, and 86% say clear regulation will drive mass adoption . Dive into the report to see how Reown’s tools can help you build gasless, compliant, and seamless onchain experiences.

LLP

LLP is the native market making vault on the Lighter exchange which launched its private beta in late January this year. Lighter is a custom L2 with zk-proofs allowing for low latency and high TPS performance. The exchange stands out by having zero fees on both maker and taker trades. Thus is part of the reason why Lighter sees $1-2bn in daily trading volume on most days (making it the second most traded exchange after Hyperliquid). Another reason for this high activity is their points program which went live at the same time as the private beta and rewards trading activity across all markets.

LLP is similar to HLP on Hyperliquid in the sense that it is the exchange-native market maker and liquidator. Users of Lighter can participate in the market making strategy by depositing into the vault and share the returns.

As mentioned by one of the team members in their discord, the purpose of LLP is the following:

"LLP has some hard missions to accomplish:

- always offer liquidity

- offer good liquidity

- offer low spreads

- offer stable returns".

While its purpose is to ensure deep liquidity and tight spreads in the orderbooks, it is far from the only market maker on the exchange. Other trader HFT firms can run market making algorithms as well.

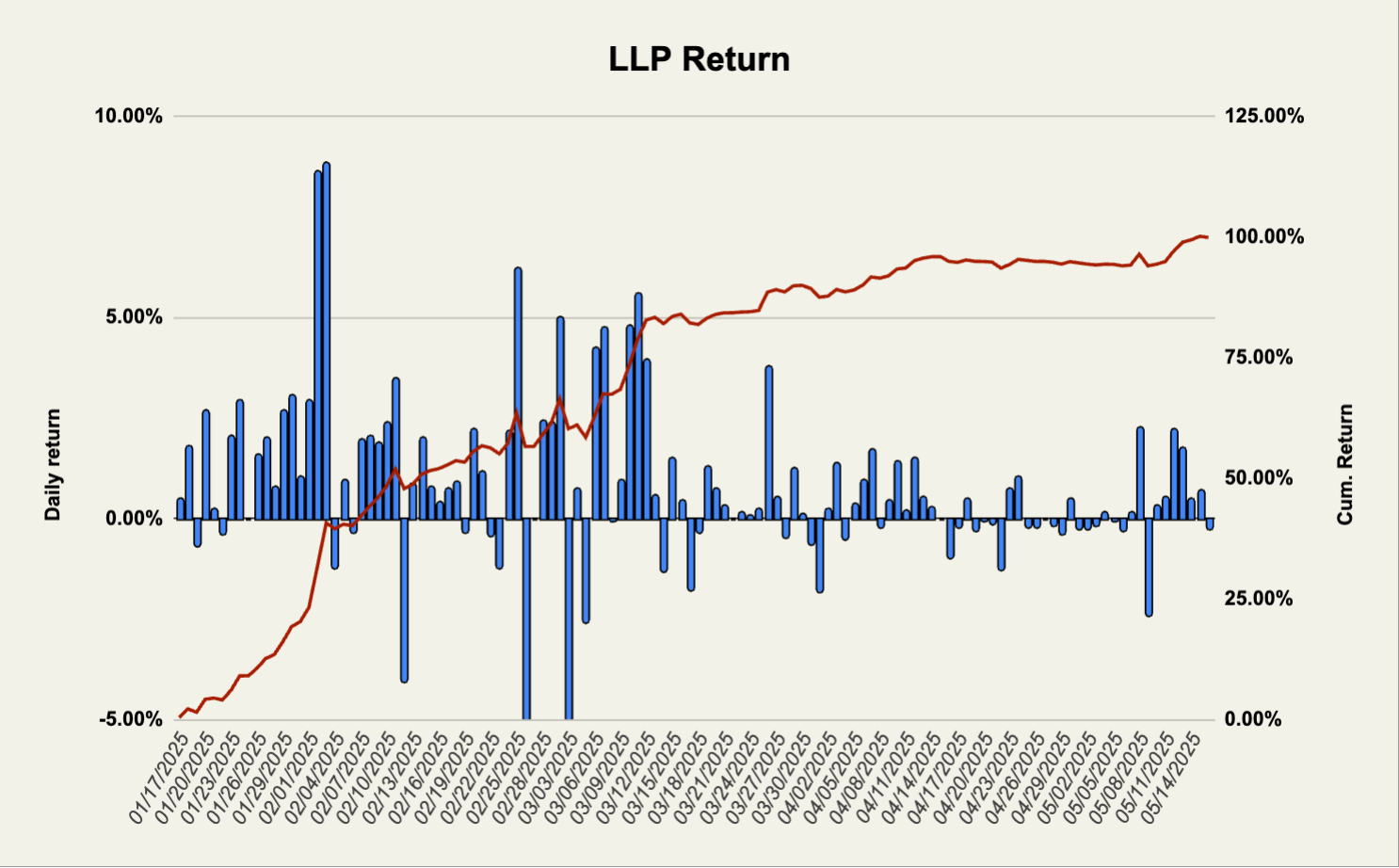

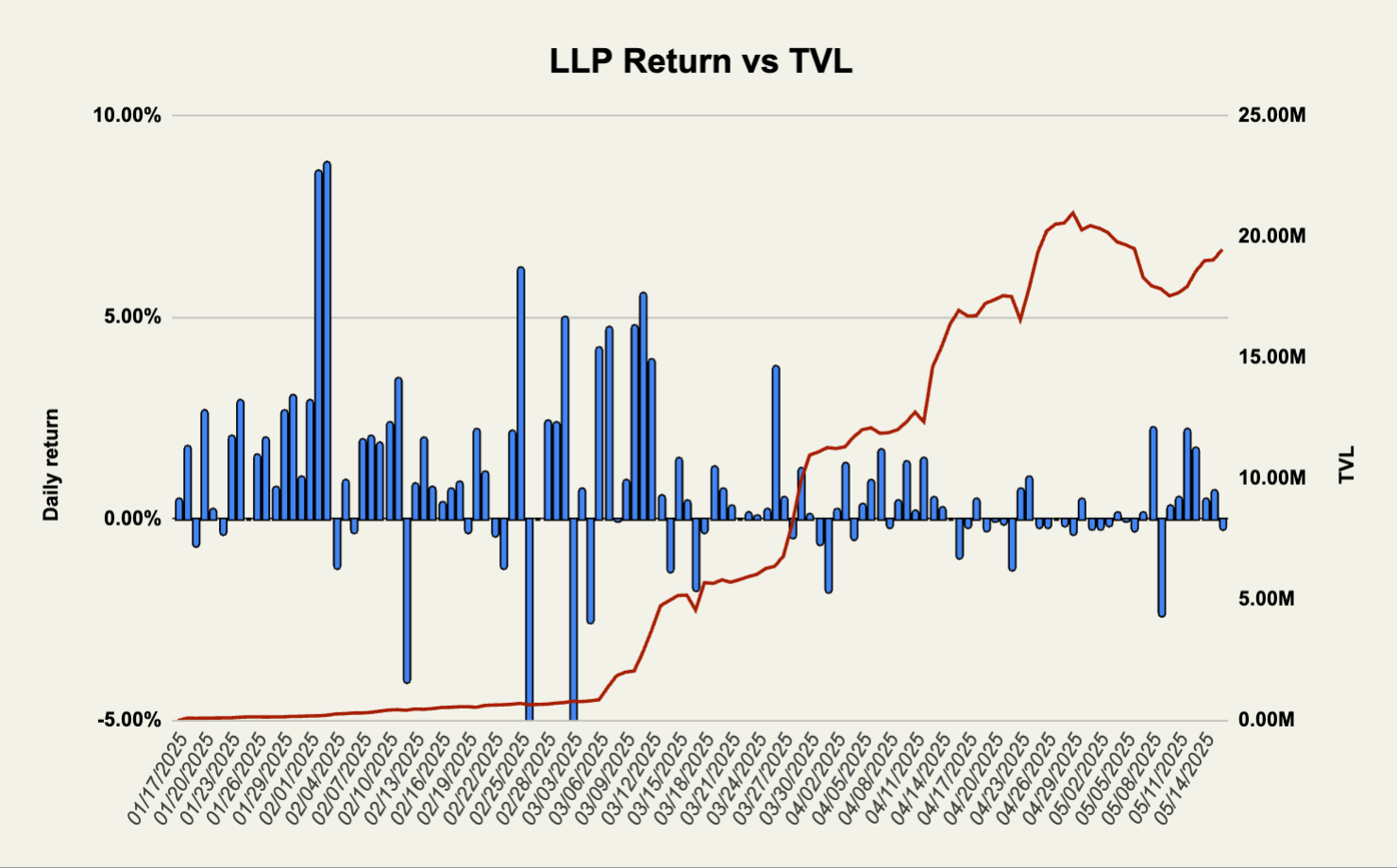

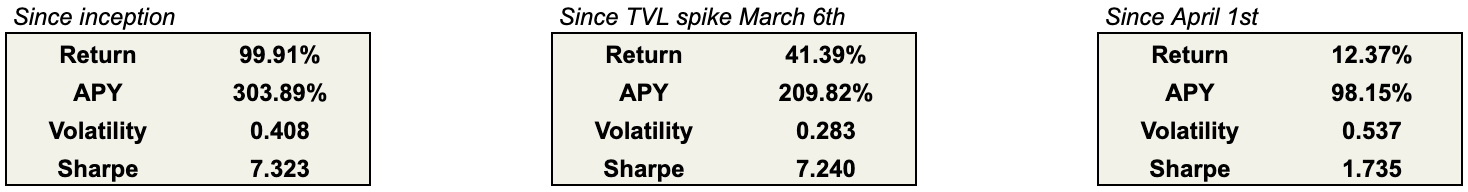

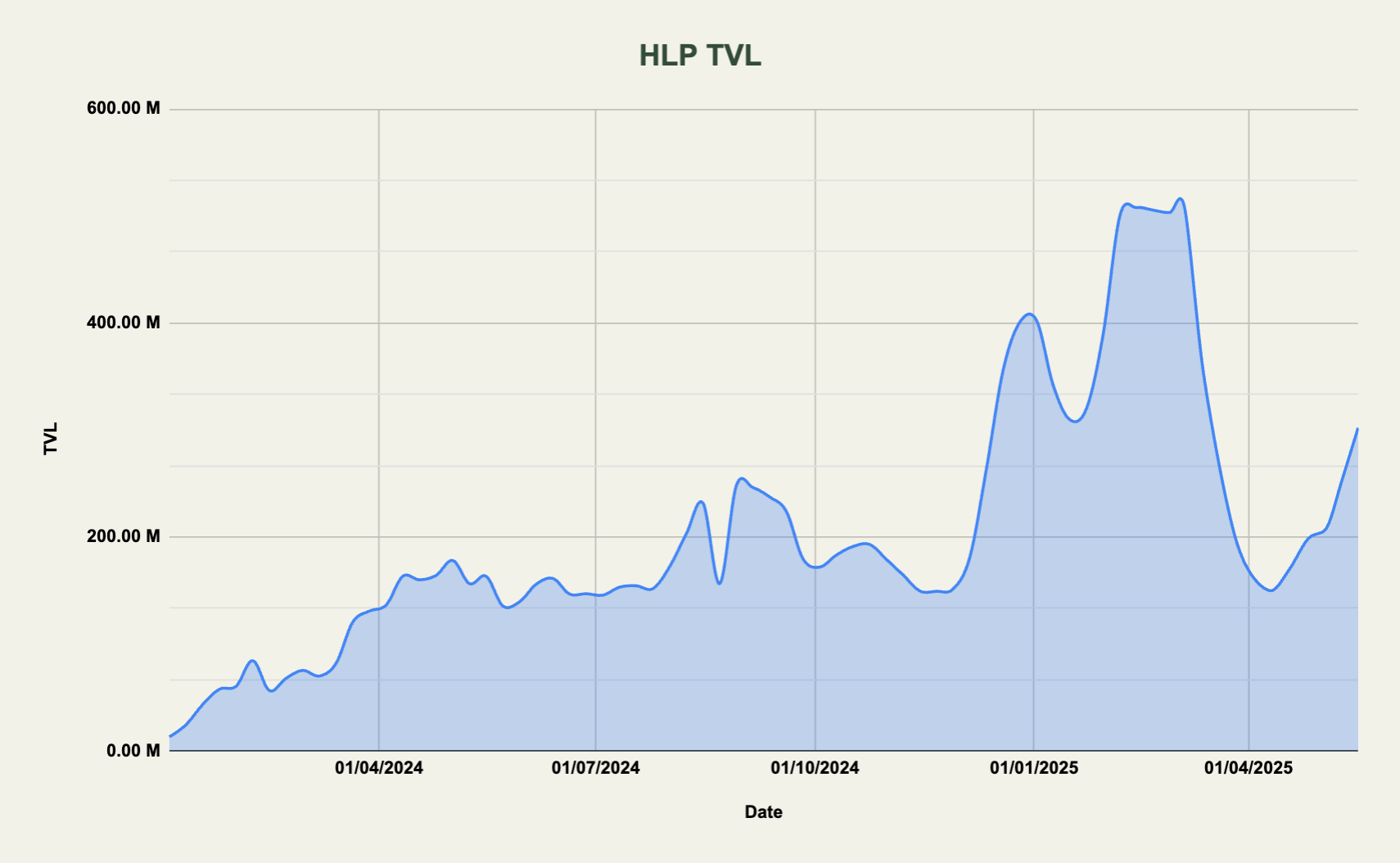

LLP has seen some impressive performance since going live in January with several days of 5%+ returns and a cumulative return of 100% since inception. As seen on the second image, TVL spiked around March 6th in which the daily returns compressed slightly afterwards. There is now a total of around $20m in LLP deposits which is likely going to grow as long as the return remains high and as they open up access beyond the private beta.

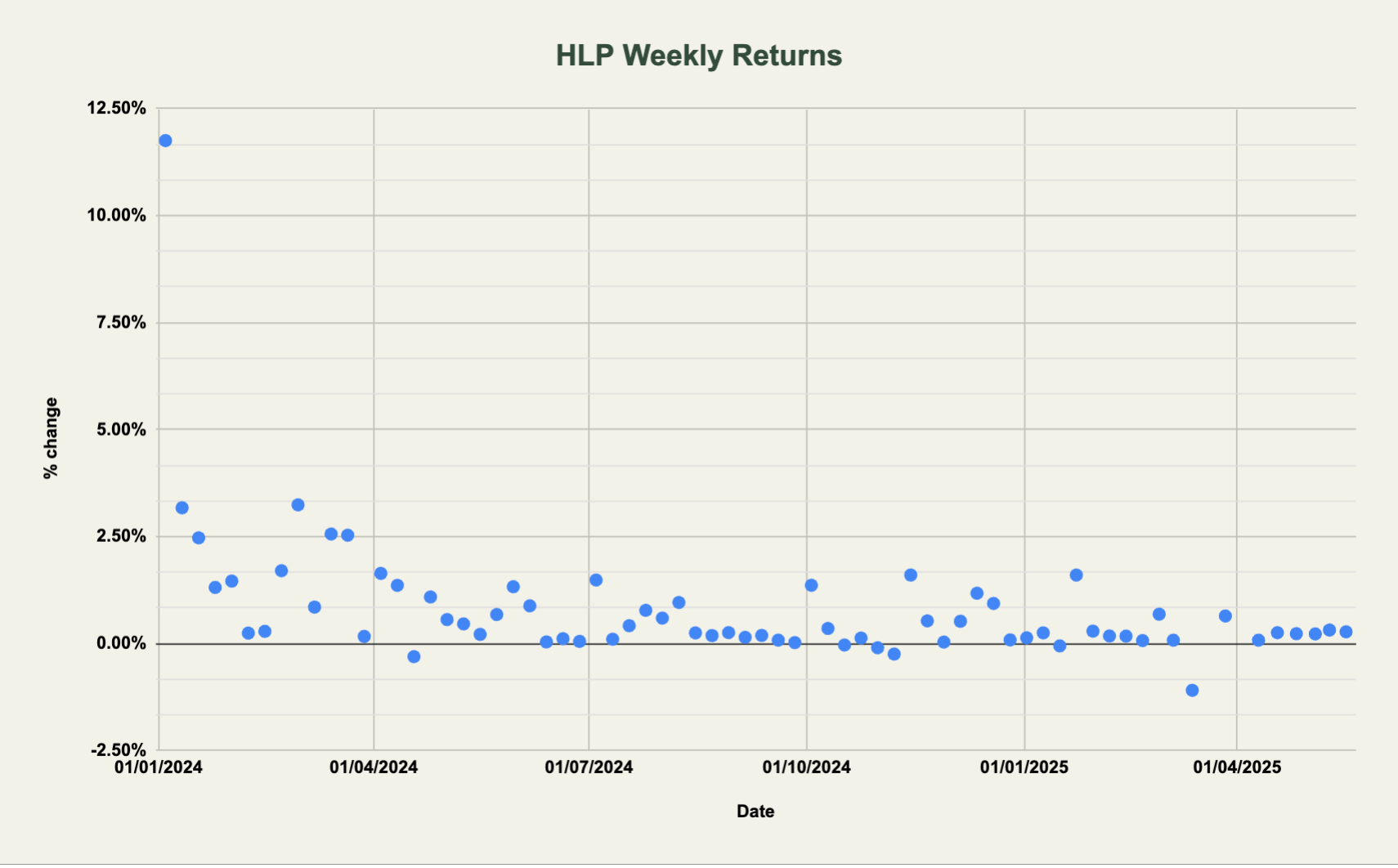

It's worth noting that LLP is the vault with the most volatility across all the vaults presented today seeing multiple days with significant drawdowns. Overall however, LLP has also performed the best of all of the vaults mentioned today by an order of magnitude and has been a 7+ Sharpe strategy when measuring both since inception and since the large TVL increase March 6th. While the Sharpe has decreased recently, the vault has returned 12% since April 1st with an APY of nearly 100%.

As Lighter is still in private beta, there is a $100k deposit limit on the exchange. In addition, only a fraction of one's balance can be deposited into LLP as a way for the team to try and ensure it continues to deliver good returns for depositors. Note that the more lighter points your account has, the larger share of your balance can be deposited into LLP.

LLP deposits do not accrue any Lighter points.

HLP

HLP is the native market making vault on Hyperliquid. Last month, we compared HLP to Jupiter's JLP. As we went in depth with an explanation of how HLP works there, we'll skip it today - but feel free to check out the piece below for a deeper understanding of how HLP works:

After the $JELLY incident earlier this year, where a larger trader forced HLP to take on a large directional position on an illiquid memecoin and the vault experienced significant withdrawals, the TVL has gone back up quite a bit and currently sits at around $350m.

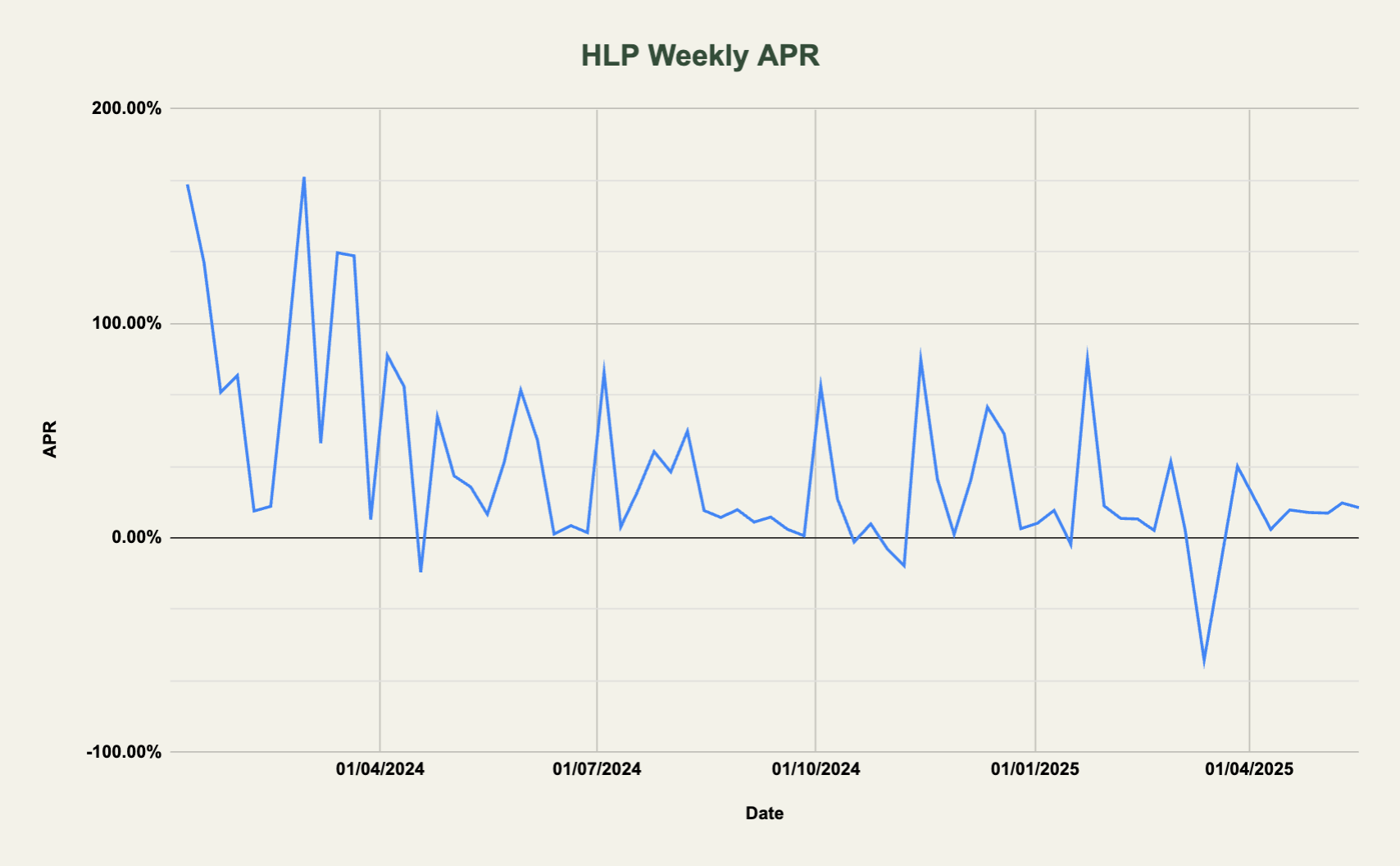

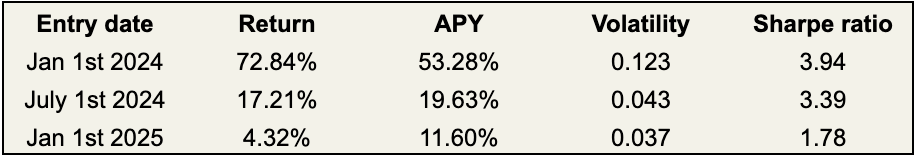

The returns of HLP has been consistent since with an average APR of around 10-13%. As is also the case with the other vaults, the APR was the highest when the TVL was lower (back in 2024):

Year to date, HLP has returned 4.32% which is equivalent to an APY of 11.6% and a Sharpe ratio of 1.78. Since Jan 1st 2024, HLP is sitting at a Sharpe of 3.94 which is pretty impressive considering the size of the vault.

Ostium Vault

Ostium stands out from the rest of the platforms mentioned in today's article by being the only exchange not using an orderbook design. Instead, Ostium relies on an AMM model where the counterparty to all trades is the protocol vault.

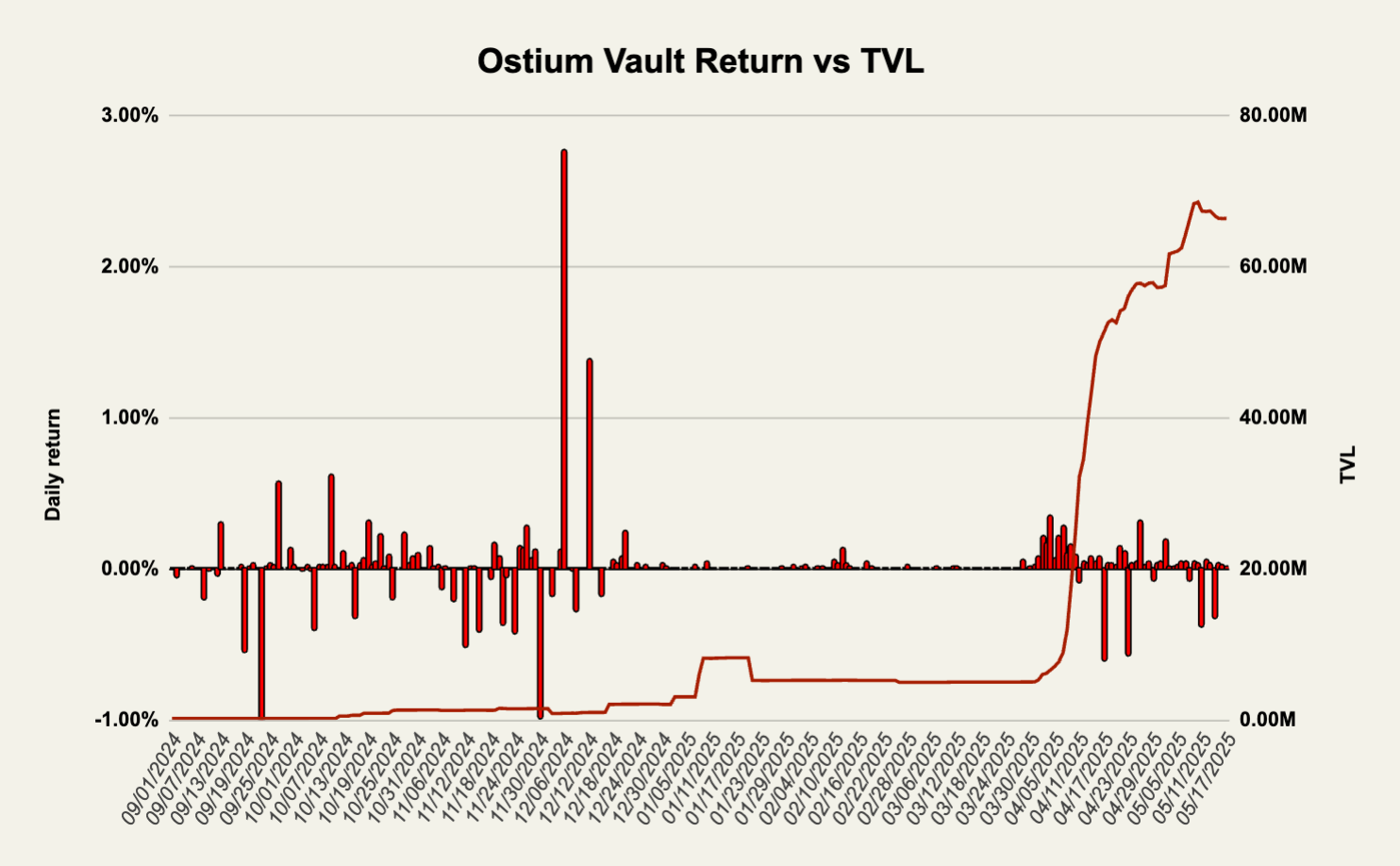

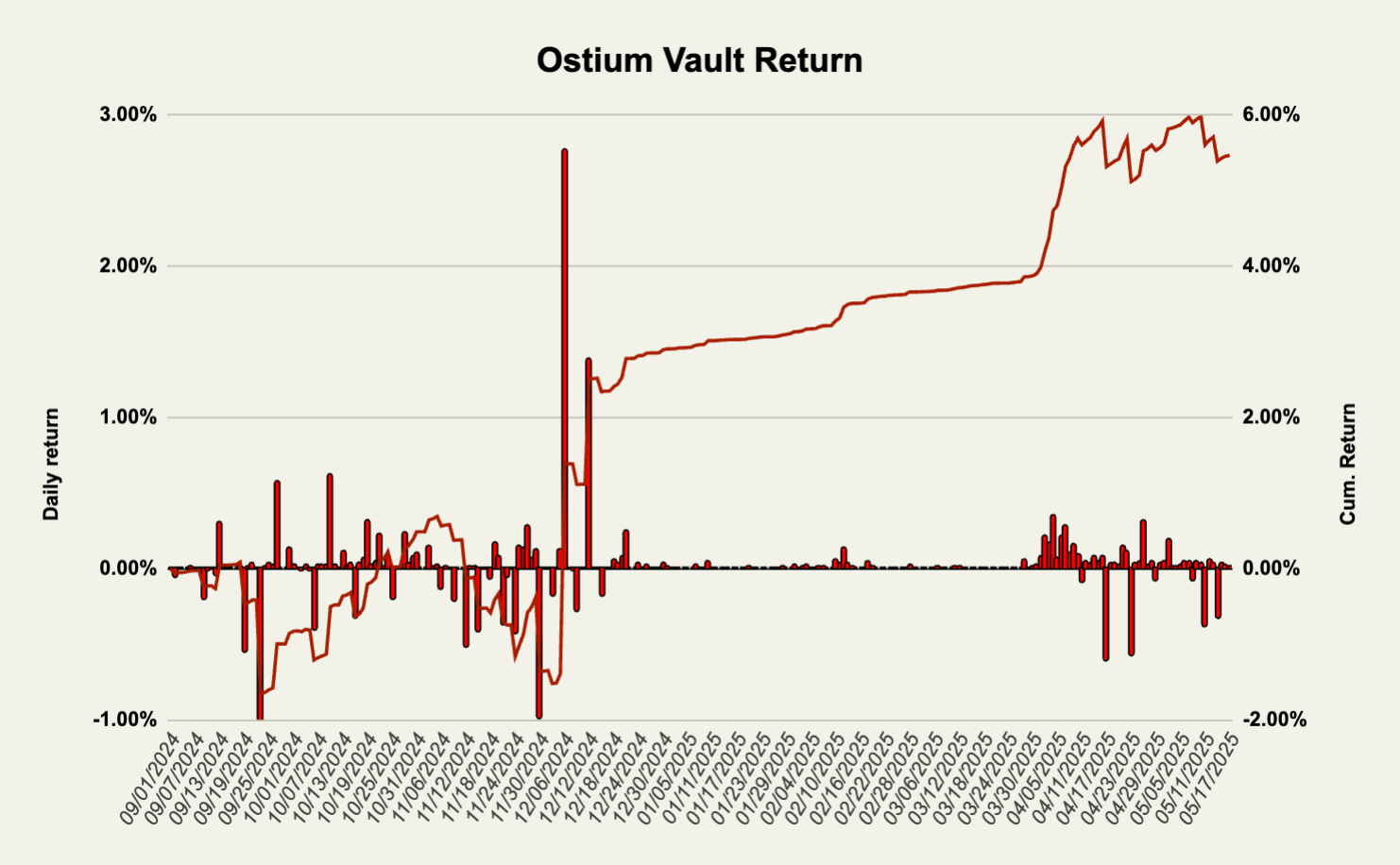

The vault has been live since September last year but didn't see proper inflows until the points campaign for Ostium kicked off earlier this year. As the exchange model heavily relies on TVL in the vault to ensure deep liquidity for traders, vault depositors are earning Ostium points alongside traders (which is not the case for Lighter). Today, the vault sits at over $60m in TVL.

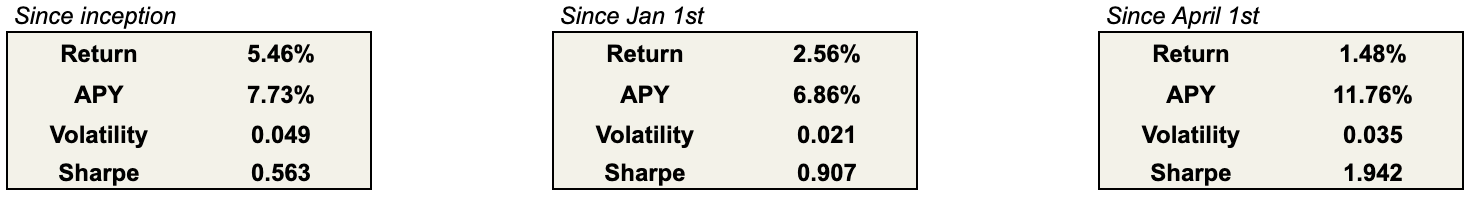

Since inception, the vault has returned 5.46% which is equivalent to an APY of 7.73% and a Sharpe ratio of 0.56%. Since April 1st, when the Ostium saw a large inflow of traders and depositors, the vault has returned 1.5% (11.76% APY) and a Sharpe of 1.94.

Extended Vault

Extended is another recently launched orderbook perp dex. Its vault is similar to Lighter and Hyperliquid as it employs market making strategies across the pairs on the exchange. Alongside crypto perps, Extended also offers some tradfi markets stock indices, commodities and forex.

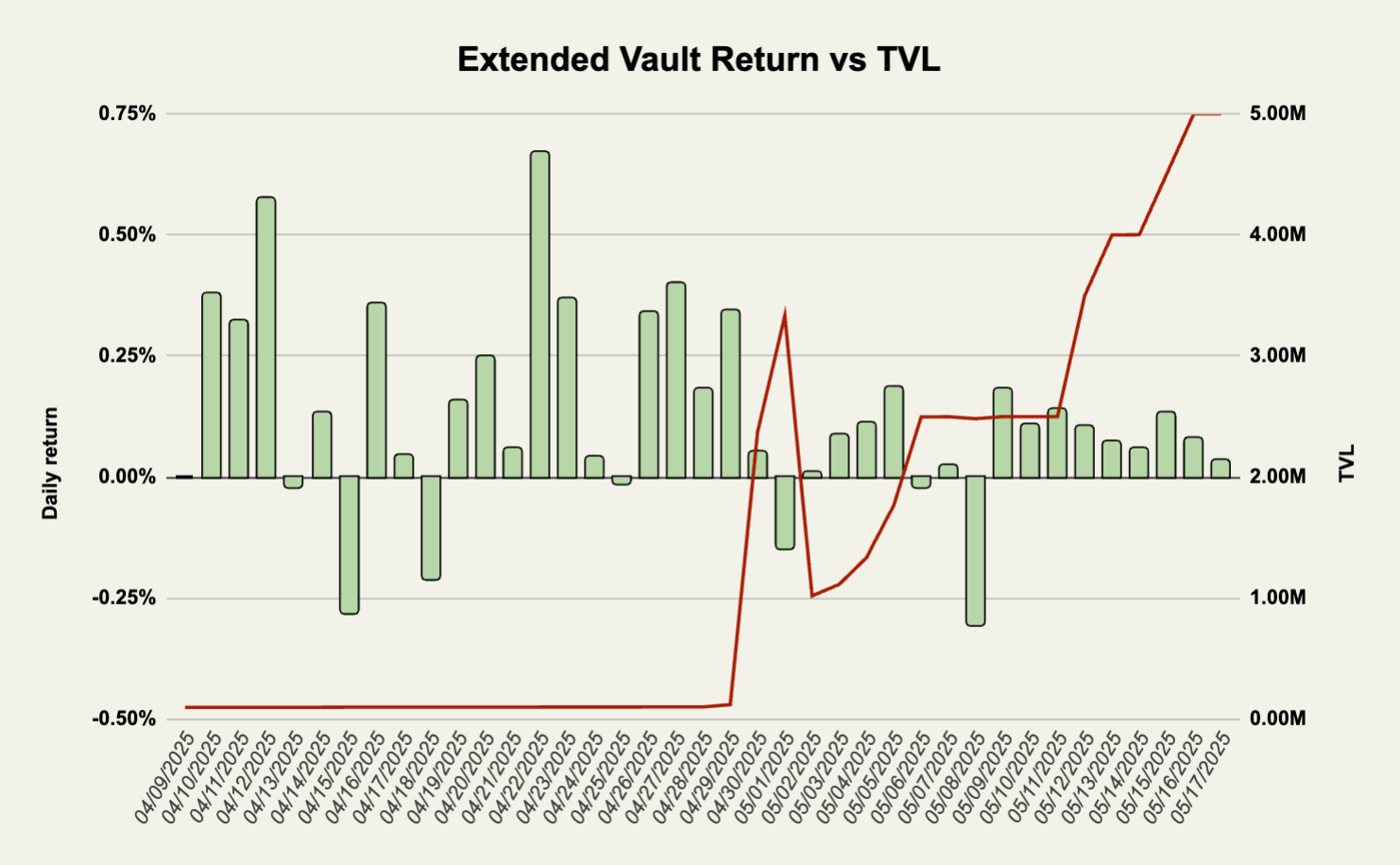

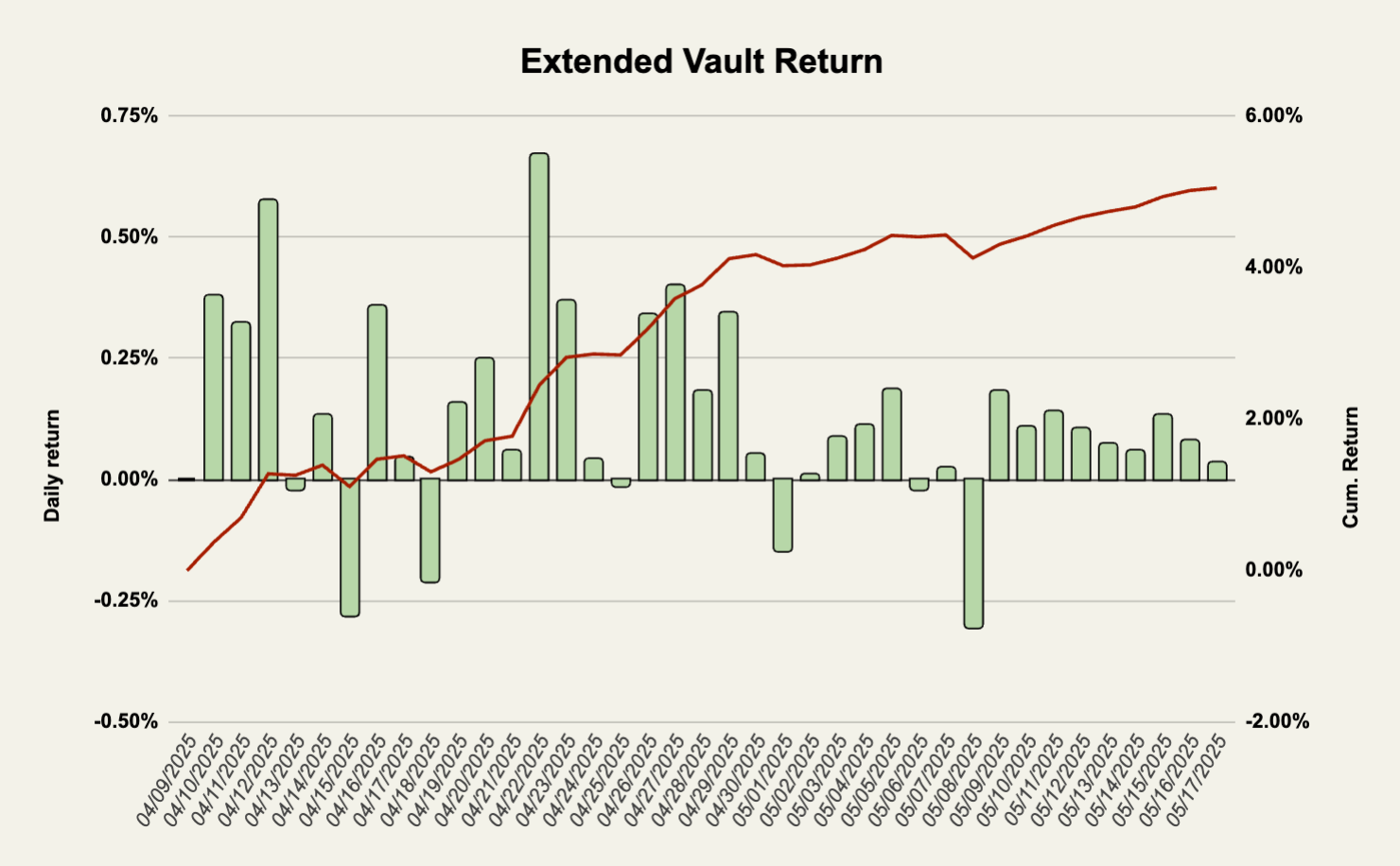

Depositing into the Extended vault grants points. It has grown to $5m since going live (with some pretty strict deposit limits).

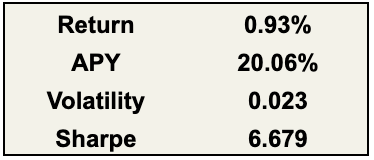

The vault went live for users April 29th and since then, it has returned 0.93% which is equivalent to an APY of 20% and a Sharpe of 6.68.

Conclusion

Perp dex vaults can offer very high risk-adjusted returns in all sorts of market environments. HLP has historically been a very good yield farming strategy. In This year however, Lighter's LLP has offered the best returns both in real terms and from a risk-adjusted perspective.

Before depositing into any of these, it's important to understand the design and risks tied to these strategies. Both Lighter and Hyperliquid have been targets of attacks trying to drain the market making vaults by exploiting their design. For AMMs, like Ostium, vaults can take a big hit in PnL if the market has skewed exposure in one direction and the market moves with them.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.