Exploring Lombard, Corn, and Pendle

A comprehensive guide to maximize yield & farm multiple airdrops using LBTC

Introduction

A few years ago, if you held a lot of native Bitcoin that you wanted to both use in defi and earn yield on, your options were limited - of the few liquid, 1:1 backed bitcoin protocols with a noteworthy TVL, Wrapped Bitcoin (with a circulation of ~285k btc in 2021) was probably your best option. While WBTC has proven fairly reliable, it is not a yield-bearing asset and it hasn’t provided much onchain utility apart from basic use cases like LPing and lending. Despite this, its dominance has remained fairly unchallenged since its launch in 2019.

A whole lot has changed since then. Over the summer, BitGo announced that they’d be transitioning their sole legal custody over WBTC into a joint venture with BiT Global, a firm with ties to Justin Sun and Tron. This surprise change triggered the launch of several new challengers to WBTC’s empire, including from major players such as Coinbase (cbBTC). Of these newcomers, though, one in particular has captured my attention: Lombard Finance. Their freshly-launched liquid bitcoin product LBTC represents a new way to use bitcoin in defi. Today I’m going to tell you a bit about what it is, how it works, what kind of utility it has, and how to use it to farm multiple airdrops at once.

Bullets

- Lombard and Babylon

- Delicious Corn

- Pendle Party

- Airdrop Tips & Proper Farm Maintenance

- Attempting to Calculate Daily Points & ROI

Interactive calculator linked at the bottom of the article.

Lombard and Babylon

To understand LBTC, let’s start by briefly running through Babylon, Lombard, and how they work together to produce a token you can use in defi. Babylon, a protocol that offers bitcoin timestamping (using btc to back up PoS chain data) and staking (using btc to provide decentralized economic security), provides the backend engine that powers Lombard. Although Babylon has not yet delegated its stake, they plan to be up and running soon, at which point they will produce a yield for bitcoin holders, aiming to be the Eigenlayer of bitcoin.

That’s awesome, but if you want to then use these staked bitcoins elsewhere, you need Lombard and their flagship liquid staking token LBTC. Here’s how it works: first, you connect your eth wallet to Lombard and stake your bitcoin - to accept it, Lombard will provide you with a bitcoin address - when you send, your bitcoin is restaked into Babylon, and Lombard mints you an equivalent amount of LBTC on Ethereum L1. While Babylon keeps track of your BTC stake, Lombard provides you with a defi-composable liquid receipt token. When Babylon’s validator services go live, LBTC will even earn a yield from the staking services its underlying btc will provide. To summarize thus far:

- Stake BTC into Lombard

- BTC restaked into Babylon, managed by group of trusted parties called the security consortium

- Mint LBTC via Lombard (issued on ETH L1)

When you want to exit the ecosystem, simply send your LBTC back to Lombard to be burnt, at which point Babylon will be prompted to unstake your bitcoin. To facilitate this process, Babylon uses unspent transaction outputs (UTXOs) to lock and unlock btc from a self-custodial vault, verifying the recipient using a combination of conditional data. Like I said, pretty simple!

If you want to read more about their vision for growth, staking/unstaking process, and security consortium, check out Lombard’s docs. For those of you who want to read a 15-page technical litepaper about how Babylon Staking works, have at it.

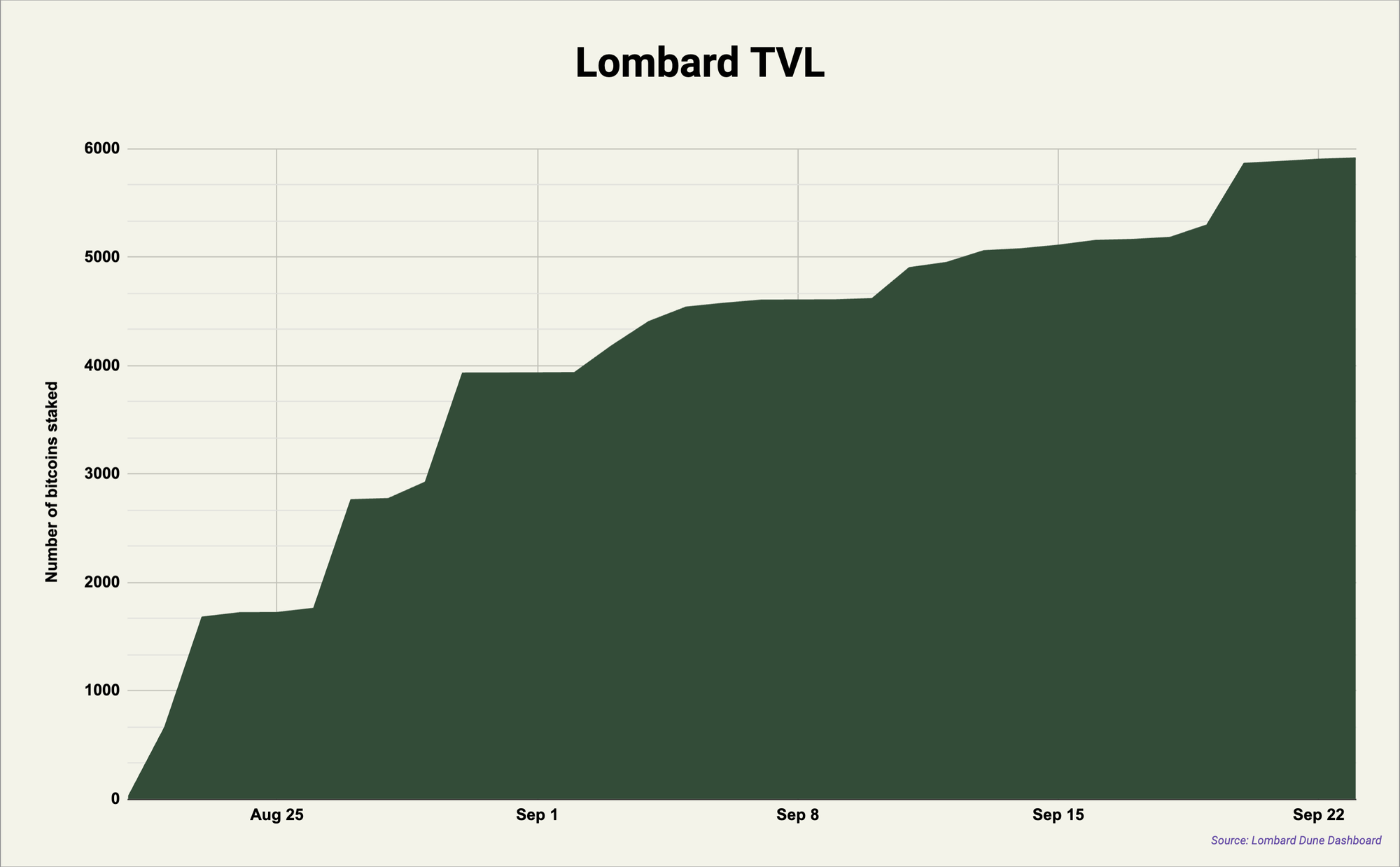

Since their launch on 8/22, LBTC has experienced solid TVL growth, rocketing to over 5900 btc, or $373m. For context, this is still only ~3.6% the size of WBTC!

So, now you understand how Lombard works, and just minted enough LBTC to purchase a small island (or maybe a Happy Meal). Now what?

Tasty Corn

As Babylon and Lombard build out the foundation for a new way to use bitcoin onchain, many other players are developing btc-specific apps to capitalize on the growth of this new segment. Corn is a new ethereum L2 aiming to provide the best yield, leverage and liquidity for bitcoin in defi - a one-stop-shop where you can take your newly-liquid btc and put it to work. Today, Corn is pretty much just a way to increase your airdrop multiple (discussed more later), but look for them to continue to release yield-bearing products for LBTC.

On a recent X Spaces featuring founding members from Lombard, Babylon, Corn and Pendle, Corn’s cofounder spoke briefly about the rivalry between btc and eth - he said that only in the past year or so have people from both camps started working together to build out a reliable EVM-based defi ecosystem for people who hold lots of native btc. To do this, they obviously need to incentivize growth, and as any budding project would do, they looked to everyone’s favorite yield tokenization engine - Pendle.

Pendle Party

Pendle is a protocol that allows for traders to either buy fixed yield (PT) or speculate on points with leverage (YT). Since Pendle has been discussed at length in On Chain Times, I won’t go further into how it works, but here’s a thread I wrote a while back that explains it more fully.

Jumping headfirst into BTCfi is a no-brainer for Pendle after seeing how the Eigenlayer ecosystem benefitted. The combo of Eigen/LSTs/Pendle YT reshaped the fabric of defi, and now bitcoin staking is trying to re-run the playbook.

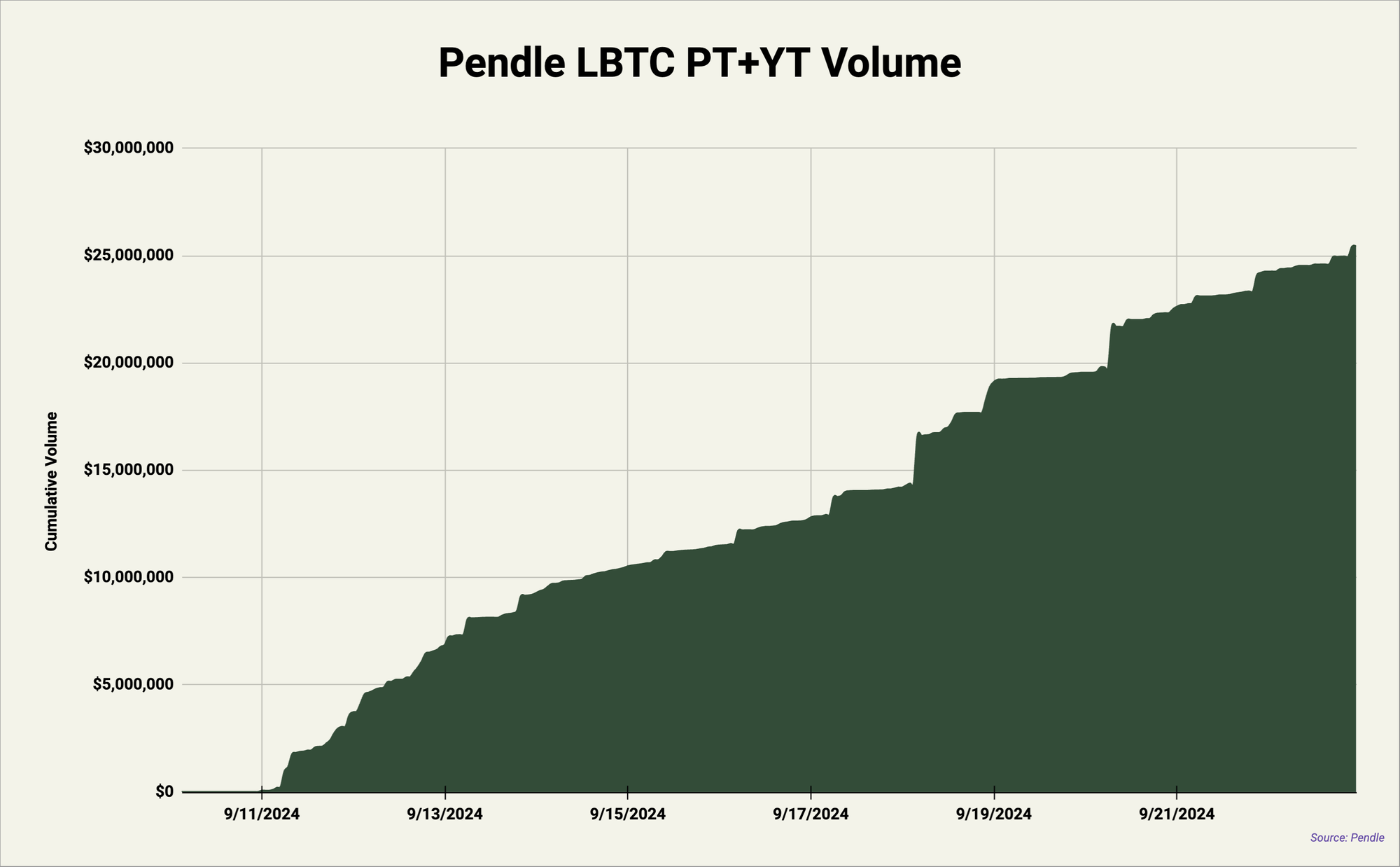

Clearly, it’s working, as volume has eclipsed $25m in under two weeks!

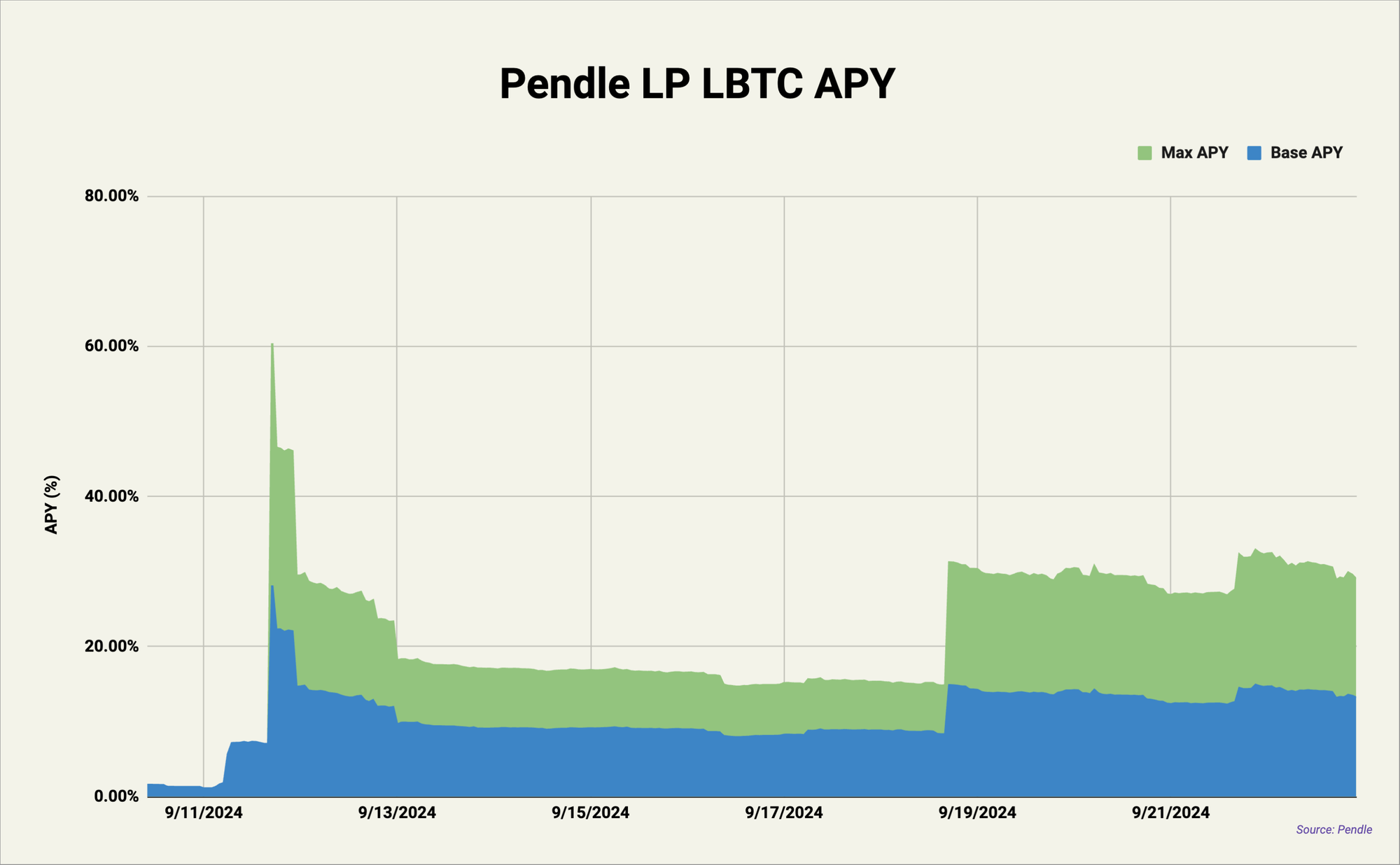

I’ll cover YT later, but first let’s talk about some other juicy looking Pendle plays:

- LP-LBTC

- Provide liquidity, retain some points while earning pool yield and $PENDLE rewards

- ~29.46% APY, ~7.51% ROI (floating)

- ~90% point exposure to Lombard/Corn vs. LBTC

- PT-LBTC

- 7.919% APY, 2.02% ROI (fixed, must hold until maturity to realize)

- Pretty solid yield already, but can get even better…

- PT-LBTC + Zerolend Looping

- Supply PT into protocol, borrow more LBTC, repeat with more PT

- Up to 10x leverage via looping = 79.19% APY, 20.2% ROI

- 90% max LTV, 95% liquidation threshold, 2.89% supply/4.06% borrow APYs

For those looking to preserve some real yield, these are three great options of varying risk levels and timelines. You guys aren’t here for that, though. Let’s talk about how to farm points from this combination of projects.

Maintaining the Farm

Before we get into farming, a quick note - because no Lombard deposits are currently earning Babylon points, I’m not going to include it in my breakdown here. Babylon’s founder said recently on X that LBTC will begin to earn points after the next round of cap lifts, so hang tight. Every strategy discussed will eventually earn Babylon points, as they all use LBTC.

That being said, let’s break down Corn and Lombard’s campaigns, as well as a few ways to farm:

Lombard Lux

LBTC

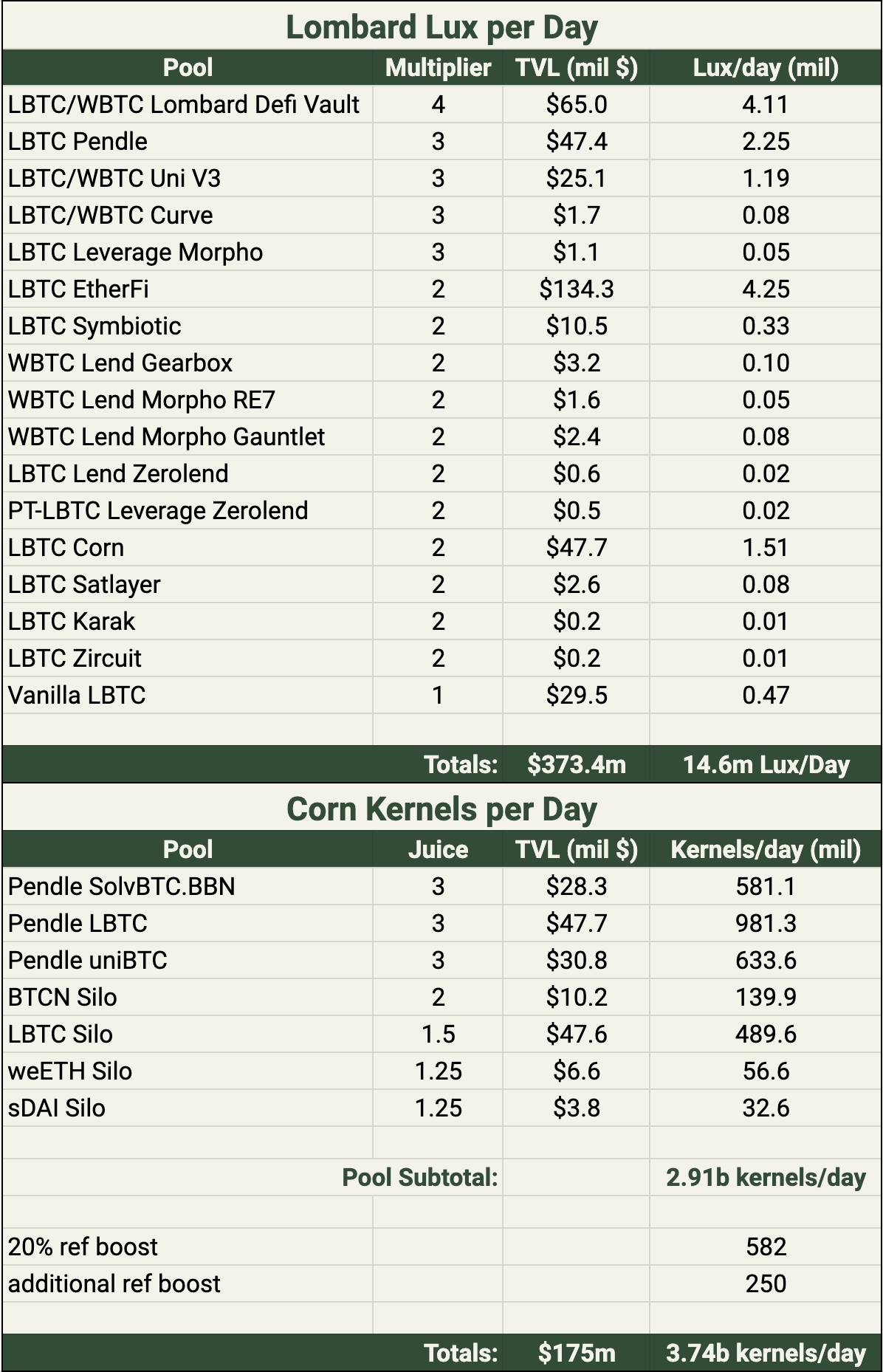

As soon as you mint LBTC, you start to earn Lombard points, called Lux, at a rate of 1000*btc staked*days staked. In other words, a user staking 0.01btc for 1 day earns 0.01*1000 = 10 Lux. This campaign started August 22, and will most likely run into late Q4/early Q1 (my guess).

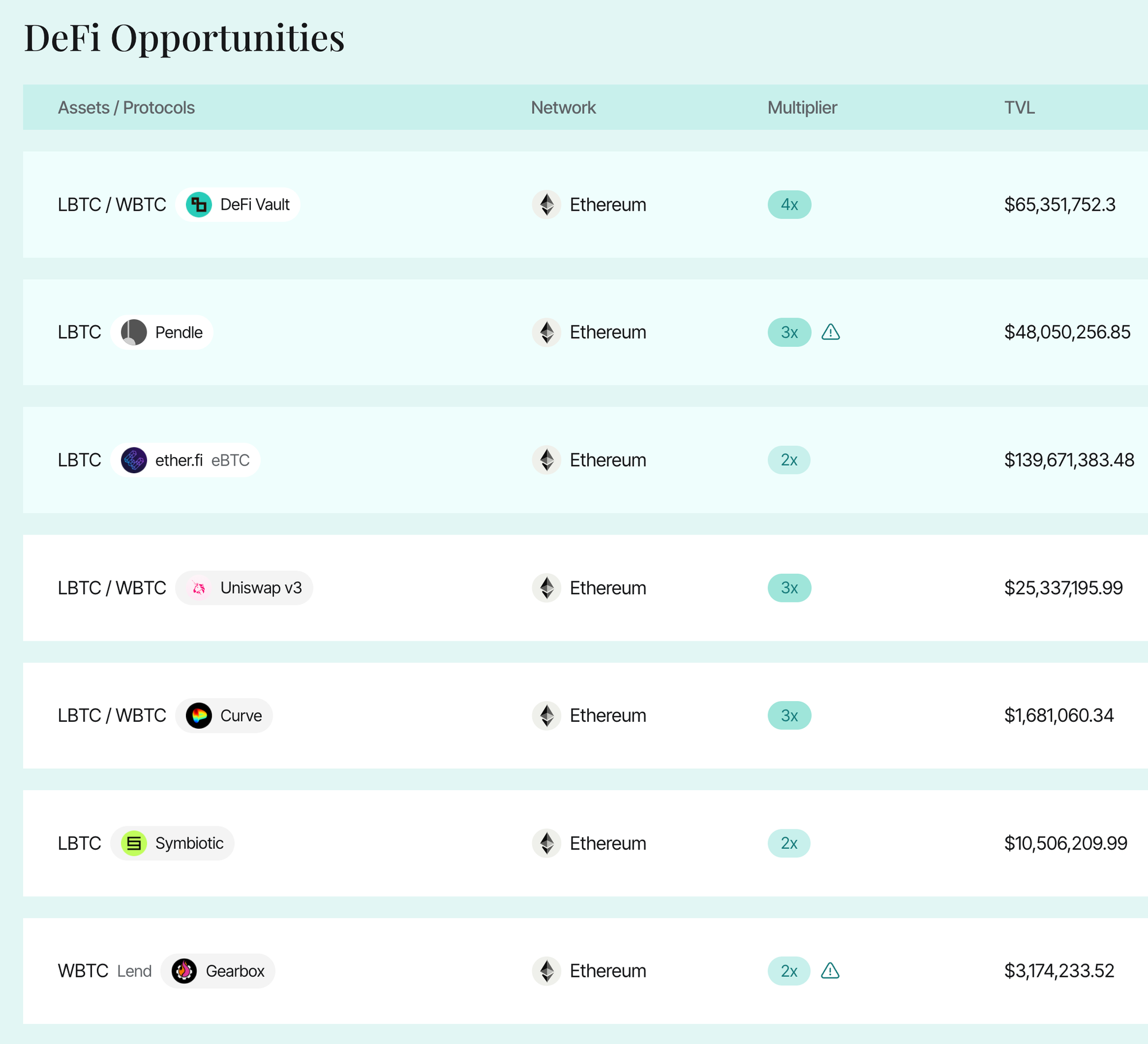

Defi Integrations

Lombard wanted to launch with a wide range of integrated options for LBTC holders, and boy did they ever. Users can deposit in Lombard’s own LBTC/wBTC vault that leverages automated defi strats to produce a 3% APY and earn 4x Lux, or opt to earn through multiple blue chip partners like Morpho, Symbiotic, Uniswap and Curve. Depositing into these vaults is a great way to choose the specific type of points you want exposure to. Currently, over $344m in LBTC (~92% of TVL) is being used in defi.

Pendle

YT-LBTC positions held on Pendle will automatically earn 3x Lux, in addition to the natural leverage YT offers (currently ~48x price leverage). So, in total these YT earn points at a ~145x rate compared to naked LBTC.

Corn Kernels

Silos

Corn is currently in phase 2 of its airdrop campaign, with phase 1 allocating points for completing tasks from an early access checklist. During phase 2, announced August 22nd, users can earn Corn points (called Kernels) for depositing LBTC (or other assets) into Corn’s Silos (pools). Kernels accrue at a rate of 1 per $1 deposited every 3.5 hours (~6.85/day), and are earned with up to a 3x multiple. Users who deposit LBTC will earn at a 1.5x Kernel rate.

References + Galxe

Refer your friends for 20% of Kernels earned by first references, 12% earned by second, 6% earned by third and 4% earned by fourth refs. Each Galxe point earned by completing Corn’s quests is also equal to 1 Kernel.

Pendle

Like with Lombard Lux, Pendle YT-LBTC earns Kernels at a 3x rate, with the same ~48x price leverage, providing ~145x total point exposure per dollar.

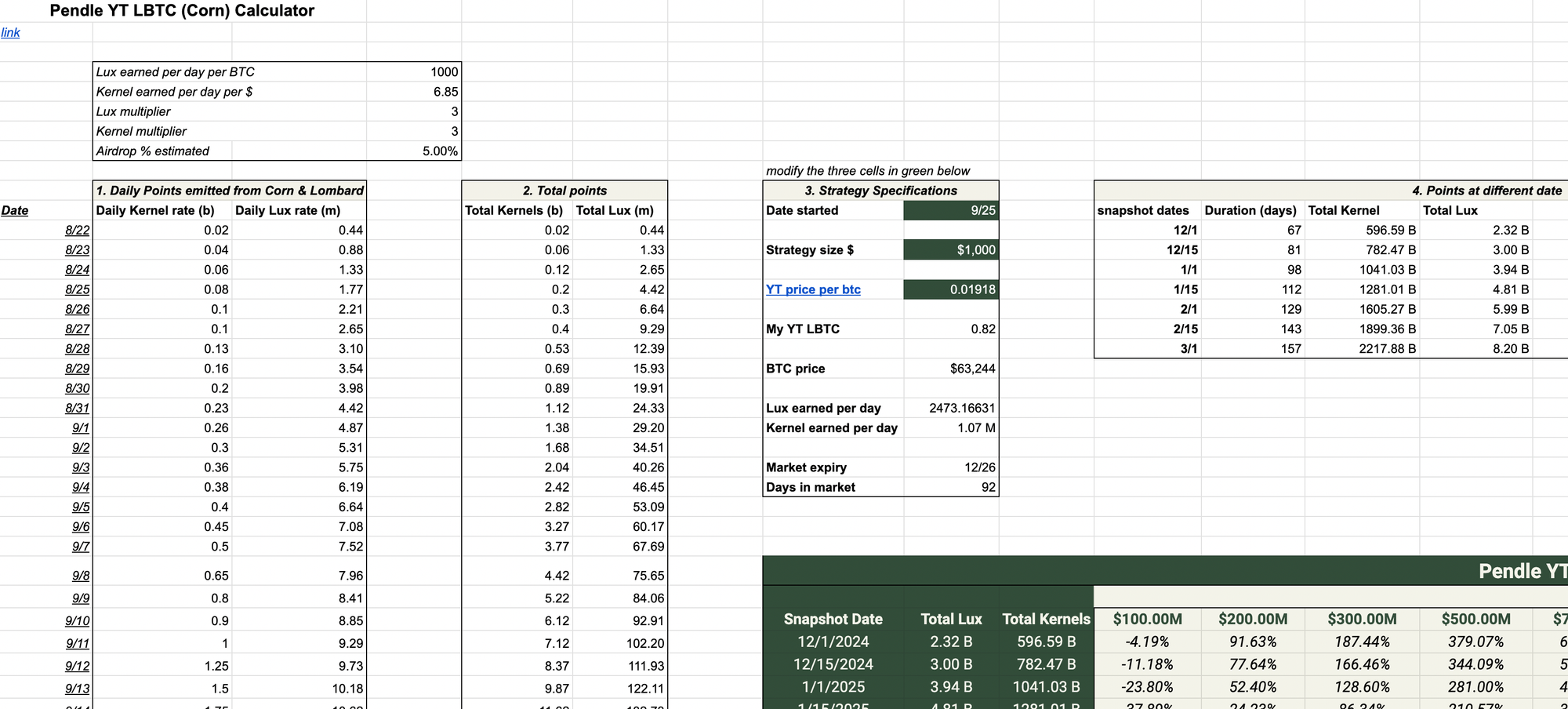

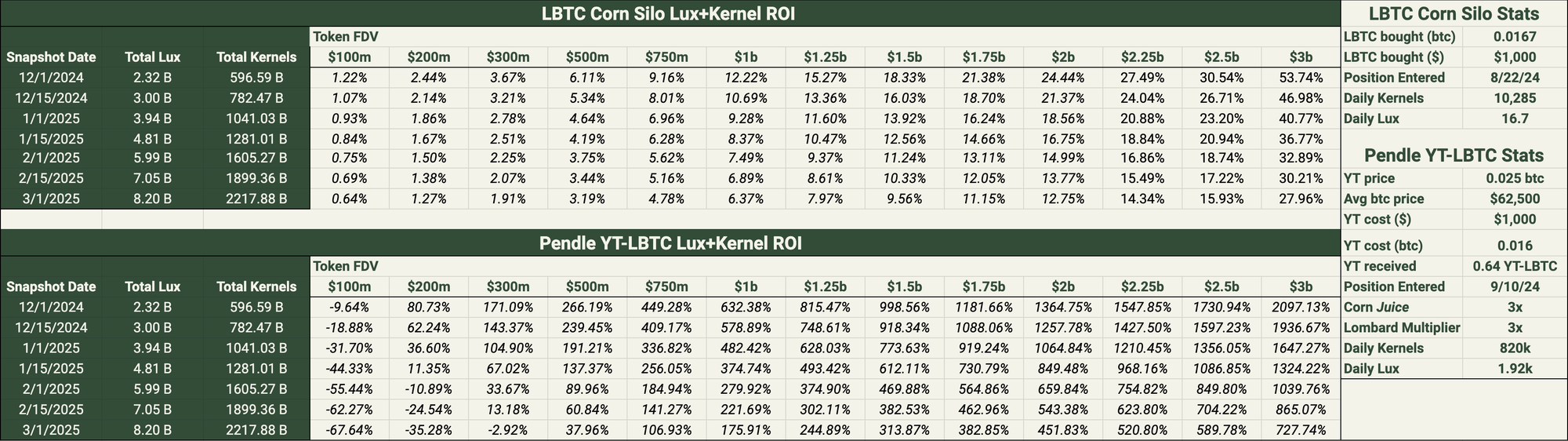

A (Very) Speculative Calculator

Assumptions

- I used a spot btc price of $63,200 to calculate daily points on 9/23/24

- Like I mentioned earlier, I'm not including Babylon points here, even though LBTC will eventually earn them. Babylon points will boost the ROI of both strategies discussed

- ROI calculators assume you entered Corn and Pendle pools on their respective launch dates

- I'm using consensus snapshot dates between late Q4/early Q1, assuming these projects will airdrop on similar timeframes. Also assuming industry-standard 5% airdrop

- "Token FDV" on the ROI chart refers to the FDV of EACH coin, not combined. I'm also extrapolating a fair amount of bullish price movement (reflected in FDVs)

- So $1b column means that both Corn and Lombard's future tokens have $1b FDVs

- I assumed roughly 6x total daily rate growth between now and March for my Lux/Kernel count forecasts

One more important note: Lombard Lux are btc-denominated (like Eigenlayer points), but Corn Kernels are dollar-driven, meaning that if the price of btc increases, Kernel rate will also increase for a given LBTC position. I'm not going to be accounting for future btc price action here, so if you're especially bearish or bullish from where we are now, factor that in as well.

Daily Point Calculations 9/23

LBTC Corn Silo & Pendle YT-LBTC ROI

Concluding Thoughts

There you have it. Today in 2024, no longer can you, a native bitcoin whale, say that WBTC is the real only choice to enable the use of your coins in defi. Lombard, Babylon, Corn, and Pendle are four crucial players working to usher in this new movement of bitcoin utility onchain. Whether it's used to stack multiple types of points with YT leverage, to collect passive yield with Silos or Vaults, or some combo of the two strategies, LBTC definitely provides value and seems to be here to stay.

As we progress into the fall and winter, keep an eye on the TVL growth of the two protocols - I'm looking for Lombard to maintain its lead in new deposits against competitors like cbBTC, and for Corn to start to develop its ecosystem and to continue its involvement with new Pendle market launches. No matter what, exciting times are ahead for bitcoin in defi.

Calculator

You can access the calculator by being a free subscriber to On Chain Times