Kamino V2 - Composability at Scale

Disclaimer

This report is made in collaboration with Kamino and is therefore sponsored. All editorial decisions, opinions, and conclusions expressed are entirely those of our own and remain independent of any external influence.

As mainstream adoption is reaching critical mass, the infrastructure supporting a new paradigm must evolve to meet growing complexity and demand.

Introduction

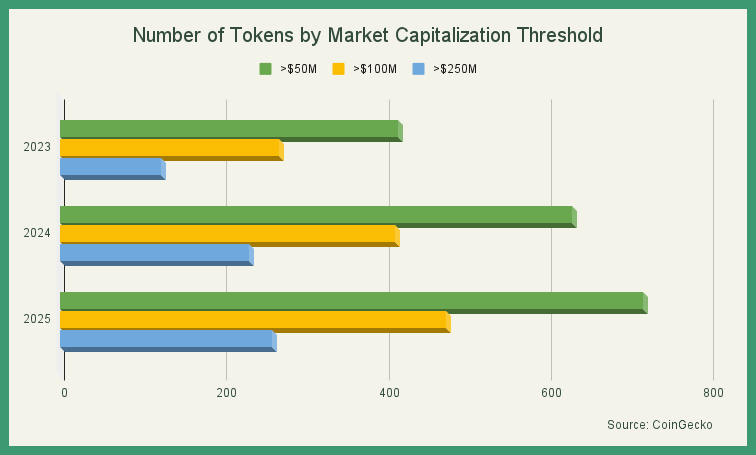

The rapid acceleration and scale of digital asset issuance have fundamentally reshaped the landscape, ushering in unprecedented market diversity. Noticeable growth across all valuation tiers, particularly in mid and large-cap tokens, demonstrates increased confidence in the industry and the market's ability to support a broader range of established assets.

To effectively keep pace with an expanding ecosystem, and satisfy the endless demand for leverage, modularity will become essential for modern money markets to adapt, scale, and specialize without compromising security in the face of continual asset proliferation.

V2 Upgrade

A principle that is exemplified in the modular market layer, a cornerstone of the recent Kamino Lend V2 release, which provides the rails necessary for spawning highly flexible and configurable credit markets—functionally analogous to Uniswap’s permissionless pool creation, but purpose-built for lending and borrowing.

The framework that enables retail users to leverage Fartcoin can also accommodate institutional treasury products requiring KYC compliance and custodial features. Different regulatory requirements, risk parameters and target audiences—same proven foundation.

Far from being a standalone feature, the implementation powers an array of novel additions appended to the already extensive product suite. Most notably curated vaults capable of facilitating automated lending strategies across multiple markets on the platform, managed by the industry’s finest to offer bespoke yield solutions to depositors with varying risk tolerance and exposure preferences.

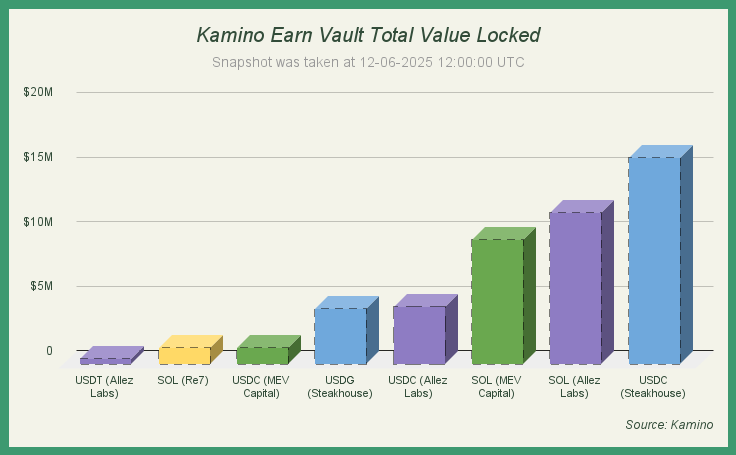

At this moment, eight vaults managed by Steakhouse, Allez Labs, Re7, and MEV Capital are actively deploying capital across the internal ecosystem. Beyond base yields, vault participants can earn weekly rewards distributed across multiple asset types through ongoing incentive campaigns targeting specific markets.

Since their inception, the vaults have accumulated nearly $48 million in cumulative deposits with those accepting stablecoins as collateral being slightly more popular than the native token counterparts. The strong growth behind these figures could be largely attributed to zero management & performance fees for all strategies except Re7's vault and temporarily boosted yields, though this state could change in the future and should be taken into account prior to making any deposits.

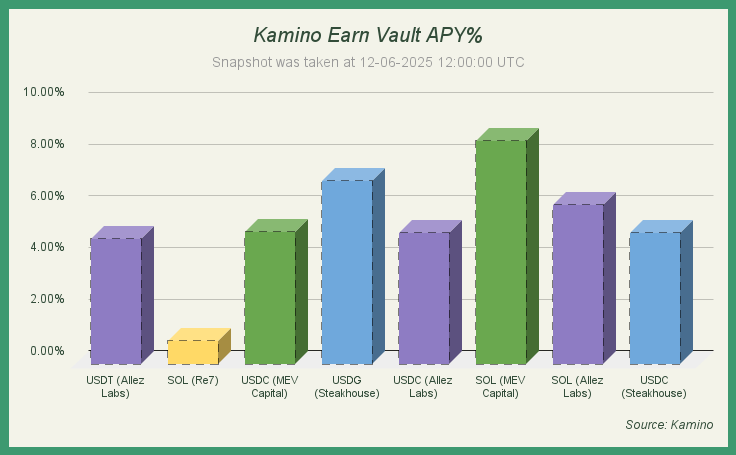

The yield performance demonstrates the effectiveness of automated strategies, with APYs ranging from 0.88% to 8.63% as of June 9th, 2025. The average annual return across all vaults sits at ~5.35%, rising to ~5.99% when excluding the outlier depicted in yellow.

For stablecoin suppliers seeking optimized returns, the most competitive option is USDG by Steakhouse (~7.08%), outperforming Aave's standard USDC lending benchmark (~4.4%), although with some additional smart contract risk on the collateral asset side.

The standout performer is MEV Capital's SOL vault, delivering ~8.63% per annum—the highest yield in the dataset. Indicating that their allocation approach must vastly differ from the other operators.

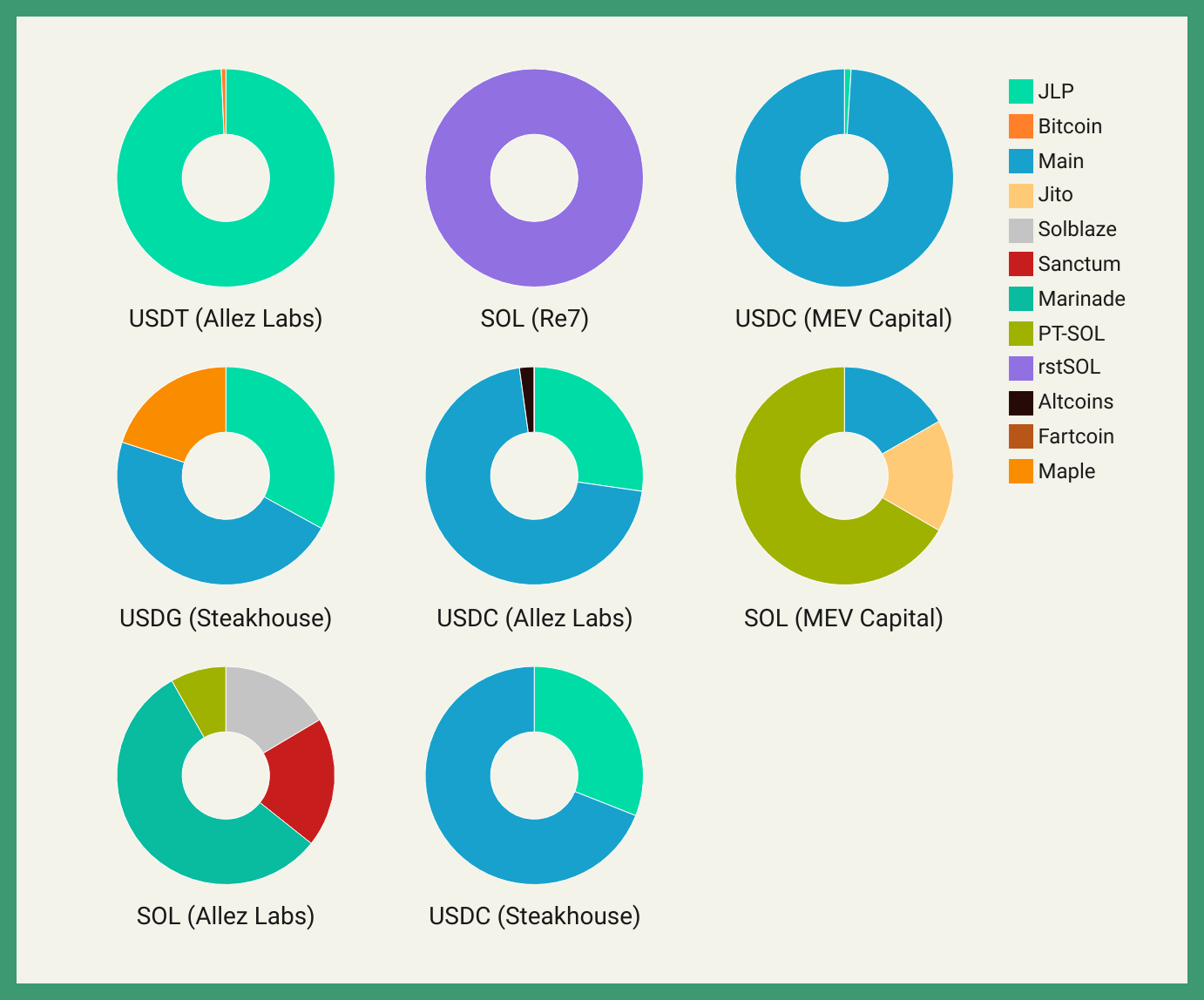

What makes each vault unique becomes clear when we trace where the money flows. Analyzing the allocations provides valuable insights into their investment objectives, risk characteristics and potential returns.

The allocation patterns reveal distinct strategic preferences across asset classes. Stablecoin vaults gravitate toward established markets: the Main market and JLP consistently dominate USDC and USDT allocations, reflecting curators' proclivity for proven yield sources with predictable risk profiles. This conservative approach makes sense given stablecoin depositors typically prioritize capital preservation over maximum returns.

However Solana vaults tell a completely different story, heavily favoring liquid staking derivatives and native Solana primitives. Rather than concentrating in traditional lending markets, managers actively diversify across Marinade, Jito, Sanctum, Solblaze, and other structured products.

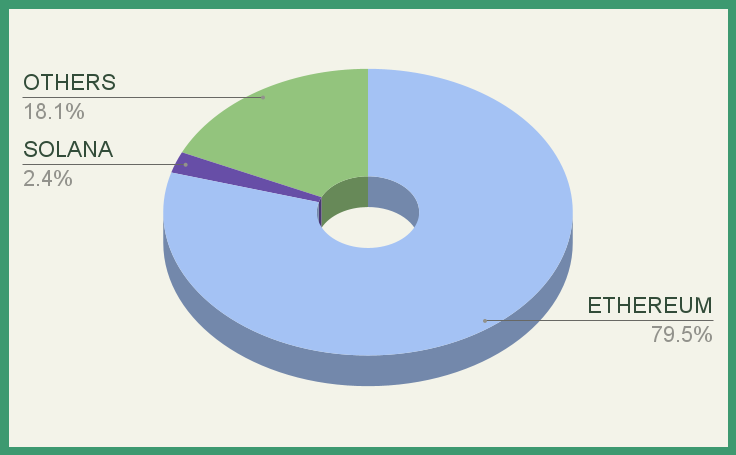

While the current vault breakdown showcases sophisticated strategies across numerous, one notable absence emerges: real-world asset (RWA) exposure remains minimal due to a lack of availability apart from the Maple market. RWA adoption to date has been predominantly captured by Ethereum-based chains, with Solana holding only a small fraction of overall market share—a trend clearly reflected in current on-chain data.

Despite this, Kamino has been actively laying the groundwork for shifting that balance. Behind the scenes, the business development team has been working overtime to attract institutional interest to Solana, most notably through a strategic partnership with Securitize. By offering a purpose-built market infrastructure, complete with native leverage products, the platform is creating a credible and compelling alternative for tokenized asset issuers.

Lastly, users interested in increasing their exposure to major or even speculative assets, can utilize the spot leverage product built atop the market layer. Unlike perpetual futures trading, which can be inherently expensive (especially over a prolonged period) and risky, leveraged spot positions offer traders the optionality of taking on conservative, mid- to long-term leveraged bets (2-4x) with better liquidation protection, lower fees and liquidity deeper than the Mariana’s Trench.

Spot Leverage also includes features like soft liquidations, where users are gradually deleveraged rather than instantly liquidated, and target leverage settings. These features allow users to set their desired leverage level and have the platform automatically adjust their position as asset prices change, reducing the need for constant monitoring and minimizing the risk of forced position closures.

It goes without saying that proper risk management should be the modus operandi for anyone engaging with financial instruments. To support borrowers in making informed decisions and to uphold a high standard of transparency, a masterfully crafted interface has been incorporated to the application for managing active positions.

The dashboard delivers a comprehensive suite of analytics from historical interest payments to loan-to-value (LTV) tracking, ensuring users have full visibility into their risk exposure. As an added layer of insight, the platform also features scenario simulations based on historical periods of extreme volatility, allowing users to stress-test their positions against potential black swan events.

Yields

With Kamino V2 now live, a wide array of interesting yield strategies across different assets have emerged. For the passive famers simply looking to earn yield on stablecoins, one of the many lending vaults offered by various curators, as presented above, are worth exploring:

For the more active DeFi participants however, it's worth looking into the various markets and looping strategies on the protocol. We've covered a few of those recently on our X account including the Maple market and Exponent PT markets which recently went live.

PT-SOL

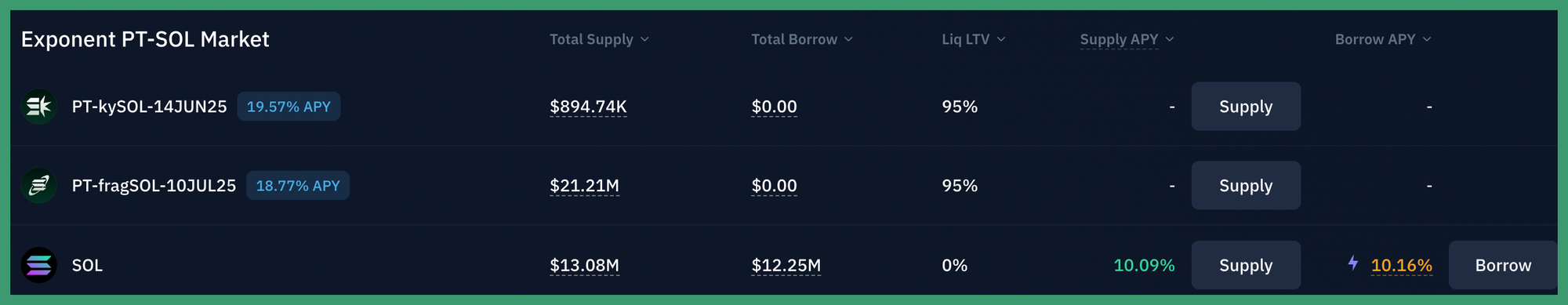

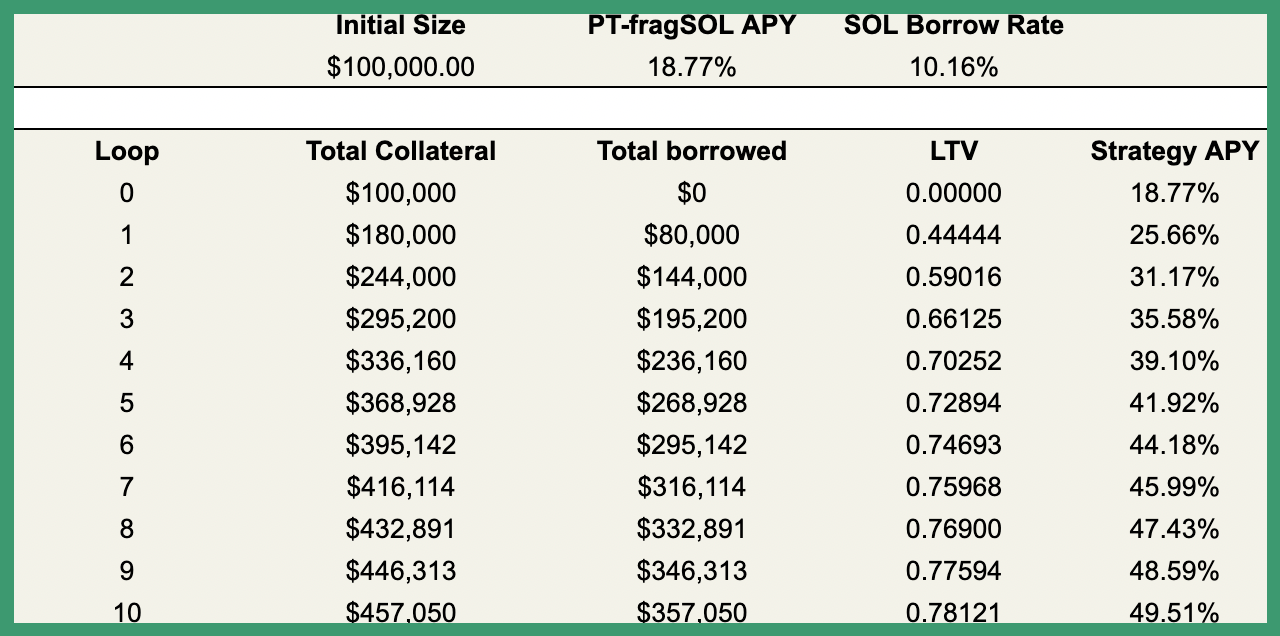

Kamino has recently launched fixed yield SOL products, namely Exponent's PT-kySOL-14JUN25 (from Kyros) and PT-fragSOL-10JUL25 (from Fragmetric). PT-kySOL just expired but a new September market should go live soon. PT-fragSOL currently offers a fixed yield of 18.77% for the next ~3 weeks.

This market can not be looped automatically as it's not integrated into Kamino multiply (yet) but can manually be looped to 5x leverage (80% LTV) which yields an APY of 53%! Manually looping 10 times looks like the following:

Manually this would work in the following way:

- PT-fragSOL is deposited as collateral

- SOL is borrowed at 80% LTV

- SOL is converted to PT-fragSOL and deposited as collateral

- Repeat

Keep in mind that while PT-fragSOL offers a fixed yield, the strategy APY can fluctuate as the borrow APY changes as a function of the SOL utilization rate.

SyrupUSDC

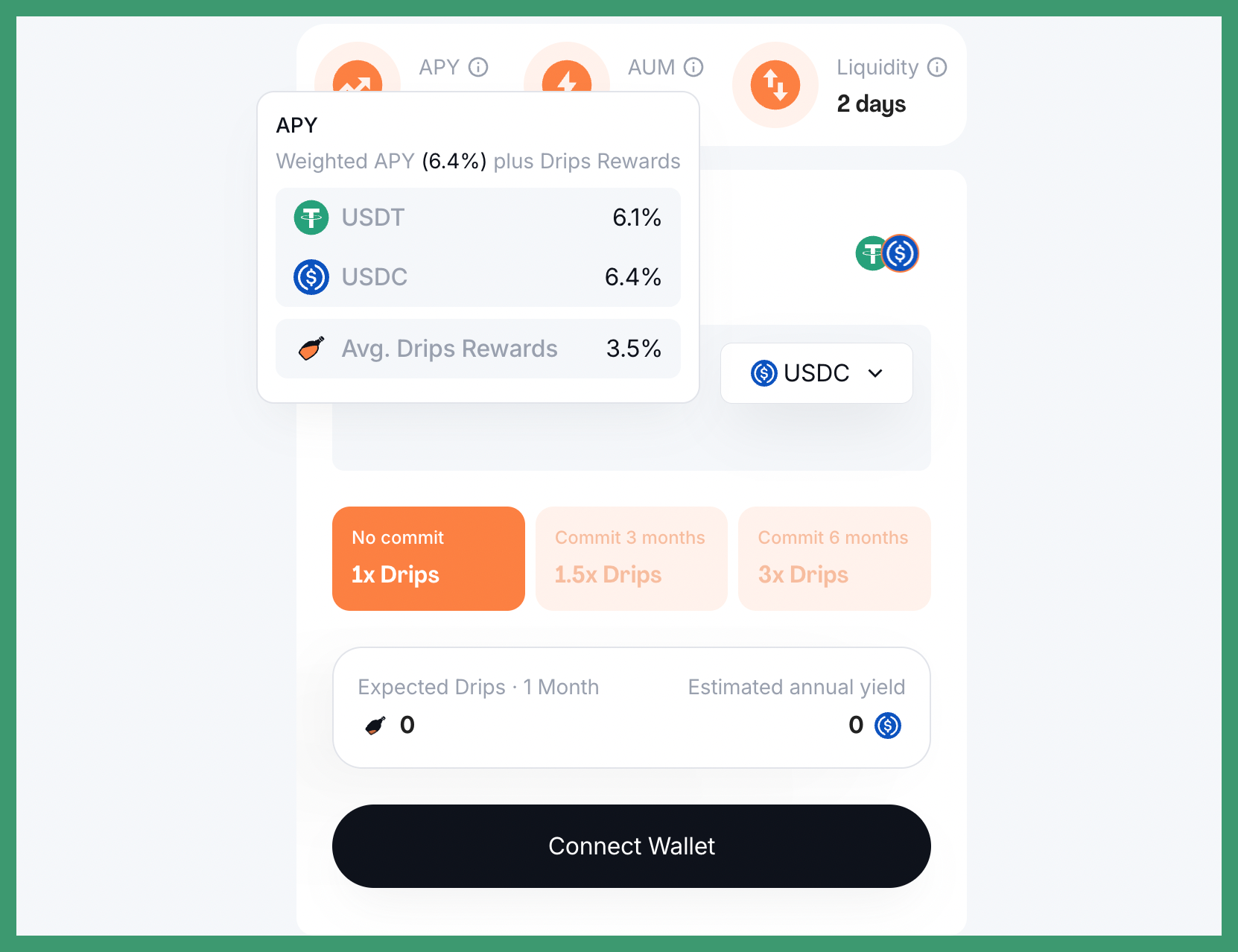

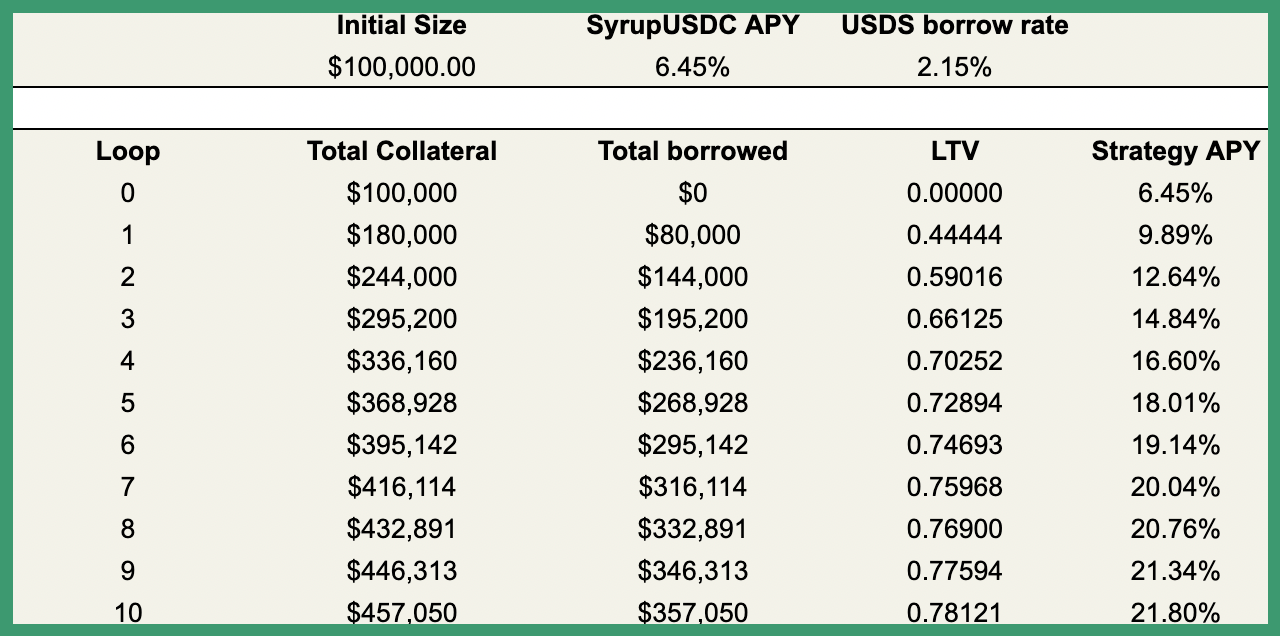

Maple finance (also known as Syrup) is a lending protocol targeted institutional borrowers. Lenders on the protocol get a liquid representation of their position, such as $SyrupUSDC, which currently yields 6.4% APY (drips are not available on the Solana market).

On the Maple market, SyrupUSDC can be supplied as collateral and a range of stablecoins can be borrowed against this with a max LTV (loan-to-value) of 80%. The cheapest option is currently USDS which can be borrowed for just 2.15% annually.

Looping this 10 times to an LTV of 0.78 yields a total APY of 21.8%.

Keep in mind that both the SyrupUSDC APY and borrow rates fluctuate. This looping strategy is therefore only profitable as long as the SyrupUSDC APY remains higher than the cost of borrowing.

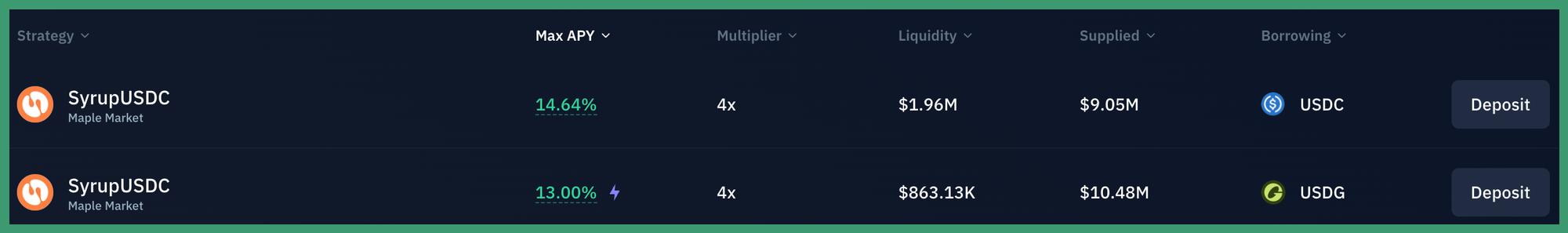

Kamino has integrated this strategy into their automatic looping product suite 'Kamino Multiply' for both USDC and USDG as the borrowed asset. This can be looped up to a 4x leverage in one click. The yield is not as high as when borrowing USDS manually as the borrow rate is lower for USDS than USDC and USDG at the moment.

In addition, Kamino has developed a custom oracle to reduce the risk of liquidation when short term price fluctuations happen on the market. You can read more about this here:

https://x.com/KaminoFinance/status/1927033758089175127…

You can also sign up to the notification system on Kamino (click the bell in the top right corner) to get telegram alerts if your positions are nearing liquidation.

Conclusion

Kamino’s V2 modular lending release illustrates how composability at scale can meet the needs of both retail users and institutions without compromising security. With automated vault strategies, spot leverage products and a variety of markets Kamino delivers attractive yields on a variety of assets and caters to a broad range of risk appetite. Kamino V2 has just begun unfolding with lots of things still in the pipeline including real world asset integrations, additional crypto markets and more.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.