Are Altcoins Still Cooked?

Past performance is not indicative of future results

There are three certainties in life: death, taxes and the only altcoins that pump are the ones you don't hold.

Sponsor - Kamino Finance

This week's edition of On Chain Times is sponsored by Kamino Finance.

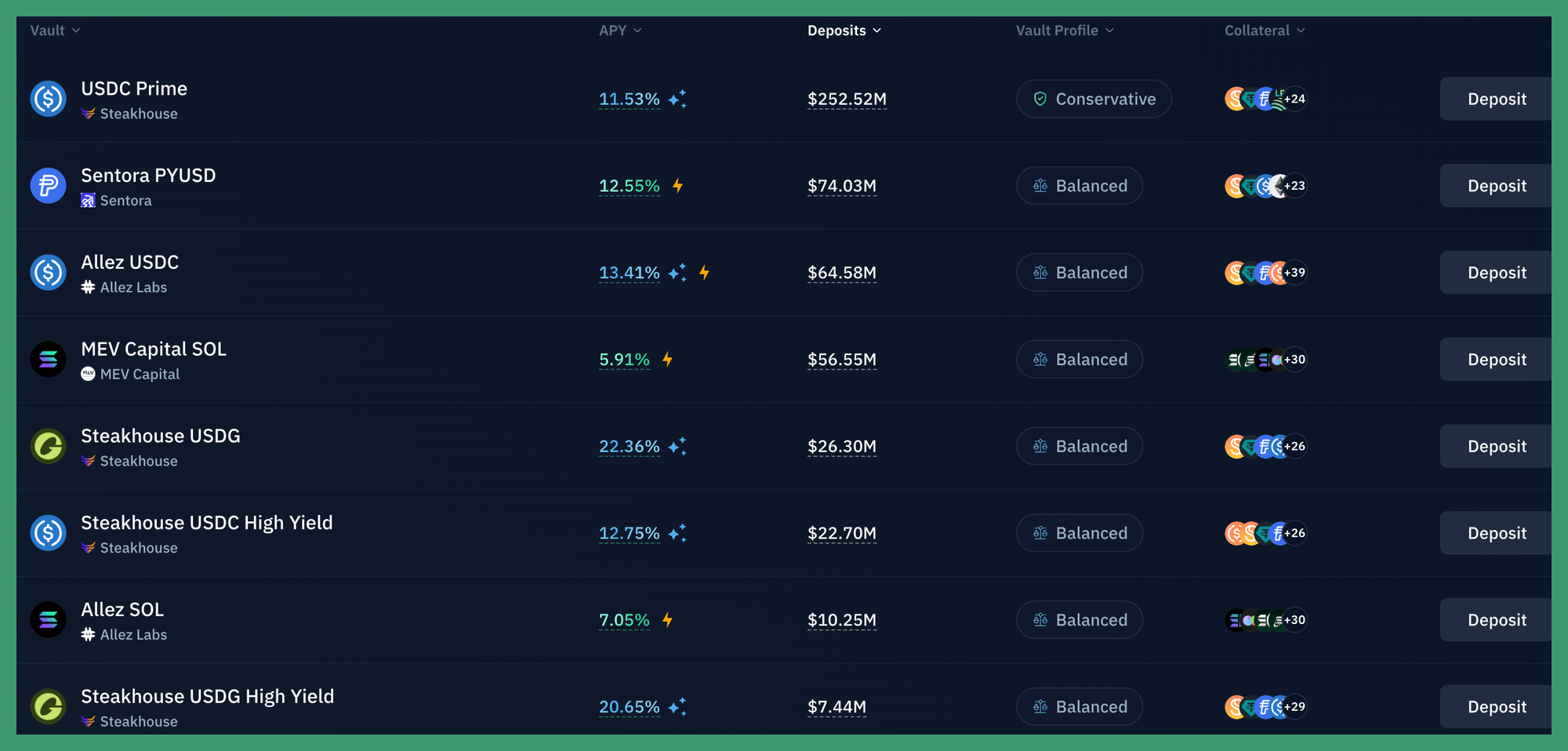

With current incentive campaigns and recently integrated markets, Kamino offers some of the highest yield on stablecoins, SOL, JLP and more. For one, several of the lending vaults issued by various risk managers are currently incentivized with KMNO emissions. Supplying USDG in one of the two Steakhouse USDG vaults yields more than a 20% APY between lending yield and KMNO incentives:

We covered the Kamino S4 incentives campaign in depth in a previous post, which you can find below.

There are in addition several more high-yielding strategies across Kamino lend and multiply - make sure to check them out at kamino.com.

Unburdened by what has been

Objectively speaking, cryptocurrencies have been on a generational run. In just a few short years targets and milestones thought unattainable have been hit.

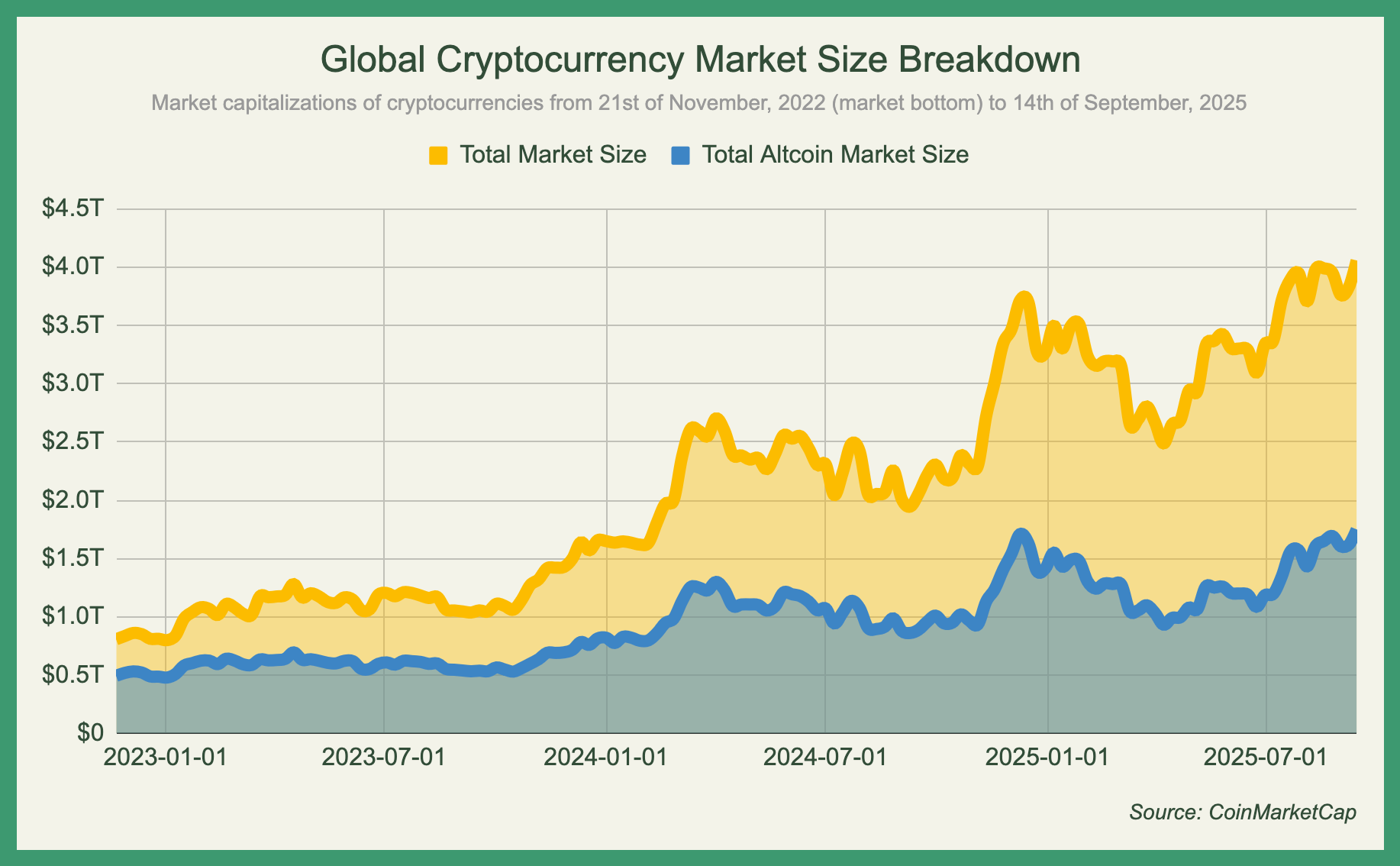

Flipping resistances to supports, the global market size has been consistently grinding to the upside, increasing roughly ~3.2 trillion dollars in value since the bear market bottom, swiftly surpassing previous all-time-highs with minimal friction. Meanwhile altcoins are re-testing a psychological resistance area for the third time after two unsuccessful attempts made in 2021 and 2024, both resulting in +40% drawdowns. A breakout into uncharted waters could subsequently lead to violent moves as the focus shifts away from Bitcoin, whereas another failure with no follow-up would be devastating for confidence that has been building up little by little.

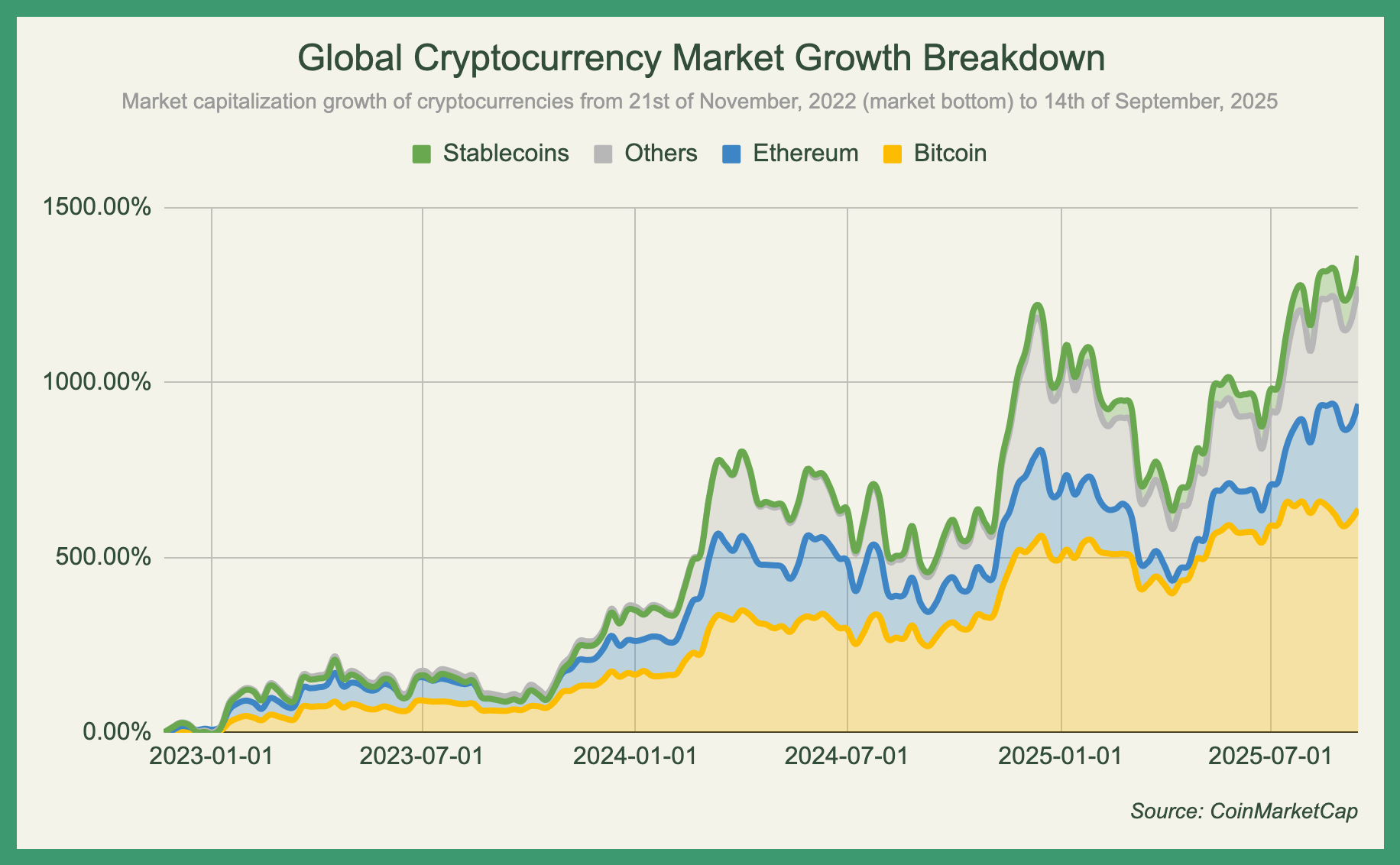

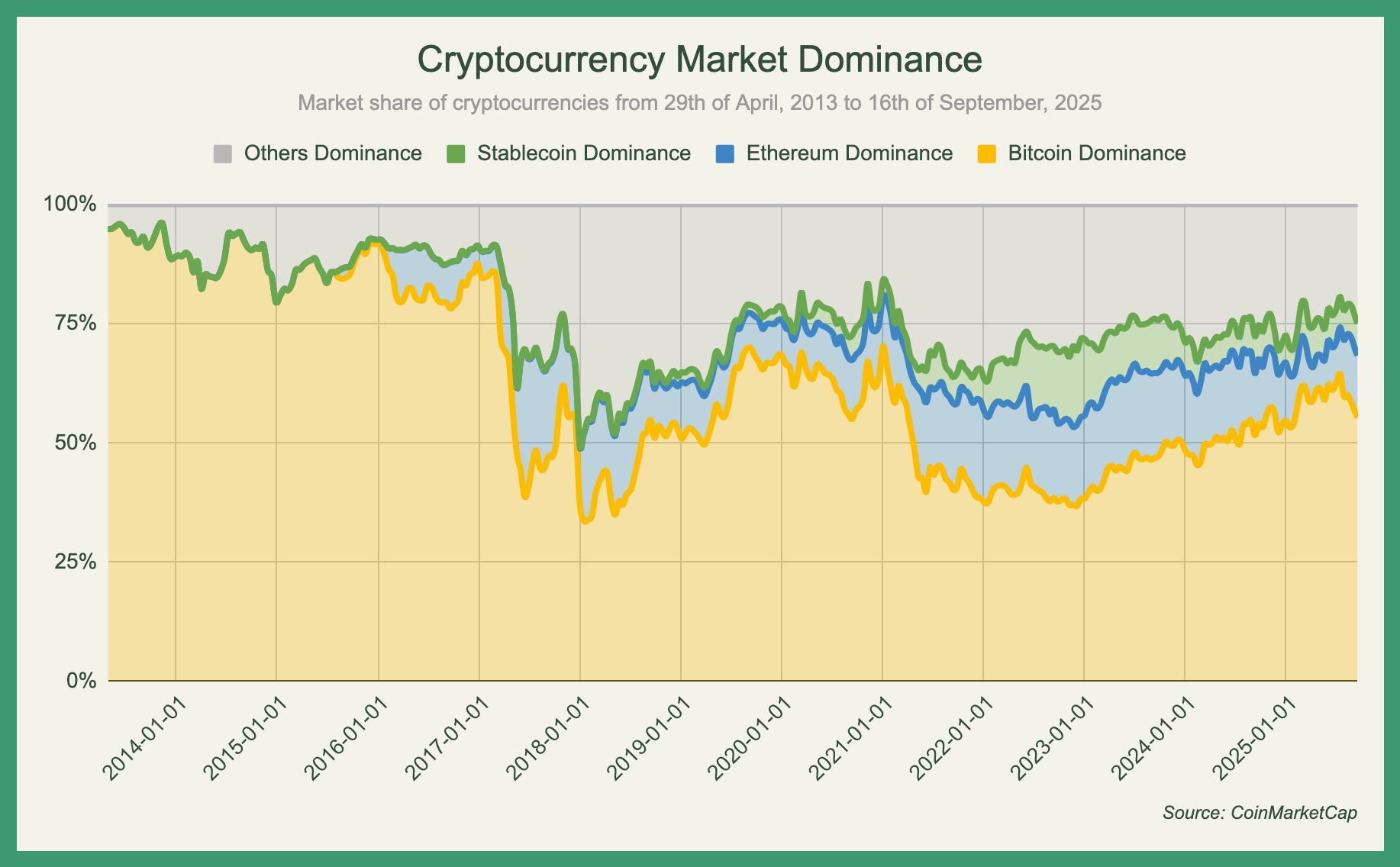

Asymmetric growth between the global and altcoin markets indicate that a majority of the appreciation we have witnessed, can be accredited to Bitcoin alone.

The first quarter of the cycle was uneventful from the perspective of returns, though everything changed in October 2023, once the market started believing that the crypto ETFs will be more than just benign optimism. Momentum quickly picked up as Bitcoin led the charge, with the consensus being that everything else will follow suit. A major catalyst for further growth was a crypto-friendly US administration hinting at monumental regulatory reforms and desire to position the country as the beacon of progress, in addition to the potential creation of a strategic Bitcoin reserve. This sent the market into a frenzy, with Bitcoin breaching the long awaited six-figure mark and putting altcoins in the limelight. While most of the gains clocked in by altcoins evaporated by April as tariff tensions escalated, this cycle's kingmaker stood unfazed. Following the slow bleed, the entire market inevitably bounced and has shown signs of rising interest in stablecoin issuance, Ethereum and others.

Suffice to say, Bitcoin has been the focal point of the bull market with alternative assets being dragged up with it as the digital asset economy, once deemed to be used only for illicit activities, attempts to establish a foothold in mainstream finance.

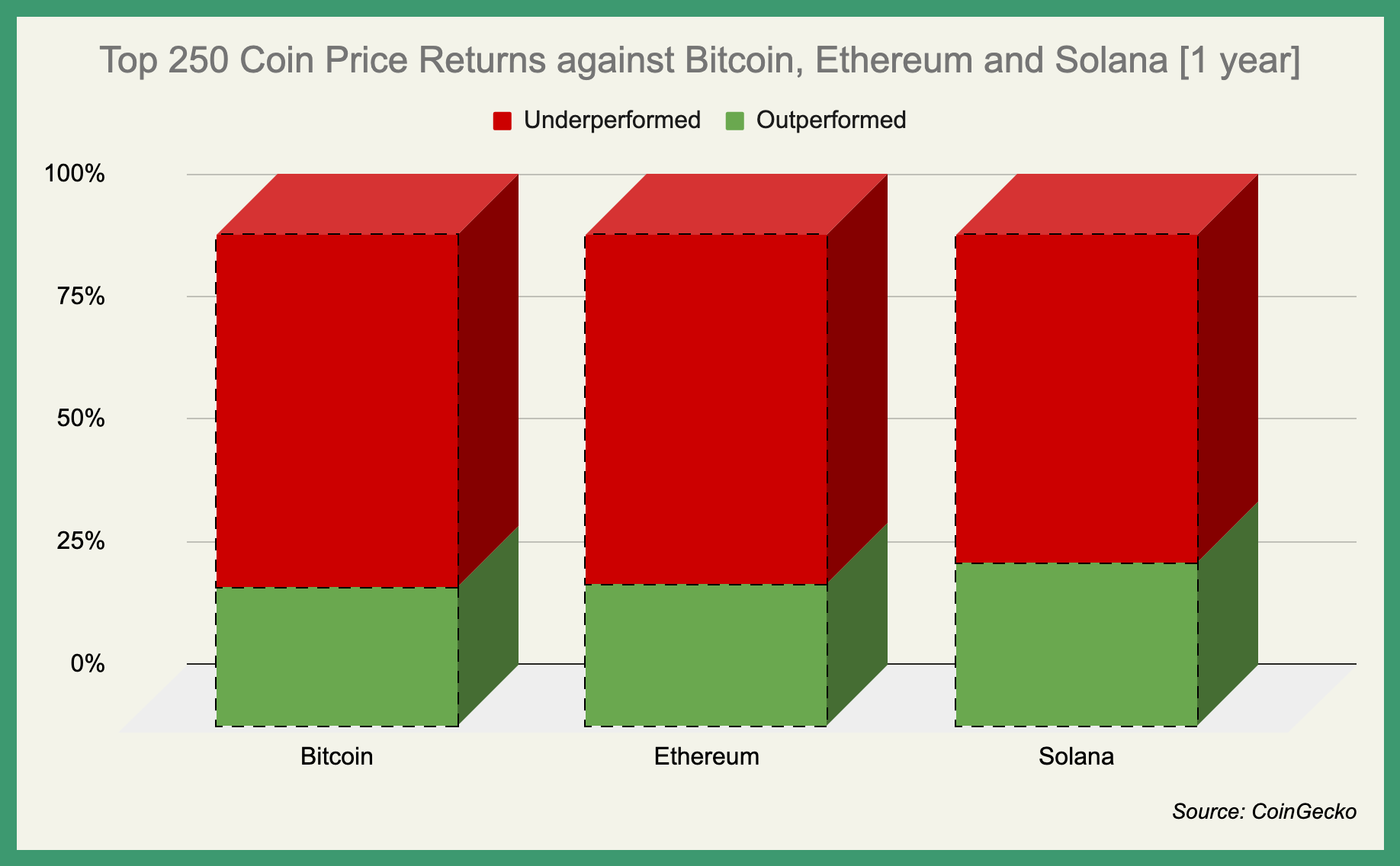

The seeming relative underperformance of altcoins and most notably Ethereum, compared to previous years has continued to catch many by surprise as larger BTCDOM correction, typically indicative of capital rotations to more speculative assets, has yet to take place. A lack of stimulus coupled with liquidity fragmentation accelerated by an influx of new venues and offerings has paved the way for an environment where outsized returns are becoming increasingly difficult to capture, and misplaced convictions lead to community member syndrome. Excluding stablecoins, wrapped native (non yield-bearing) and bridged tokens, the 365 day returns of coins situated in the top 250 should illustrate this notion rather well.

With a mean price performance of ~368.55% and a median of ~25.9%, every two out of three entries in the dataset have failed to surpass Bitcoin, Ethereum nor Solana. Admittedly those who bet on the wrong horse likely had some sort of return on their investment, but were subjected to greater risk and volatility.

Outliers that did manage to beat the benchmarks, were native token derivatives (e.g. staking, re-staking), a handful of memecoins or immensely popular tokens with strong fundamentals and narratives behind them, such as Hyperliquid, Mantle and Ethena.

Is it over?

Hindsight being our specialty and the current budget lacking resources to obtain a magic crystal ball that lets us gaze into the future, any bold predictions regarding future directional moves for altcoins will be left up to paid group leaders and unprofitable traders on crypto twitter. Instead of selling dreams or nightmares, we will try to remain impartial and analyze available data so that readers can form their own assumptions.

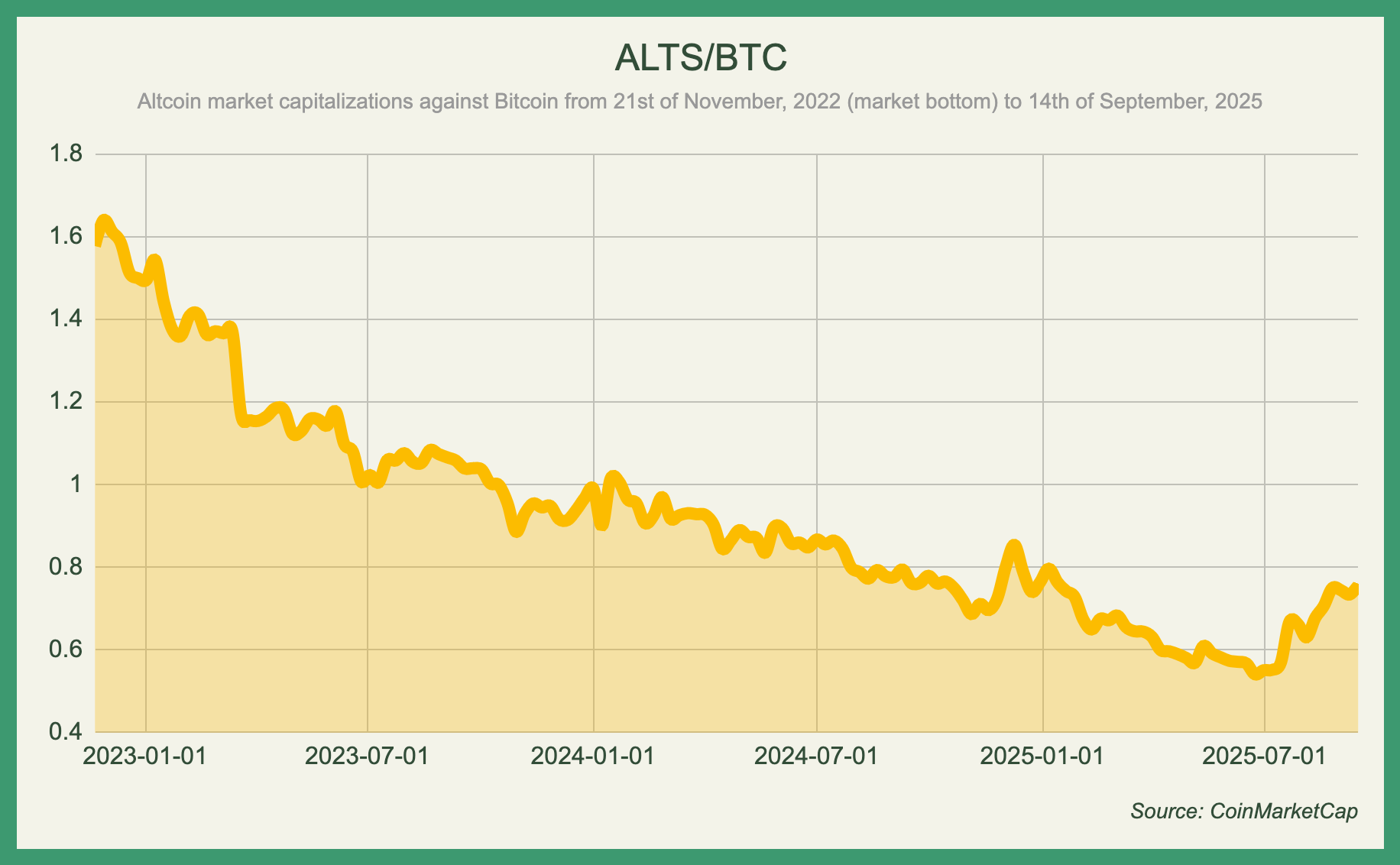

Charting the total altcoin market capitalization against Bitcoin's, highlights some of the points made in earlier paragraphs, but from a slightly different angle.

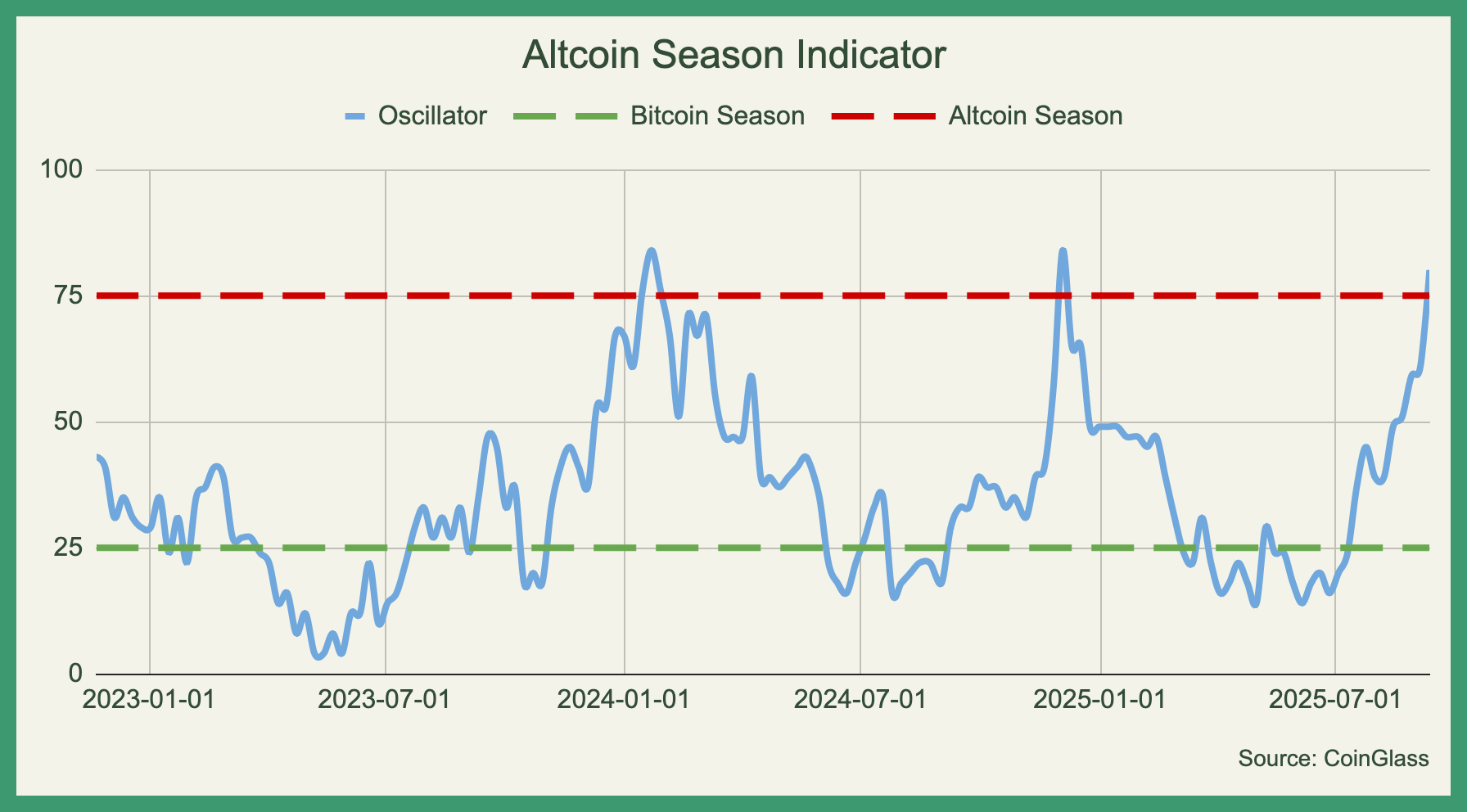

Using the romanticized 2021 run-up as a reference point, one would have expected the steep downtrend to be challenged sooner rather than at the tail end of the cycle. Despite the disappointing price action up until July, this year, a higher low has been formed and at a glance, a reversal seems promising. While there have been two instances of notable altcoin outperformance before it, they have been short-lived and barely left a dent in the chart. However the movement unfolding currently, has been the largest (+37.17%) and most extended one recorded in the last two and a half years. For a more granular overview, a handy indicator tracking the relationship between Bitcoin and altcoin price returns, among other relevant metrics, can be consulted.

High indicator readings during periods of minimal relative outperformance suggest that while upside is correlated and favors altcoins, any significant value added to market capitalizations are eclipsed by Bitcoin, which is expected in the first innings of a bull run. At later stages, especially as Bitcoin starts showing signs of stagnation, the directional shift becomes more pronounced and correlation starts to disappear. This was apparent in the previous comparison chart as the magnitude of fluctuations had increased sequentially.

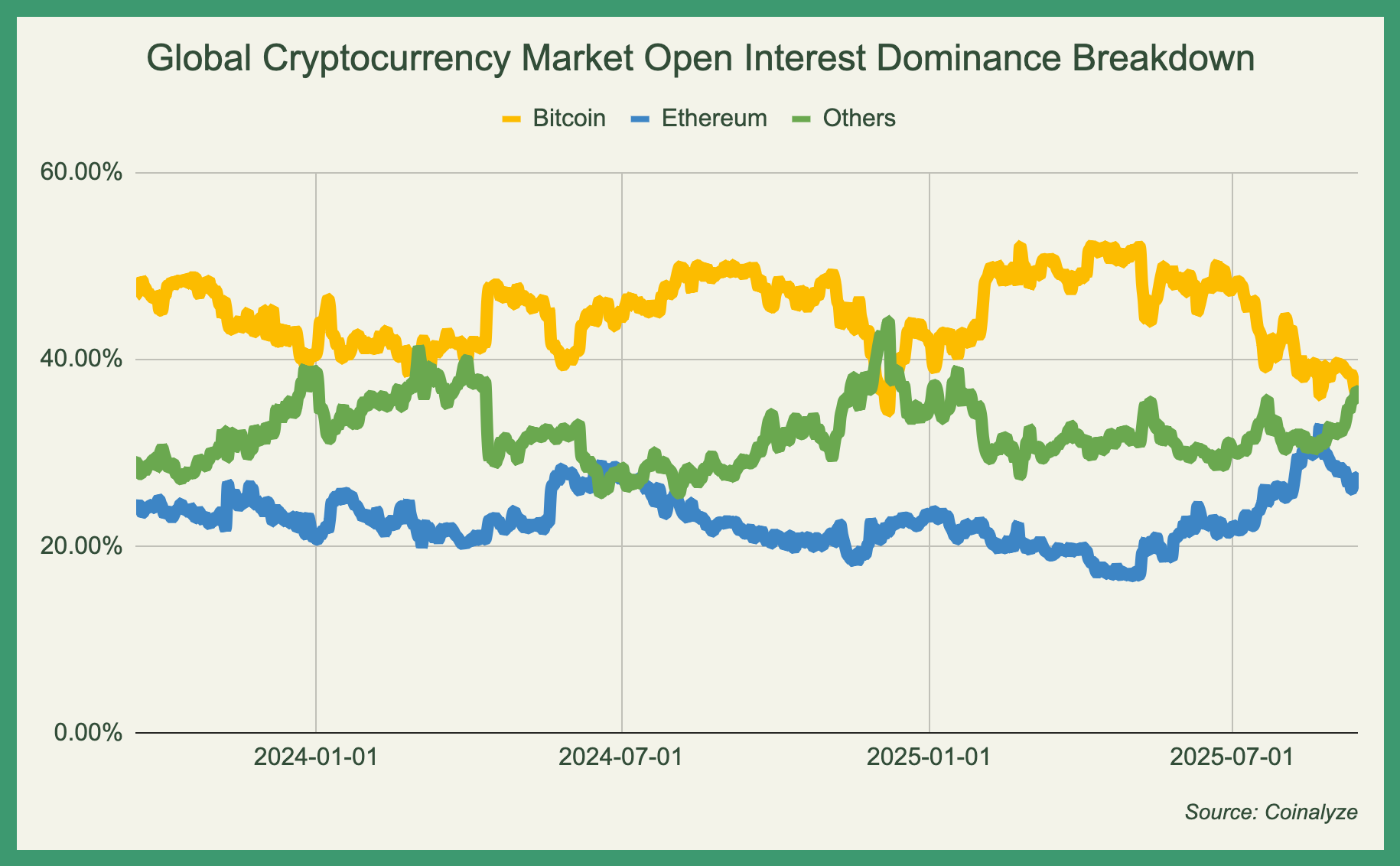

Key areas of interest on the global open interest (OI) dominance graph reveal a striking pattern. Leading up to a major move, Bitcoin's share of the total OI shrinks and altcoins take charge. Interestingly enough this phenomenon emerges near local tops after Bitcoin has or is about to set a fresh high, which is more often than not accompanied up by a selloff. The present being no exception from a timing standpoint, as the cumulative altcoin open interest dominance inches closer towards ~64%, following a push to a new all-time-high of $123,682 a month ago. In contrast to the previous outperformance period, several differences stand out: Bitcoin's gradually declining dominance, Ethereum's greater presence, and the atypical behavior of altcoins excluding ETH. This gives off two conflicting impressions, either it's lights out or a proper altcoin uptrend by Ethereum is brewing, just as the ancient texts foretold. Irregardless of the trajectory, increased volatility seems likely and the use of leverage should be carefully approached.

Conclusion

The verdict for as to whether altcoins are still cooked or not, has to be a resounding "no", due to the sheer abundance of positive outcomes and developments that have taken place. It might be tough to shake off cognitive biases instilled from easier times when blindly picking tickers or doing minimal due diligence were the only prerequisite to making it, but every cycle presents new dynamics and challenges, often invalidating assumptions based on stale information. At the end of the day, investing in speculative and unregulated assets is inherently risky and requires extreme caution to avoid losses.

It's tempting to bet the farm in hopes of securing an early retirement after constantly being exposed to social media posts of people celebrating and promising huge returns, telling everyone to believe in something. Their lies are not to be trusted.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.