A Look Into Lighter's LLP & Recent Performance

Introduction

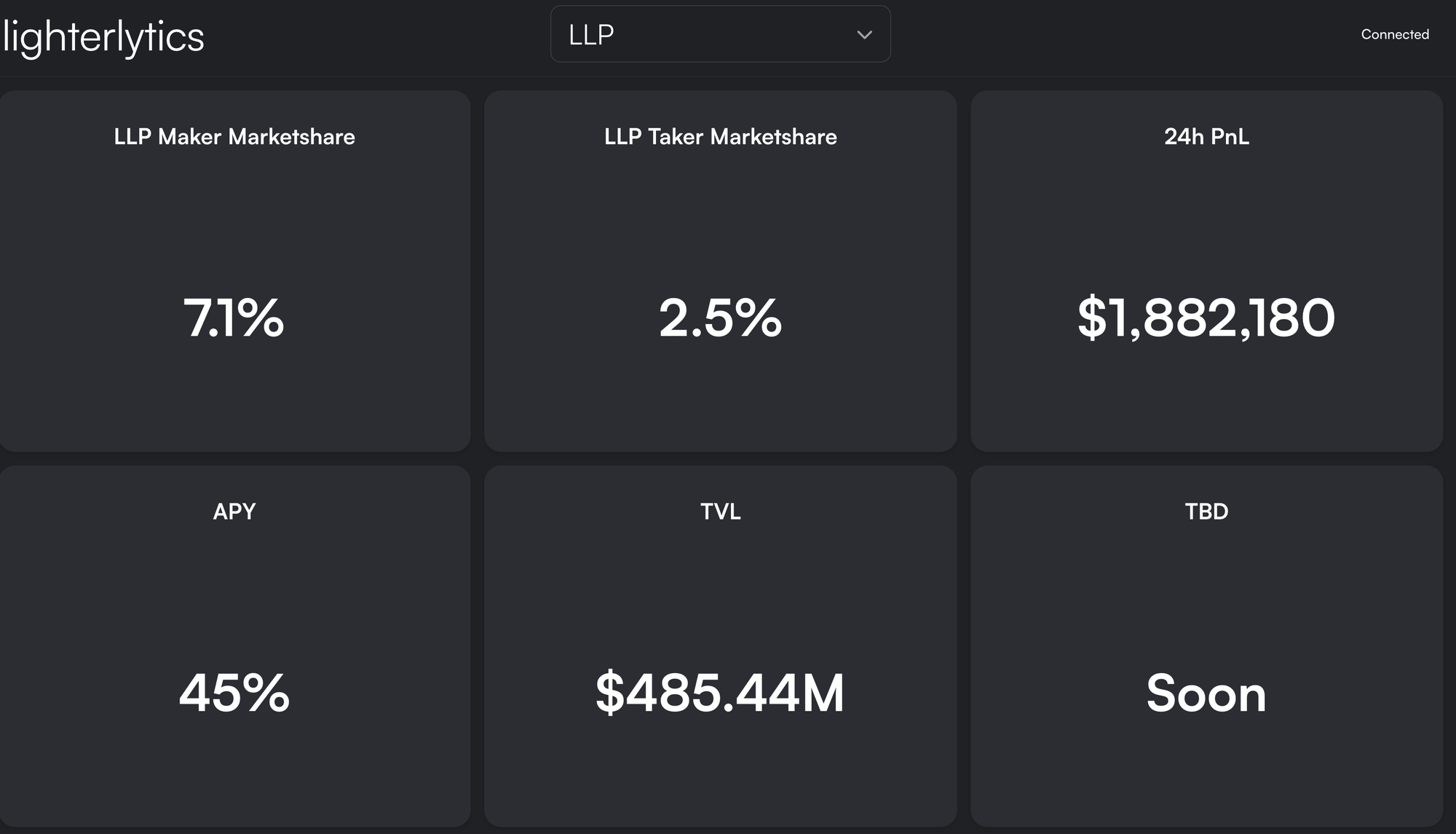

Since covering LLP 6 months ago, the vault has grown from $20m to $500m in TVL. Despite this growth and potential yield dilution, the APY on LLP remains very attractive at over 34% the past 2 weeks. Today's post will cover the recent growth of Lighter as well as dive into LLP's performance and how it achieves such high returns.

Sponsor - Kamino Finance

This week's edition of On Chain Times is sponsored by Kamino Finance.

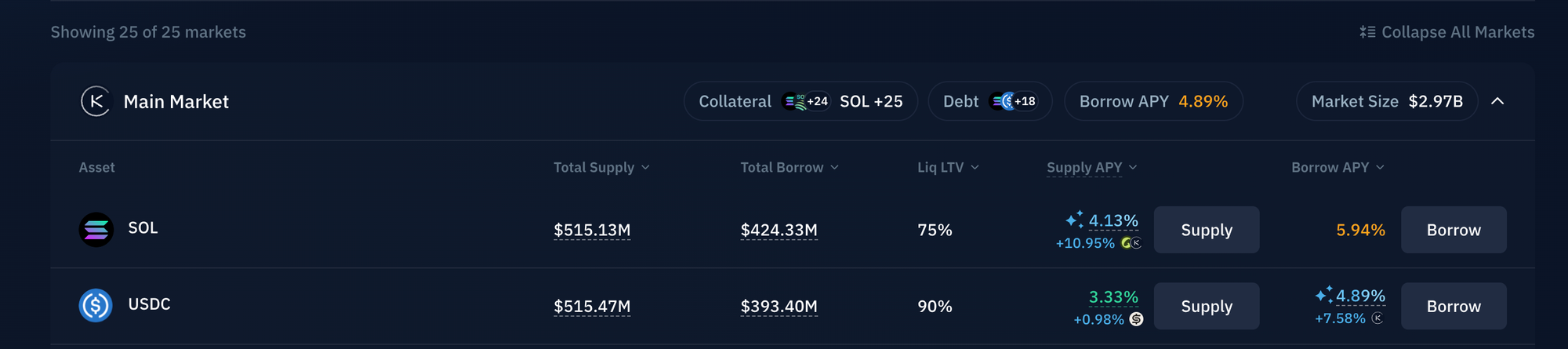

Season 5 of the $KMNO incentive campaign went live last week. In addition to lending rewards, Season 5 introduces borrow incentives when borrowing USDC against SOL. As seen below, SOL deposits currently earn a combined 11% APY coming from the supply yield and the S5 $KMNO rewards. Borrowing USDC against SOL comes in at a -2.69% annual cost, which means you get paid 2.69% to borrow USDC at the moment. These borrow incentives are currently only live for USDC against SOL collateral, but will most likely be enabled for other markets in the future as well.

Make sure to check out Kamino for the highest yields in the Solana ecosystem as well as cheap borrowing.

Lighter Traction & Growth

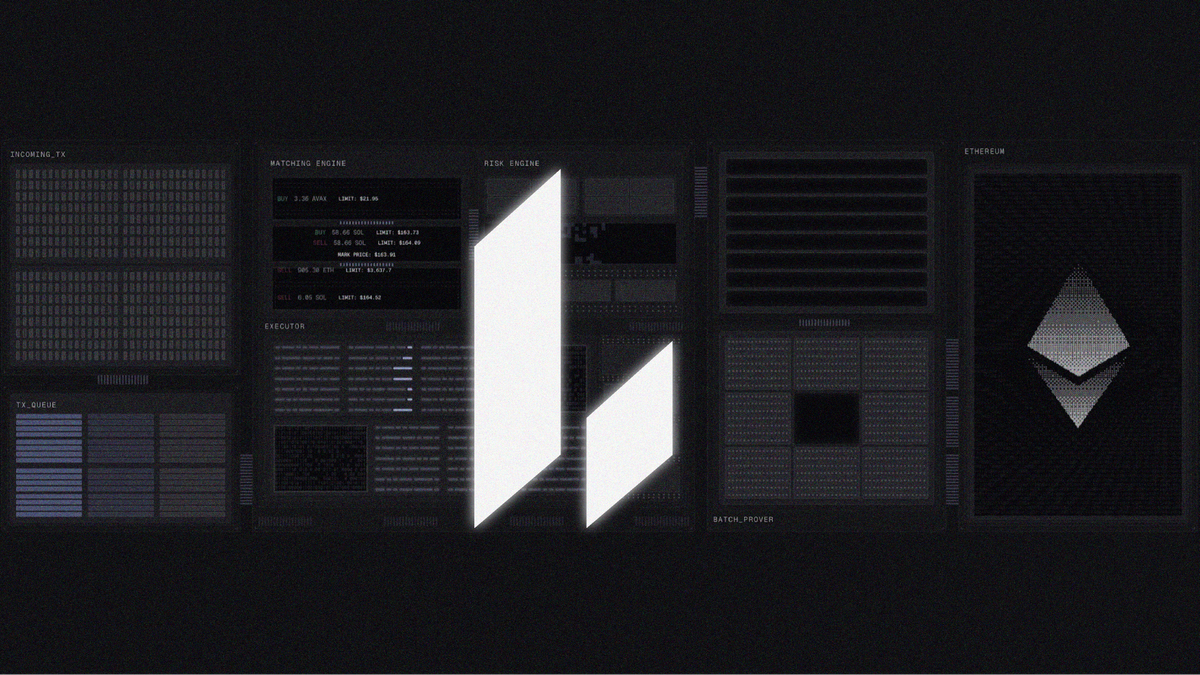

Lighter is a crypto perpetual futures exchange designed as a zk-powered layer 2 rollup on top of Ethereum. Aside from crypto futures, Lighter recently launched commodities trading (gold and silver futures) as well as forex and their spot exchange is set to go live within the next few weeks.

Just in from L2BEAT - 20x growth in rollup UOPS (user operations per second)📈

— Tomasz Tórz 💗 (@torztomasz) November 4, 2025

All of that because we added @Lighter_xyz. Congrats @vnovakovski and the whole team 🫡 pic.twitter.com/alobGEt0O1

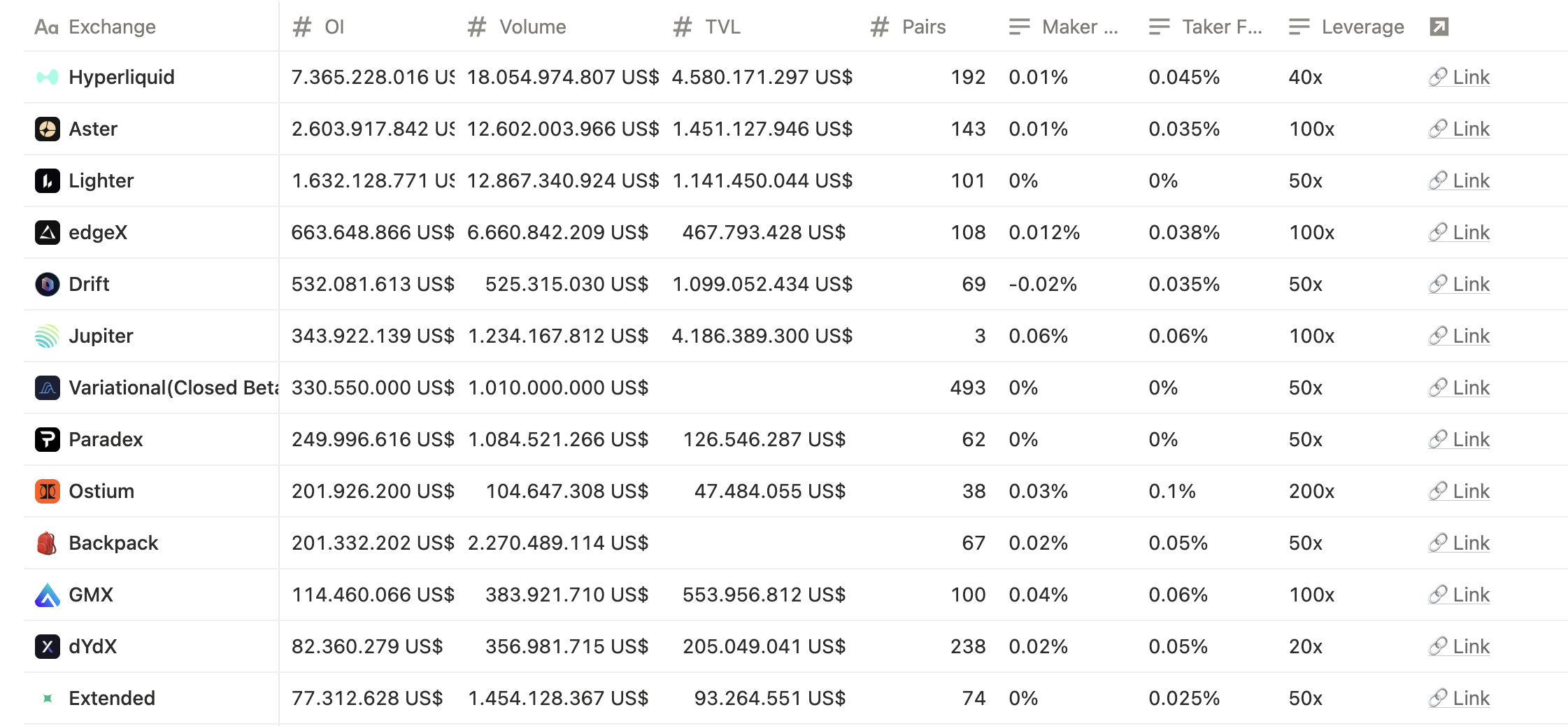

Since launching at the beginning of the year, Lighter has experienced strong growth across all metrics and has now firmly established itself as the primary competitor to Hyperliquid. Lighter is currently sitting at over $1.1b in TVL with $1.6b in current open interest and sees more than $10b in trading volume most days.

Lighter has been running a points program since its inception which has played a big role in its growth. The program is set to conclude in December with the TGE expected to happen shortly after.

LLP

LLP is the native market making vault on Lighter and posts liquidity across the trading pairs on Lighter. We first covered LLP back in May (see post below) when the TVL was sitting at ~$20m. Roughly 6 months later, LLP is now sitting at nearly $500m in user deposits. LLP has grown to become one of the most popular stablecoin farms across all of DeFi due to its high APY all year.

Since May, a lot has changed in how LLP operates. Lighter has onboarded a lot of larger market makers over the past months and as a result, LLP mostly acts as a liquidity backstop today (having gone from 80% maker market share down to ~7% currently).

In addition, Lighter has launched XLP, a similar market making vault that provides liquidity to more volatile markets such as commodities, forex and crypto pre-markets. As XLP is capped at less than $1m TVL, we won't cover this vault further today but will dive into its performance in a future report. With this model however, Lighter is able to launch more volatile/risky assets without putting the $500m in LLP in danger.

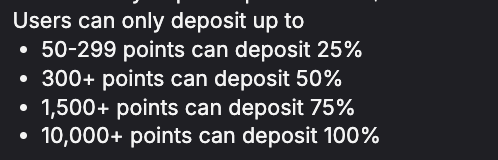

It's worth noting that there are deposit caps on LLP in an attempt by the team to avoid the vault getting too diluted. Only Lighter points holders can deposit into LLP with the following allocation:

LLP Performance

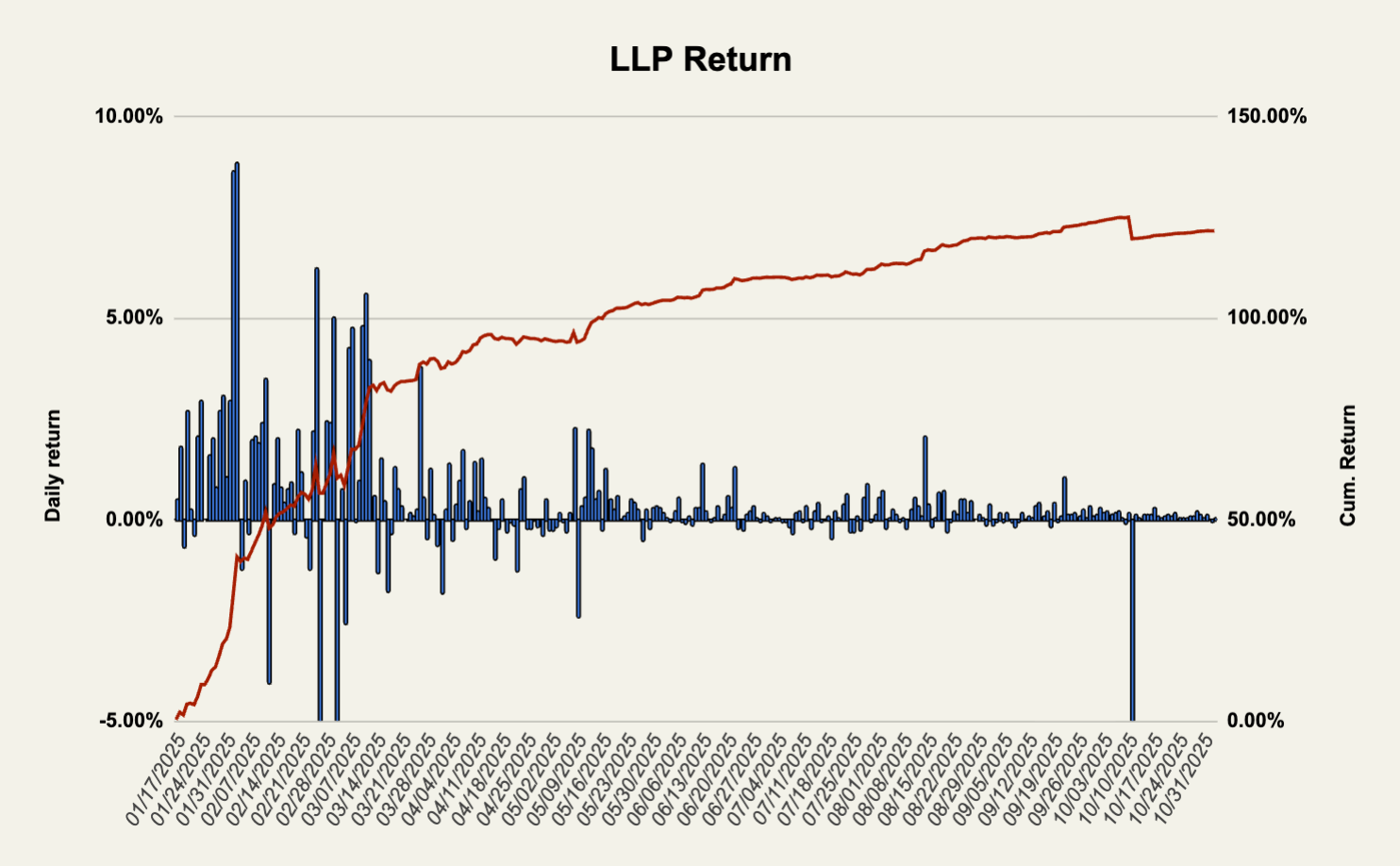

As seen in the chart below, LLP returns have compressed over time as more capital has flowed into the vault.

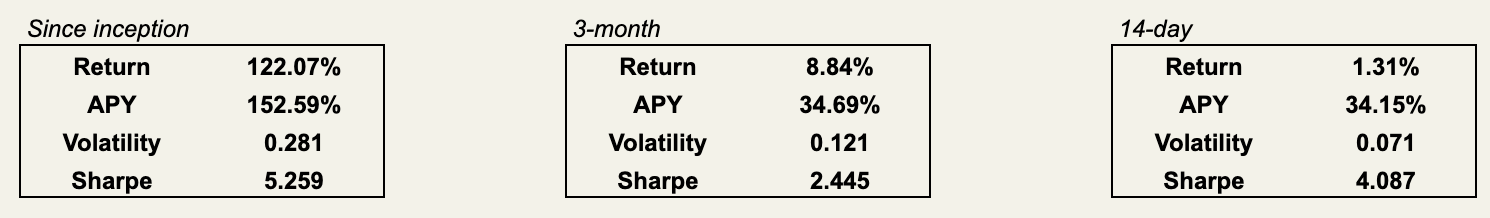

Despite this, LLP still managed to perform fairly well across most timeframes. Roughly 34% APY on both a 3-month and 2-week timeframe with a cumulative return of 122% since inception.

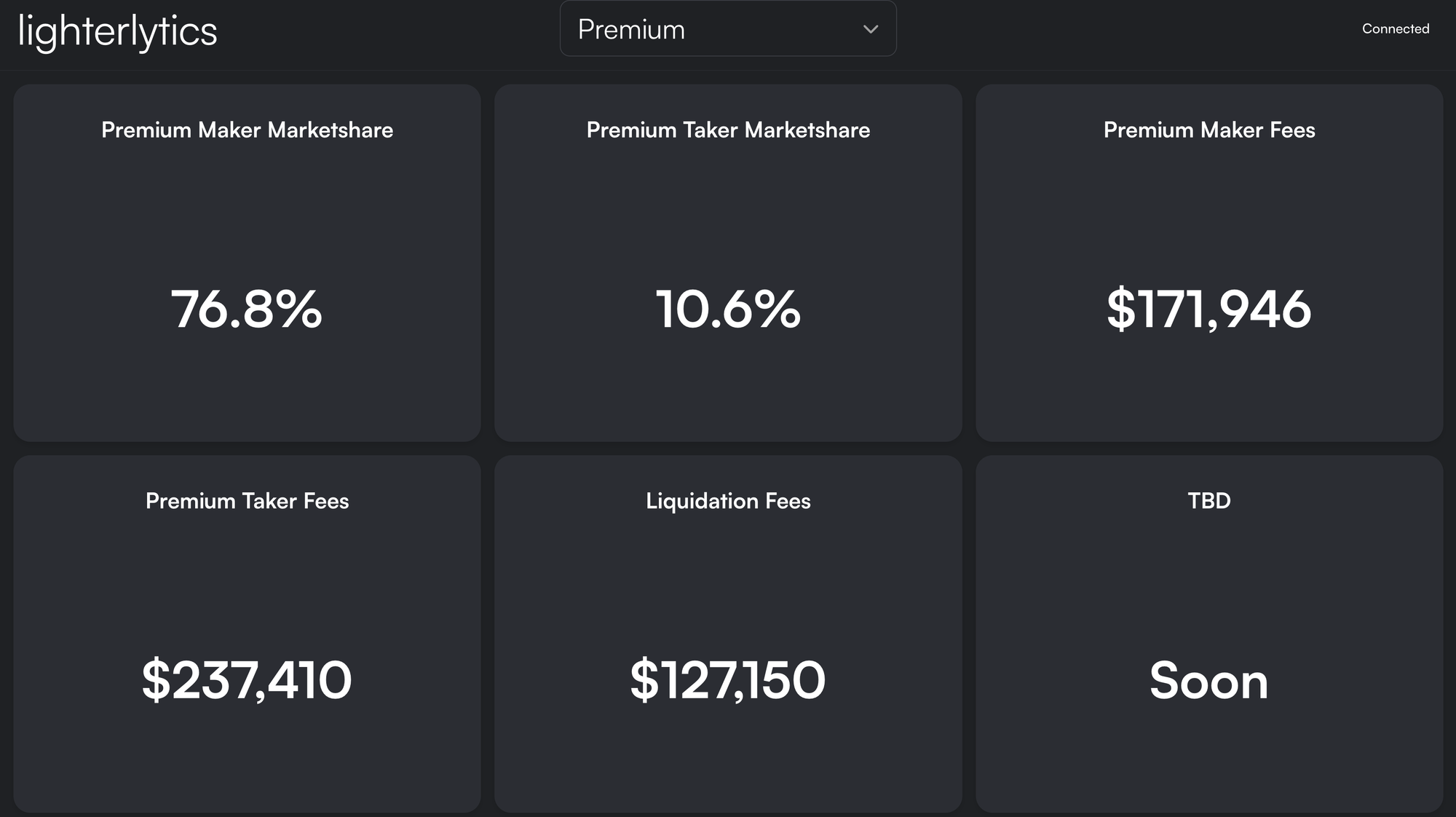

In comparison, in the past 2 weeks, HLP PnL is close to $0 and thus 0% APY. Despite LLP only accounting for 7% of the maker market share on Lighter, LLP is able to offer such a high yield on nearly $500m in deposits. This is largely because the vault currently receives most of the revenue generated by the exchange. According to community created analytics pages like lighterlytics, Lighter does ~$500k on average in daily revenue. This revenue comes from the 1% liquidation fee paid by all users as well as premium users paying trading fees on both maker and taker orders. Note that the revenue numbers are estimates as the team hasn't published exact revenue numbers. It's clear however that the revenue distribution plays a big role in the strong LLP performance.

At TGE, Lighter faces a new challenge in having to figure out how revenue should be distributed moving forward. Should they decrease/remove revenue flowing to LLP in order to redirect it to e.g. token buybacks? If that is the case, The APY on LLP will most likely decrease with a potential outflow of capital from the vault as well. Some are also speculating that holding the Lighter native token will be necessary in order to deposit into LLP (similarly to how points currently dictate the size of one's deposit. With this, Lighter could still have some of the revenue going to LLP while having utility for the Lighter token.

As a final remark in this post, it's worth noting that there are risks when participating in these sorts of vaults. When having funds in LLP, you are essentially acting as the 'liquidity of last resort' for traders in volatile circumstances where other market makers might pull liquidity. On October 10th, LLP took a 5% loss as Lighter prioritized providing liquidity to its users where other exchanges resorted to closing positions instead (ADL). While LLP holders were compensated in points, it's important to keep these risks in mind and note that high APYs typically come with risks.

Disclaimer

The information provided is for general informational purposes only and does not constitute financial, investment, or legal advice. The content is based on sources believed to be reliable, but its accuracy, completeness, and timeliness cannot be guaranteed. Any reliance you place on the information in this document is at your own risk. On Chain Times may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those expressed or implied in such statements. The authors may or may not own positions in the assets or securities mentioned herein. They reserve the right to buy or sell any asset or security discussed at any time without notice. It is essential to consult with a qualified financial advisor or other professional to understand the risks and suitability of any investment decisions you may make. You are solely responsible for conducting your research and due diligence before making any investment choices. Past performance is not indicative of future results. The authors disclaim any liability for any direct, indirect, or consequential loss or damage arising from the use of this document or its content. By accessing On Chain Times, you agree to the terms of this disclaimer.