How to Value L1 Blockchains (Without Ignoring the Magic)

Sponsor - Kamino Finance

Today's report is sponsored by Kamino Finance, the premier money market and yield hub on Solana, continues to offer competitive yields across DeFi. The platform's recent RWA integration of PRIME (by Figure) delivers an 8% fixed APY to holders coming from HELOCs ('Home Equity Lines of Credit').

On Kamino Multiply, yield farmers can borrow USDC or CASH against PRIME and earn >23% APY on their looped position. There is a utilization cap on these markets, which means that the multiply strategy is at max capacity at the moment. This utilization cap, however, also ensures the loop remains consistently profitable (as supply APY is higher than the borrow cost). Make sure to keep an eye out for the utilization and borrow caps if you wish to try out this strategy.

We recently posted an in-depth report on this new product which you can find below. You can also read more about the HELOC structure specifically loan duration, types of borrowers and more in the X post here.

Introduction

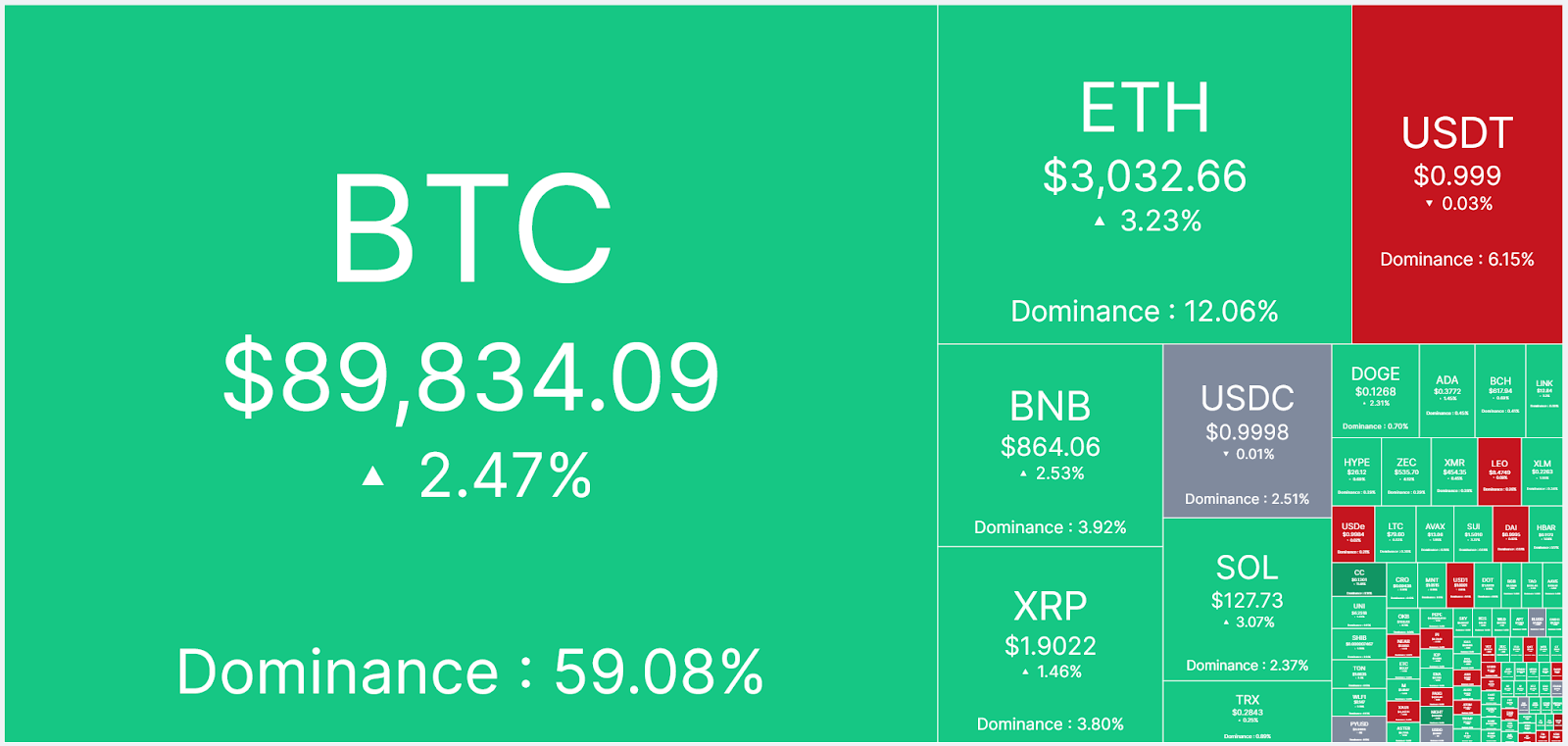

Crypto loves debating Layer 1 blockchain valuations, and for good reason. One, L1 tokens still make up ~84% of the $3 trillion total crypto market cap. The stakes are high.

Second, for an industry that is supposedly now “mainstream”, the smartest investors in the room still totally disagree on how to value these damn things.

On one side, you’ve got the more fundamentals-minded investors, who emphasize the importance of tangible cash flows metrics and P/E ratios. For instance, to value L1s, DBA’s Jon Charbonneau suggests applying a standard tech P/E multiple to “REV” (real economic value) – a GDP-like metric measuring all fees/tips paid to transact on any given chain.

On the other side, you've got the “monetary premium” believers in Bitcoin and Ethereum maximalist territory. These guys argue that cash flows dramatically understate the value of L1 networks, and reject treating L1 tokens exclusively as equity-like instruments. The value of an L1 token lies in many amorphous intangibles such as the token’s “moneyness”, network effects, decentralization, store of value, etc.

A recent debate between Santiago of Inversion and Haseeb from Dragonfly pretty much exemplified that classic L1 token debate, which went a little like this:

Santiago: P/E multiples of L1 tokens are like, ridiculously high and it’s time for it to plummet man.

Haseeb: But P/E ratios and cash flows are irrelevant right now – exponential growth is coming!

(To be clear, Haseeb is not exactly a “monetary premium maximalist”, but he's definitely on the side of "it's too early to judge these things on traditional metrics”.)

Bridging both sides

Is there a valuation method that can make both sides happy? Can we introduce some economic rationality without getting lost in vague hand-waving about "monetary premiums"?

A recent valuation model presented by Artemis’ CEO Jon Ma at the recent Breakpoint conference seems to do just that (you can watch it here for yourself).

Ma’s model is basically a marriage of two classic valuation methods:

- The hybrid framework VCs use to value pre-mature tech network platforms (e.g. Uber, Amazon)

- The quantity theory of money (MV = PQ)

SOL valuation

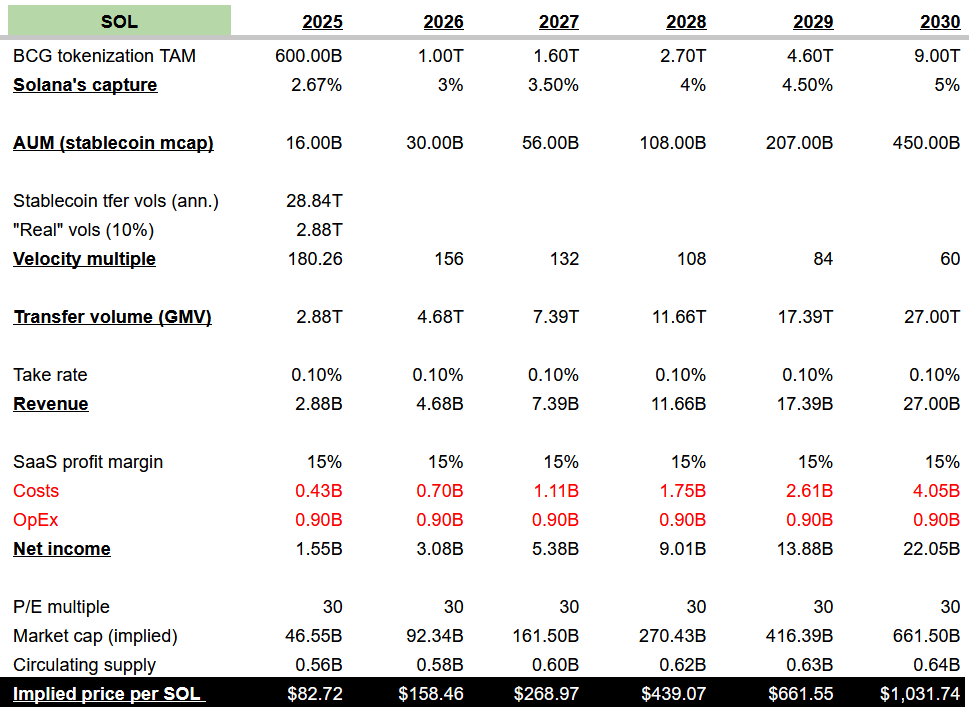

Ma applies his model to SOL, and the results are wild. I’ve made slight tweaks to his model and you can see the implied SOL prices in the bottom bar.

When you run SOL through this model, it projects a $1K valuation by 2030, but that’s not the surprising number.

What really caught my attention is that the model values SOL at ~$83 today. The actual market price right now is $135. That's pretty close! Here’s the line of logic that enables this model to project $1000 SOL in 2030:

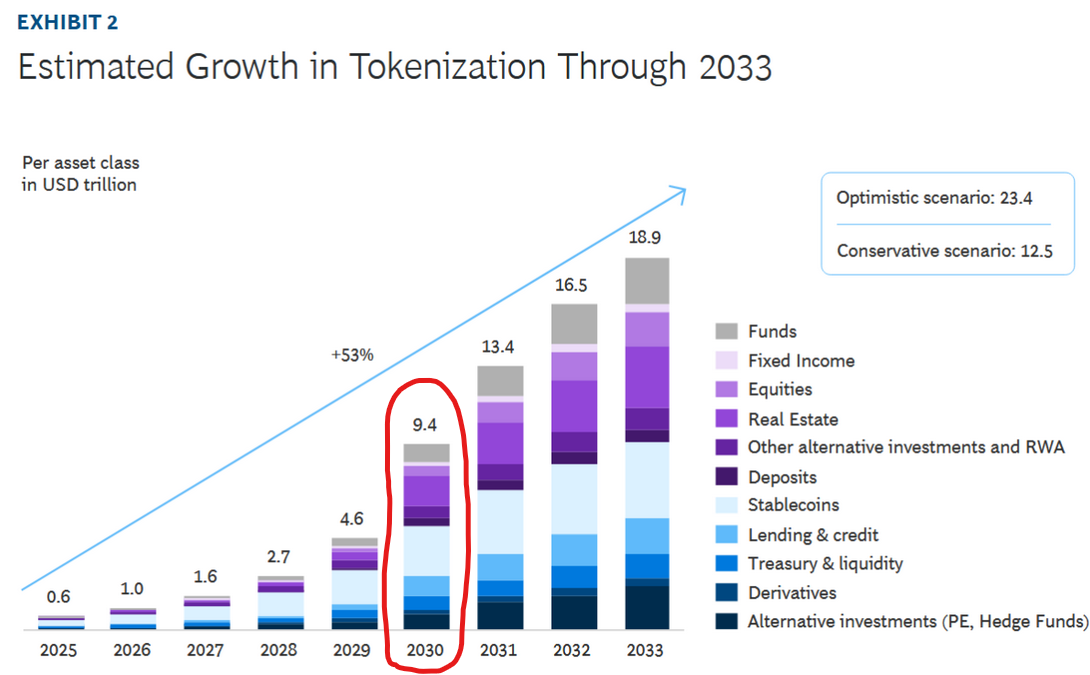

- You start with a BCG report that projects a TAM ~$9 trillion tokenized assets by 2030.

- Using stablecoin market cap as a proxy, Solana has 2.72% ($16 billion) of this TAM today. Assume Solana captures a modest 5% of TAM by 2030.

- That 5% TAM would come up to $450 billion in stablecoin market cap/AUM by 2030 (Note that this is AUM, not TVL).

- The velocity of money on Solana today is roughly 180. It’s safe to assume that as more institutional assets (RWAs) come onchain, these assets get “heavier”, move less, and generate lower volumes than, say, memecoins. So the model assumes velocity tapers off to ~60 by 2030 (Tron’s velocity is something in the range of 80-90 today).

- At ~60 velocity, that’s $27 trillion in transfer volumes, which translates to $27 billion in revenues for Solana at a 0.1% take rate. (For context, Solana’s annualized REV – a metric that ETH maximalists detest – in 2025 is roughly $1.4 billion, about half of what this model projects at $2.9 billion)

- Factor in a SaaS profit margin of 15% plus Solana's foundational annual OpEx of $0.9B, and you get net income of roughly $22.1 billion.

- Applying a 30 P/E multiple implies a SOL price of ~$1000 in 2030.

Okay, so another L1 valuation model tells you your favorite L1 token is going to the moon in a decade. So what? Who cares? The interesting thing about this model is not so much what valuations it projects, but how it gets there. This model may be the first to strike a middle ground between the “fundamentals” and “monetary premium” investors.

The fundamentalists like it because it’s using P/E multiples and treating blockchains like Web2 SaaS businesses. It doesn’t ask you to swallow the mantra that “ETH/SOL is money”.

For the monetarists, the model explicitly tries to price in that elusive monetary premium by using transfer volumes (AUM × velocity) to generate a revenue line. It's saying that even idle capital sitting on a chain (stablecoins, tokenized RWAs) should count in a proper valuation, even if it doesn't directly generate transaction fees or MEV.

ETH valuation

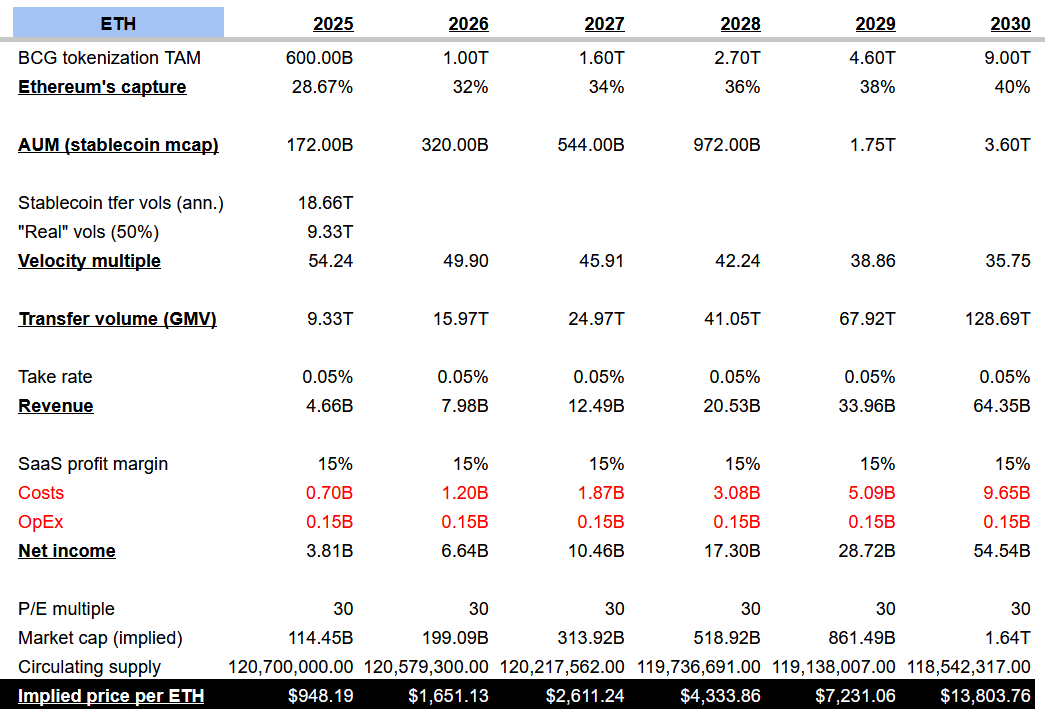

Now for the three hundred-billion dollar question: What happens when you apply this model to ETH? No sugarcoating it – the outlook for ETH is bleaker in the short-term.

The model implies an ETH price of $948 today (hold your horses), but it’s in 2029 where ETH begins to find rapid appreciation to $7.2K, and landing in the mythical $10K range by 2030.

At current ETH prices of ~$3K, that is still roughly a CAGR of 36.06% over five years. Not too shabby at all! But most importantly, it fits into the increasingly popular narrative that crypto valuations, like the dot-com bubble, will see a prolonged depression before it rises in the long-run.

To adapt Ma’s model to ETH, I’ve made a few changes:

- Lower velocity: I’ve discounted ETH’s velocity much more (50%) than Solana (10%). The reason here is straightforward: Ethereum is an older chain. Much of the capital on it is “cold” collateral that doesn’t move as much. Ethereum doesn't have a "memecoin casino" phase to shed; it is already entering its "digital bond" phase.

- Lower take-rate: 0.05% versus 0.1% on Solana. This reflects the Ethereum L1’s "landlord" status which keeps high-value settlement by institutions and captures a small but steady "rent" via blob fee floors, while offloading transaction volume to L2s.

- Lower OpEx: The Ethereum Foundation's operating expenses ($0.15 billion) are way lower than Solana's ($0.9 billion), as per recent disclosures.

- Slight deflation: The circulating supply of ETH is modestly deflationary to account for the recent Fusaka hard fork fixing the inflation leak by tying the price floor of blob fees to L1 gas.

- One final note: I considered including WBTC and WETH under “AUM” but decided against it. While it’s also technically used as “money” in protocols like Maker vaults, the problem with counting them as “AUM” is it introduces a reflexive, circular logic. When the price of BTC is volatile, so is AUM and it makes the L1 token seem more/less expensive based on animal spirits.

Conclusion

Jon’s model seems to find a reasonable middle ground between investors, though I’m sure they will still find plenty to disagree about.

If you are a value investor, it offers the safety of a P/E framework and balance sheet discipline.

If you hate REV, believe in monetary premiums, or think Blackrock's tokenized BUIDL fund is a big deal for your bags, it respects the structural value of tokenization and network effects.

If you’re long crypto over a multiyear horizon and subscribe to the "power law" growth that Haseeb believes, the model leaves ample room for exponential upside.

But most importantly, it’s a model that speaks to Wall Street.